PJM’s energy prices continued to rise into the third quarter of 2021, the Independent Market Monitor reported Thursday, but they also remained competitive.

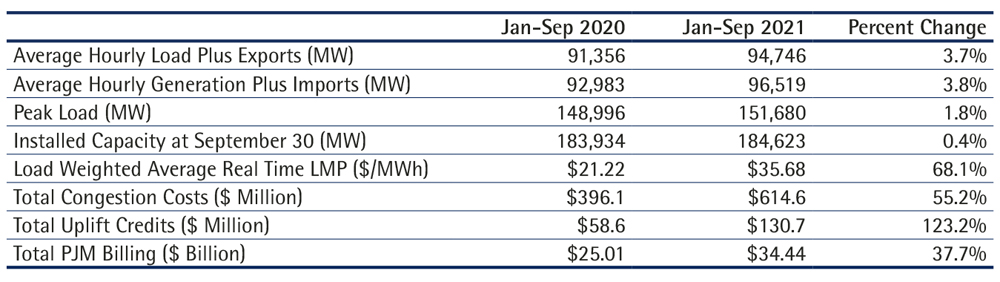

In presenting Monitoring Analytics’ third-quarter State of the Market Report, Monitor Joe Bowring said the load-weighted average real-time LMP was 68.1% higher in the first nine months of 2021 than the same period in 2020, coming in at $35.68/MWh versus $21.22/MWh. Of the increase, Bowring said, 91.5% was a result of higher fuel costs, especially higher natural gas prices.

Real-time, average hourly load for the same period increased by 4.2% from 2020, from 85,886 MWh to 89,515 MWh.

“Energy prices in PJM in the first nine months of 2021 were set, on average, by units operating at, or close to, their short-run marginal costs, although this was not always the case,” the report said. “This is evidence of generally competitive behavior and competitive market outcomes, although high markups for some marginal units did affect prices.”

The Numbers

The report found that theoretical net revenues, which are a “key measure of overall market performance” and a “measure of the incentive to invest in new generation,” increased for all unit types in the first nine months of 2021 compared to 2020 in the energy market. Revenues increased by 42% for a new combustion turbine, 50% for a new combined cycle, 68% for a new nuclear plant and 974% for a new coal unit. The report said the new coal unit percentage was inflated because it remained near zero in 2020.

Other theoretical net revenues for units included 157% for a new diesel, 51% for a new onshore wind installation, 72% for a new offshore wind installation and 66% for a new solar installation.

Higher energy prices and gas costs changed the “relative economics” of coal and gas units, the report said, with coal generation increasing 30.9% and gas generation decreasing 6.4%. The Monitor found the changes in fuel prices this year have slowed but did not change the long-term decline in the share of coal generation versus the increase in gas.

PJM energy produced from coal was 24%, while the share of energy produced from natural gas was 37%, the largest of any fuel source in the RTO.

“The role of gas-fired generation highlights the importance of ensuring that PJM has current, detailed and complete information on the gas supply arrangements of all generators and that PJM consider rules requiring capacity resources to have firm fuel supplies,” the report said.

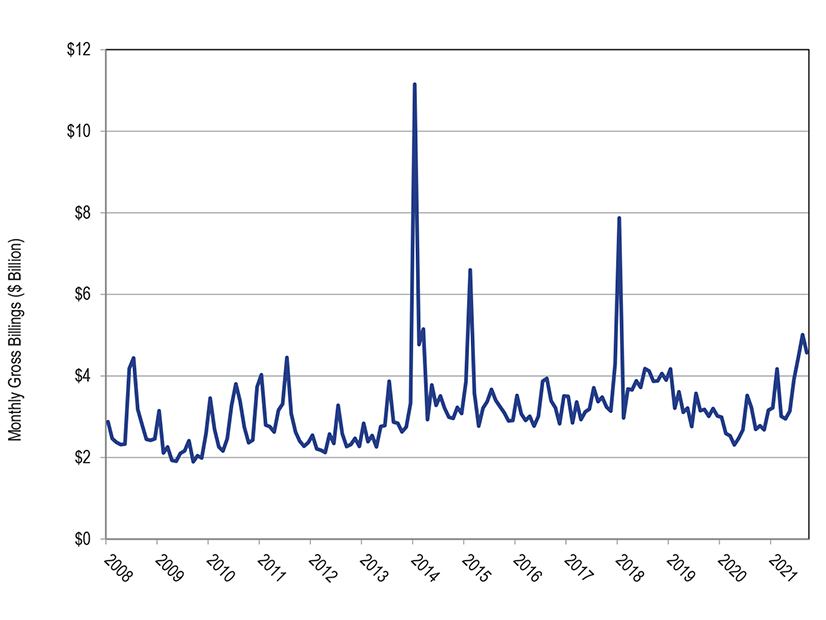

The cost of transmission continued to be greater than the cost of capacity, the report said, while the total cost of wholesale power increased by 37.6%, from $43.67 in 2020 to $60.10. Total energy uplift charges increased by 123.3%, from $58.6 million to $130.8 million.

The Monitor found that total congestion increased by 55.1%, going from $396.1 million to $614.6 million. Only 61.1% of total congestion paid by customers for the first four months of the 2021/22 planning period was returned to customers through the auction revenue rights and the self-scheduled financial transmission right revenues offset.

“The goal of the FTR market design should be to ensure that customers have the rights to 100% of the congestion that customers pay,” the report said.

New Recommendations

The Monitor made two new recommendations for PJM and stakeholders to examine.

In the energy market, the IMM recommended that capacity resources be required to use flexible parameters in all offers at all times to ensure effective market power mitigation and to ensure that resources meet their obligations to be flexible. The Monitor rated the change as a high priority.

In the capacity market, the IMM recommended that the value of capacity transfer rights (CTRs) should be defined by the total megawatts cleared in the capacity market, the internal megawatts cleared and the imported megawatts cleared, and not redefined later prior to the delivery year. The recommendation was rated as a medium priority.