Markets and Reliability Committee

Solar-battery Hybrid Resources

PJM has proposed changes to a stakeholder-endorsed proposed on solar-battery hybrid resources after consulting with FERC over a future filing of the issue.

Andrew Levitt, of PJM’s market design and economics department, reviewed the RTO’s solar-battery hybrid resources issue in a second first read at last week’s Markets and Reliability Committee meeting. The proposal, which would update PJM’s governing documents and manuals to clarify several aspects of market participation by solar-battery hybrid resources, was originally endorsed at the August Market Implementation Committee meeting with 99% stakeholder support. (See “Solar-Battery Hybrid Proposal Endorsed,” PJM MIC Briefs: Aug. 11, 2021.)

Levitt said PJM had a prefiling meeting with FERC staff back in September, and they made suggestions to reconfigure the language to increase its chances for approval. Staff suggested that the term “hybrid resource” should be structured as a largely independent resource-neutral category and not specifically about solar-battery resources.

PJM reconfigured the language as staff suggested, Levitt said, styling it as a friendly amendment. He said the new proposal is “substantively and functionally almost identical” to the language endorsed at the MIC, but there was “a lot” of new tariff language.

Levitt said FERC staff recognized that, for now, certain provisions specific to solar-storage hybrids will be pursued by the RTO before other hybrid types “due to overwhelming presence of solar hybrids in PJM queue,” so it made sense to focus the language changes on solar-battery hybrids.

One stakeholder requested that PJM add an energy market must-offer clarification for wind and solar to the proposal through a “quick fix” process.

Ken Foladare of Tangibl Group said he objected to the idea that the language changes were a quick fix or something PJM could do unilaterally. He said the changes should go through the proper stakeholder process.

“I’m not quite sure the people I work with are going to be on board with this so easily,” Foladare said. “It needs to be fully explained to the PJM stakeholders.”

The committee will be asked to endorse the proposal at the December MRC meeting.

Undefined Regulation Mileage Ratio Calculation

PJM presented its plan to stakeholders to get a vote on a short-term solution to the undefined regulation mileage ratio calculation while endorsing a further look at other issues in the regulation market.“

Adam Keech, PJM’s vice president of market design and economics, discussed the next steps of the undefined regulation mileage ratio proposal after a failed vote at the October MRC. (See “Regulation Mileage Ratio Fails,” PJM MRC/MC Briefs: Oct. 20, 2021.)

Stakeholders rejected two different proposals to change the undefined regulation mileage ratio calculation in Manual 28 and the tariff, sending the issue back to the MIC for more discussions. (See “RTO to Propose Review of Regulation Market,” PJM MIC Briefs: Nov. 3, 2021.)

Danielle Croop, senior lead market design specialist at PJM, presented a first read of a new problem statement and issue charge to create a new senior task force to re-evaluate the current regulation market design. Keech said the language in both documents was similar to language endorsed creating the former Regulation Market Issues Senior Task Force that last met in 2017.

Keech said the proposal was in response to stakeholder feedback at the October MRC meeting with the intention to initiate short-term fixes. Members said there were larger issues with the regulation market that needed review, and PJM was supportive of the review.

The key work activities include regulation market education, evaluating the benefits factor curve and proscribed RegA/RegD commitment percentages, and proposing any modifications to the regulation market to address issues raised in the evaluation. Keech said the review would utilize a new senior task force reporting directly to the MRC.

If the MRC endorses the task force at its December meeting, Keech said, it will take another vote on the short-term proposals from PJM and the Monitor that failed last month.

“Our hope is that by committing and moving forward with this broader review of the regulation market, that the stakeholders will reconsider the proposals that failed to pass,” Keech said.

Regulation mileage is the measurement of the amount of movement requested by the regulation control signal that a resource is following; it is calculated for the duration of the operating hour for each regulation control signal. PJM’s performance-based regulation market splits the dispatch signal in two: RegA for slower-moving, longer-running units; and RegD for faster-responding units that operate for shorter periods, including batteries. If a signal is “pegged” high or low for an entire operating hour, the corresponding mileage would be zero for that hour.

PJM has seen an increased frequency of RegA signal pegging and times the RegA signal is pegged for extended periods, highlighting a potential problem in the regulation mileage ratio calculation. The RegA mileage can be set at zero for a given hour and create a divide-by-zero error in the calculation of the mileage ratio.

PJM proposed setting the RegA mileage floor at 0.1 instead of zero, which would provide a solution for the division ratio and still maintain market design objectives while having no impact on the regulation signal design, operations or regulation market clearing.

The Monitor proposed a cap of 5.5 on the realized mileage ratio in all hours instead of 0.1, indicating the cap would eliminate the current undefined mileage ratio result that PJM is attempting to address.

