PJM’s upcoming 2023/24 Base Residual Auction will be delayed again after FERC on Dec. 22 partially reversed its May 2020 decision on the RTO’s proposed energy price formation revisions, requiring tariff and Operating Agreement revisions within 60 days (EL19-58).

In a 3-1 vote, the commission reaffirmed its previous decision directing PJM to consolidate its tier 1 and tier 2 reserve products, but it said it erred in its approval of changes to the shape of the RTO’s operating reserve demand curve (ORDC). Commissioner James Danly was the lone vote against the decision, saying he would publish his full dissent in the future, while newly appointed Commissioner Willie Phillips did not participate in the order.

PJM filed its proposal unilaterally in March 2019 under Section 206 of the Federal Power Act because stakeholders could not come to a consensus on a single plan after more than a year of discussions and debate. (See PJM Files Energy Price Formation Plan.)

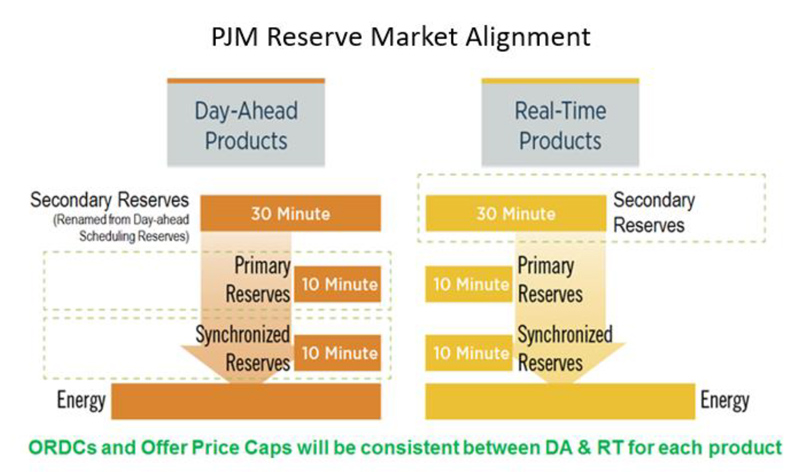

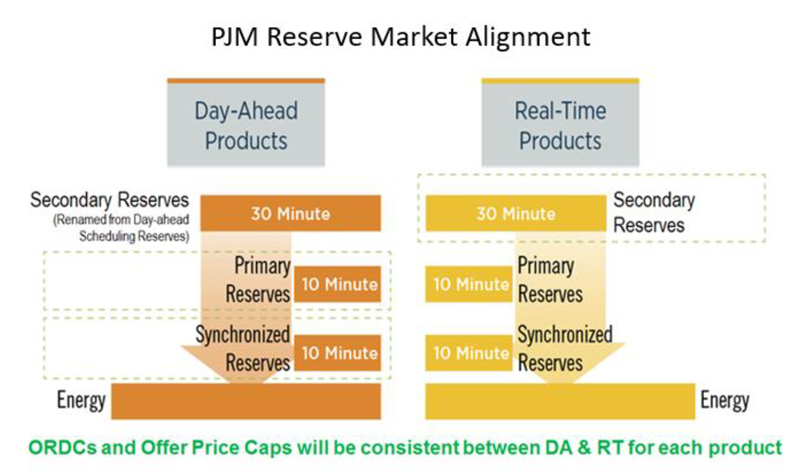

PJM’s realignment of its reserve market under the proposal it filed with FERC in 2019 | PJM

PJM’s realignment of its reserve market under the proposal it filed with FERC in 2019 | PJM

The RTO uses an ORDC and transmission constraint penalty factors to establish LMPs. Under its current rules, the maximum price the energy component of an LMP can reach is $3,750/MWh.

But the “downward sloping” ORDC, approved by FERC in May 2020, allowed the RTO’s LMPs to reach or exceed $12,050/MWh in cases of extreme reserve shortages.

The commission approved the proposal in a 3-1 vote in 2020, with then-Commissioner Richard Glick issuing a strongly worded dissent that said he was “particularly troubled” that PJM’s revision to the ORDC was accepted and that annual increased costs to load could reach up to $2 billion. (See FERC Approves PJM Reserve Market Overhaul.)

Public interest and consumer organizations challenged FERC’s decision over the increased costs to ratepayers. In May, several petitioners, including state consumer advocacy agencies, asked the D.C. Circuit Court of Appeals to reverse the decision, and the court in August remanded it.

FERC said the 2020 order “relied on broad statements” concerning the amount of PJM’s “operational uncertainty,” the practice of “load forecast biasing” by its operators and the “prevalence of reserve market uplift” in determining that aspects of the RTO’s markets were unjust and unreasonable, including the “shape of its ORDCs beyond the minimum reserve requirements.”

