Activity at FERC’s Office of Enforcement returned to pre-pandemic levels last fiscal year, as the unit opened 12 new investigations and settled nine pending ones for about $5.9 million in civil penalties and $2 million in disgorgement, according to an annual report released by the commission Thursday.

The number of new investigations was identical to those opened in fiscal year 2019 and double those in fiscal year 2020, during which it relaxed some reporting and auditing requirements. (See Report: FERC Enforcement Actions down Sharply in FY20.) Fiscal year 2021 began Oct. 1, 2020.

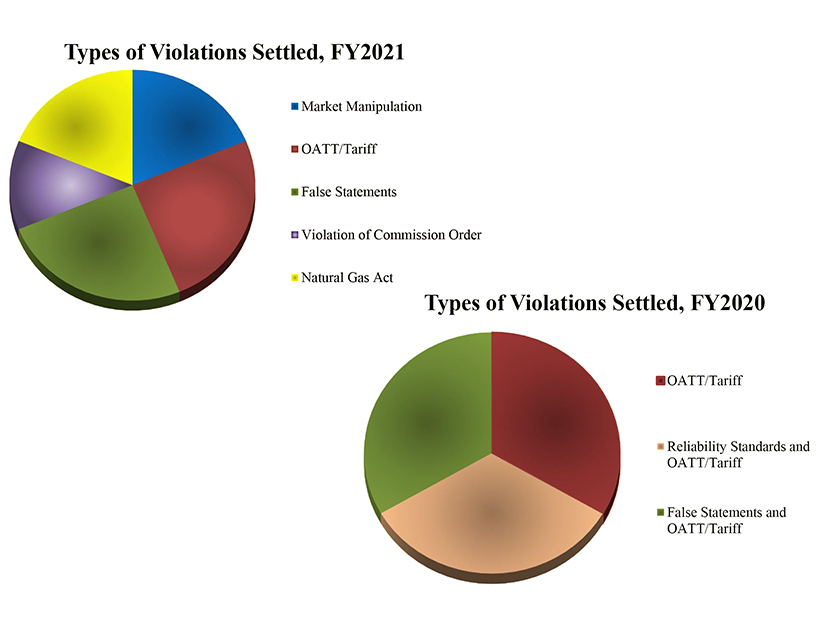

The number of settlements increased from two in 2019 and three in 2020. And though the amount the office collected from settlements was down about 45% from 2019, it was far more than the $550,000 in 2020. The bulk of the penalties and disgorgements in 2019 came from a settlement with Dominion Energy Virginia, which paid $14 million to settle allegations that it had manipulated PJM’s energy market.

“I’m pleased to see that after a lull over the last couple years, the commission is more aggressively pursuing market manipulators,” FERC Chair Richard Glick said during the commission’s open meeting Thursday. “The message to those seeking to manipulate electric and gas markets or shirk their duties as certificate holders or licensees should be clear: The cop is back on the street, and we will aggressively pursue wrongdoing.”

The largest settlement of the year was reached in federal court (IN12-12). The commission resolved its long pending action against Competitive Energy Services and principal Richard Silkman in the U.S. District Court for Maine, with the company and Silkman agreeing in November 2020 to disgorge a total of $1.475 million to ISO-NE and the U.S. Treasury over seven years. The commission had sought a $9 million assessment in August 2013.

FERC alleged that the company fraudulently inflated client Rumford Paper’s energy load baselines in ISO-NE’s day-ahead load response program, and then offered load reductions against that inflated baseline. The alleged scheme began in 2007.

Of those settlements reached directly with FERC, the largest was a combined $2.1 in penalties and disgorgement from Algonquin Power & Utilities’ Windsor Locks gas plant in Connecticut for violating its must-offer obligations in ISO-NE markets in 2012/13 (IN21-2). (See FERC Fines Algonquin Plant $1M for Bungled Offers.)

The report also noted that Enforcement’s Division of Analytics and Surveillance conducted 10 inquires into natural gas market participants related to the February winter storm, closing seven of them and referring two to the Division of Investigations. It also conducted four inquiries into SPP and MISO market participants; it closed three of those and is still examining the last one.

FERC and NERC on Tuesday released their final report on their joint inquiry into the grid’s performance during the storm, but its scope was limited to infrastructure reliability and did not include any information on potential market manipulation or issues with market design. (See related story, FERC, NERC Release Final Texas Storm Report.)