Monitor Joe Bowring said he was glad PJM was taking up a broader review of the regulation market and that the IMM was prepared to discuss a compromised RegA mileage between 0.1 and 5.5. Bowring said he wanted to get a sense from stakeholders whether they were calling for the IMM to work with PJM to come up with a compromised ratio.

Susan Bruce, counsel to the PJM Industrial Customer Coalition, said the ICC would be interested in PJM and the Monitor trying to find a “midpoint” in the conversation on the ratio. Bruce said the ICC understands the “math problem” PJM has identified, but the short-term solution could be as simple as “splitting the baby” and settling on a number in the middle.

“I would still hope there could be a place of common ground found during the intervening time,” Bruce said.

Synchronous Reserve Deployment Stakeholder Initiative

Michael Zhang, senior lead engineer in PJM’s markets coordination department, reviewed a PJM proposal to improve the deployment of synchronized reserves during a spin event.

Developed from discussions in the Synchronized Reserve Deployment Task Force (SRDTF), the Operating Committee endorsed the proposal earlier this month. (See “Synchronous Reserve Endorsed,” PJM Operating Committee Briefs: Nov. 4, 2021.)

Synchronized reserve events are emergency procedures triggered by PJM to maintain grid reliability in accordance with NERC’s Resource and Demand Balancing (BAL) standards. The RTO invokes those procedures under conditions such as the simultaneous loss of multiple generating units or a sudden influx of load.

The SRDTF examined ways to secure controlled deployment of synchronized reserves throughout emergency events by using tools such as real-time security-constrained economic dispatch (RT SCED) to maintain consistent pricing and dispatch signals. The goal was to ensure BAL compliance during the recovery process and maintain a reliable transition in and out of emergency events and to define clear rules and expectations that address how PJM operators approve RT SCED cases around a synchronized reserve event.

PJM’s proposal would create an intelligent reserve deployment (IRD), a SCED case simulating the loss of the largest generation contingency on the system and for which approval of the case will trigger a spin event. The proposal calls for taking the megawatts of the largest generation contingency and adding them to the RTO forecast to simulate the unit loss. The RTO would then be allowed to flip condensers and other inflexible synchronized resources cleared for reserves to energy megawatts and procure additional reserves to meet the next largest contingency.

Zhang said some of the significant changes over the status quo in the proposal include updating the economic basepoints to replace all-call instructions and having active constraints controlled by IRD so that deployed resources don’t have negative impacts on the constraints.

PJM is looking to conduct a phased approach of IRD, with the initial phase of six to 12 months beginning in early 2022, Zhang said, possibly by March. Zhang said the phased approach will allow operators to make any fine-tuning adjustments as they gain more experience with the tool.

PJM will reconvene the SRDTF toward the conclusion of the initial phase to review performance metrics, Zhang said, soliciting stakeholder feedback, adjusting and finalizing the deployment approach and adapting to market changes.

“IRD is ready to go,” Zhang said. “It does not require any additional development. It can be turned on when ready, and it will integrate into all of our existing applications.”

Catherine Tyler of Monitoring Analytics said the IMM still has concerns with the proposal, including that it relies on resources to meet the system needs during a spin event that did not actually clear reserves. Tyler said that if reserves are going to be paid more, it’s important that they “have an obligation” and related penalties for nonresponse because they’re being counted on in a spin event.

Bruce said PJM may need a better way to address the manual deployment of synchronous reserves, but she argued that “we’re not there” in terms of IRD being the correct solution. Bruce said there are many small issues with the proposal that taken together could cause bigger problems.

“There’s more work that should be taken here in getting the details right,” Bruce said.

The committee will be asked to endorse the proposal at its meeting next month.

Carbon Pricing Senior Task Force Sunset Endorsed

Stakeholders unanimously endorsed the sunsetting of the Carbon Pricing Senior Task Force (CPSTF). A majority of stakeholders have indicated they are not ready to move forward with developing rules on leakage mitigation in carbon pricing. (See “Carbon Pricing Senior Task Force Sunset,” PJM MRC/MC Briefs: Oct. 20, 2021.)

Eric Hsia, senior manager in PJM’s applied innovation department, reviewed the recommendation to sunset the CPSTF, which was established in July 2019. The main objective of task force’s issue charge was to explore the impacts of emissions and price leakage between regions with and without carbon pricing policies, such as the Regional Greenhouse Gas Initiative states, and to develop business rules to manage leakage where appropriate.

The first stage of the task force included education on concepts like a carbon tax versus cap-and-trade programs and an introduction on leakage between states. Analysis in the first stage included studies on a range of carbon prices and potential leakage mitigation approaches.

Hsia said there are current efforts in the interconnection process, transmission policy workshops and phase 2 of the capacity market overhaul to include discussions related to decarbonization and the procurement of clean resource attributes.