“Upon reconsideration, we find that PJM failed to demonstrate that the operator bias it cited is caused by its currently effective ORDCs, and thus that the biasing data PJM provides does not demonstrate that its ORDCs are unjust and unreasonable,” FERC said.

FERC Directives

The commission ordered PJM to maintain its currently effective reserve penalty factors of $850/MWh for the synchronized reserve requirement and primary reserve requirement and $300/MWh for the extended requirements.

PJM argued that the $850/MWh factors were no longer just and reasonable because FERC Order 831 directed the RTO to increase its cost-based incremental energy market offer cap to $2,000/MWh, and thus “$2,000/MWh is the lowest reasonable level at which the penalty factor can be set and still be consistent with the actions that system operators are required to take to maintain reserves.” (See New FERC Rule Will Double RTO Offer Caps.)

The RTO proposed a replacement rate design that would establish reserve penalty factors of $2,000/MWh to align with the maximum price-setting energy offer cap of $2,000/MWh. But FERC said it disagreed with the RTO’s arguments as to the necessity for the change.

“The costs of a resource providing reserves are mainly based on that resource’s lost opportunity costs: the difference between the prevailing locational marginal price and its energy offer, i.e., its foregone net energy market revenues,” FERC said. “Thus, even when LMPs in the PJM region exceed $1,000/MWh, there is usually reserve capacity available at a cost much less than $1,000/MWh.”

The commission also reversed its decision on PJM’s forward-looking energy and ancillary services (E&AS) offset, a key variable in calculating the net cost of new entry (CONE) for resources in capacity auctions. The RTO must now revert to the previous, backward-looking offset.

FERC said PJM’s failure to demonstrate that its reserve penalty factors and ORDCs were unjust and unreasonable “undermined the fundamental basis” for the commission’s determination that the backward-looking offset is unjust and unreasonable.

“Without these fundamental changes to the reserve market, there is insufficient evidence in the record to find that E&AS revenues will increase to such an extent that the backward-looking offset does not reasonably reflect future E&AS revenues and is therefore unjust and unreasonable,” the commission said.

Auction Delay

The commission said it recognized PJM will need to delay the BRA for the 2023/24 delivery year currently scheduled for Jan. 25 to implement the revised E&AS offset. FERC previously approved PJM’s request in October to delay the BRA in response to the commission’s order in September revising the RTO’s market seller offer cap (MSOC). (See FERC Accepts PJM BRA Delays.)

PJM must submit a compliance filing with the commission within 30 days proposing a new schedule for the BRA and subsequent capacity auctions impacted by the delay.

The commission said it will not require PJM to rerun capacity auctions that utilized the forward-looking offset because doing so would “undermine the expectations of the parties who are making commitments for the 2022/23 delivery year.” Capacity prices fell sharply in the last BRA held in May, the first capacity auction held since a delay in 2018. (See Capacity Prices Drop Sharply in PJM Auction.)

PJM spokeswoman Susan Buehler said the RTO was still reviewing the FERC order and examining next steps.

Order Opinions

FERC Commissioner Mark Christie | © RTO Insider LLC

FERC Commissioner Mark Christie | © RTO Insider LLC

FERC Commissioner Mark Christie said in a concurring opinion that certain changes in PJM’s reserve market construct proposal represented an “unacceptable risk that hundreds of millions of dollars of additional costs could be placed on consumers without a conclusive demonstration, in my view, of a commensurate increase in reliability.”

Christie said he agreed with the majority of commissioners that PJM “failed to meet its demanding burden” under FPA Section 206 to show that aspects of its currently effective reserve construct were unjust and unreasonable. He also agreed that because the replacement ORDC construct and reserve penalty factors “formed the bases” of challenging the E&AS offset from backward-looking to forward-looking, it too was unjust and unreasonable.

Christie said the order does not prevent PJM from seeking the approval of a forward-looking offset in the future if a proper case can be made, and he said it also doesn’t prevent the RTO from proposing other modifications to the reserve market construct.

Kent Chandler, Kentucky PSC | AWEA

Kent Chandler, Kentucky PSC | AWEA

“Consumers deserve a reliable supply of power at the least cost (consistent with applicable laws),” Christie said in his concurrence. “The issues implicated by PJM’s proposal to make major changes to its reserve market construct involve both reliability and consumer costs. Achieving the right balance is always the challenge in utility regulation.”

In a Twitter thread published on Dec. 23, Kentucky Public Service Commission Chairman Kent Chandler gave praise to FERC for “rethinking a prior decision.” Chandler said the previously approved ORDC “would have raised electricity prices by hundreds of millions of dollars, with little increase in resource availability or reliability.”

“The real win for consumers from this order is the reduced risk of extended periods of high prices that don’t increase reserves during emergency events,” Chandler said. “Without a circuit breaker, the ORDC posed a risk of high prices that look to bring on new generation, even if no one can show up.”