Jason Barker of Exelon said it was “with reluctance” that the company was accepting the sunset motion of the task force. Barker called carbon emissions from the electricity sector an “imminent problem” that needs to be solved, and PJM stakeholders should continue to discuss the possibility of regionwide carbon pricing and the impacts on the market.

“We believe there are methods to effectively address leakage mitigation,” Barker said.

HVDCSTF Sunset Endorsed

The committee unanimously endorsed the sunsetting of the High Voltage Direct Current Senior Task Force (HVDCSTF), which was created last year to examine integrating HVDC converters as a new type of capacity resource in PJM. (See “HVDCSTF Sunset,” PJM MRC/MC Briefs: Oct. 20, 2021.)

Carl Johnson of the PJM Public Power Coalition, speaking on behalf of American Municipal Power, moved to sunset the task force. The MRC had endorsed an issue charge by Direct Connect Development in May 2020 to consider establishing HVDC converter stations’ eligibility to participate in the capacity market. (See HVDC Initiative Endorsed by PJM Stakeholders.)

The change would allow Direct Connect’s SOO Green HVDC Link — the 350-mile, 2,100-MW, 525-kV underground transmission line planned to deliver renewable energy from upper MISO to Illinois and the PJM grid — to compete in the market.

The task force stopped meeting last October, and several stakeholders requested that it be sunset earlier this year. (See “HVDC Senior Task Force Update,” PJM MRC/MC Briefs: March 29, 2021.) SOO Green has brought an official complaint to FERC seeking approval of the proposal. (See SOO Green Seeks Relief from PJM Rule on External Capacity.)

“There wasn’t a way with the currently approved or a significantly modified approach to external capacity that we could get to where [SOO Green] wanted to go without completely upending where we are with how we do pseudo-ties,” Johnson said.

Consent Agenda

The committee unanimously endorsed as part of the consent agenda several revisions to:

- Attachment F: Control Center and Data Exchange Requirements of Manual 1 addressing exceptional circumstances outside of the COVID-19 pandemic. The attachment was originally developed and implemented at the start of the pandemic to provide guidance for remote operations in case of control center staff illnesses. (See “Manual 1 Changes Endorsed,” PJM Operating Committee Briefs: Oct. 7, 2021.)

- Manual 3: Transmission Operations resulting from a periodic review. Updates include minor changes such as removing a reference to NERC standard PRC-001 because of its retirement. (See “Manual Changes Endorsed,” PJM Operating Committee Briefs: Nov. 4, 2021.)

- Manual 13: Emergency Operations resulting from a periodic review. The revisions were endorsed by the OC earlier this month. (See “Manual Changes Endorsed,” PJM Operating Committee Briefs: Nov. 4, 2021.)

- Manual 14F: Competitive Planning Process addressing changes to the Regional Transmission Expansion Plan proposal fee structure to conform to the OA. The updates were endorsed at the Planning Committee’s meeting this month. (See “Manual Endorsements,” PJM PC/TEAC Briefs: Nov. 2, 2021.)

- Manual 19: Load Forecasting and Analysis resulting from the biennial review. Changes included adding battery storage to the list of forecasted items in the load forecast model overview. (See “Manual Endorsements,” PJM PC/TEAC Briefs: Nov. 2, 2021.)

- the 2022 day-ahead scheduling reserve (DASR) requirement to 4.43%, slightly lower than the 2021 requirement of 4.78%. (See “Day-ahead Schedule Reserve Endorsed,” PJM Operating Committee Briefs: Nov. 4, 2021.)

Members Committee

ARR/FTR Market Task Force Proposal Endorsed

Stakeholders endorsed proposed tariff revisions to address changes related to auction revenue rights (ARRs), financial transmission rights and transparency at the Members Committee meeting.

The joint PJM-stakeholder proposal was endorsed in a sector-weighted vote of 3.73 (74.6%), surpassing the necessary 3.33 threshold. It was endorsed at last month’s MRC meeting after failing an initial vote. (See Stakeholders Endorse PJM ARR/FTR Market Changes.)

Brian Chmielewski, manager of PJM’s market simulation department, said the changes were the result of a two-year stakeholder process initiated after the GreenHat Energy default in 2018, including a six-month review by the London Economics International (LEI), a consultant enlisted by the RTO to conduct a “holistic review” of the ARR/FTR market that led to a report.

The proposal aims to recognize recommendations made in the report and address concerns raised by the Monitor and stakeholders regarding the ARR/FTR market, along with seeking to maintain the consultant’s conclusion that the existing FTR product is “reasonable and generally achieving the intended purposes” of serving as a financial equivalent to firm transmission service and to ensure “open access to firm transmission service by providing a congestion-hedging function.”

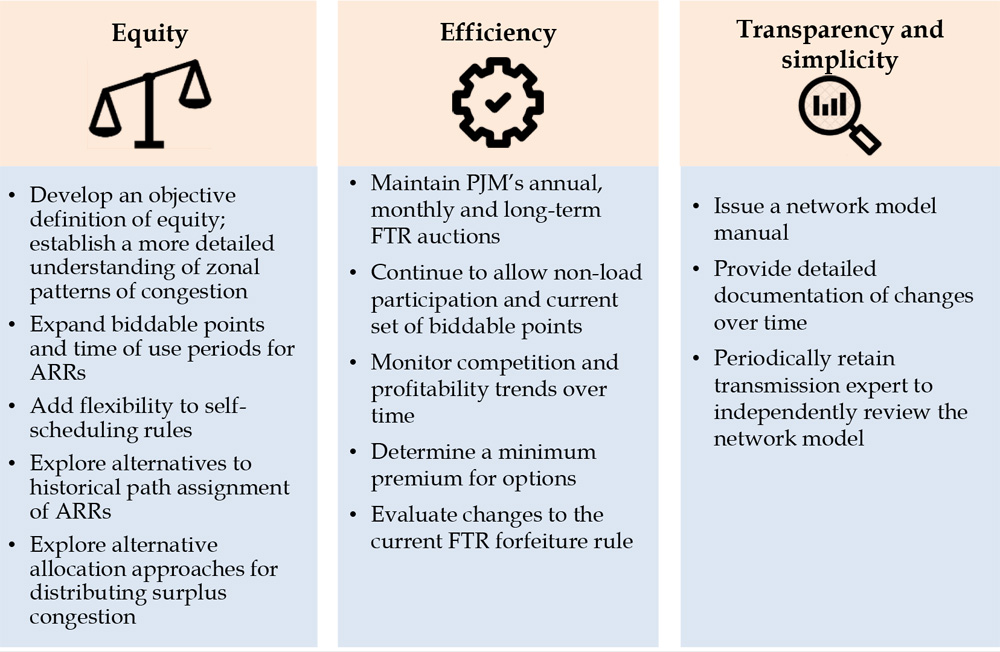

PJM’s proposal was broken into three separate areas as recommended in the LEI report, with an ARR track dealing with “equity” issues, an FTR track for “efficiency” issues and a transparency track for a “simplicity” model.

Proposed enhancements to PJM’s current ARR/FTR market design. | London Economics

Proposed enhancements to PJM’s current ARR/FTR market design. | London EconomicsGregory Carmean, executive director of the Organization of PJM States Inc. (OPSI), highlighted a recent letter sent by OPSI to PJM asking for staff to weigh in on whether or not they felt the proposal “fully addressed” the equity, efficiency, simplicity and transparency concerns highlighted in the LEI report.

Carmean said a letter OPSI received from PJM indicated that the joint proposal “was a consensus among stakeholders and that was why the RTO was supporting it. He asked if PJM understands OPSI’s concerns so that staff can report to the Board of Managers “that we won’t have to revisit this issue again in three years.”

Chmielewski said the LEI report and the areas of recommendation were “used as guidelines” for the development of the proposal and that every recommended area in the report was “fully discussed” by stakeholders throughout the process.

“I’m confident that the package that was endorsed last month is comprehensive that increases value for everyone in the ARR/FTR market,” Chmielewski said.

Ed Tatum, vice president of transmission at American Municipal Power, voiced his support, saying that when members can come together to support a proposal, the result is better than not coming together on an issue at all.

“Not everybody’s crystal ball is clear,” Tatum said. “And not everybody’s market design takes care of what needs to be taken care of.”

Bruce said there have been divergent views as to the right approach to ARR/FTR, but the ICC is glad PJM undertook the “comprehensive review” in the wake of the GreenHat default.

“From a customer perspective, we want to make sure that our load-serving entities have the tools they need in order to help support retail contracting and service to retail customers,” Bruce said.

Consent Agenda

As part of the consent agenda, stakeholders unanimously endorsed:

- the 2021 reserve requirement study results for the installed reserve margin and forecast pool requirement. The results were endorsed at last month’s Planning Committee meeting. (See “Reserve Requirement Study Results Endorsed,” PJM PC/TEAC Briefs: Oct. 5, 2021.)

- revisions to Manual 15: Cost Development Guidelines, the OA and the tariff to address incremental and no-load energy offers. PJM said the Cost Development Subcommittee proposed revising the no-load cost and incremental energy offer definitions to clearly define what costs can be included, including operating costs, tax credits and emissions allowances. (See “Manual 15 Revisions Endorsed,” PJM MIC Briefs: Sept. 9, 2021.)

- tariff revisions addressing behind-the-meter generation business rules on status changes. The updates were developed in special sessions of the Market Implementation Committee. (See “Manual 14G Updates Endorsed,” PJM PC/TEAC Briefs: Aug. 31, 2021.)