GreenHat listed its address as 826 Orange Ave., Suite 565, Coronado, Calif. — a UPS store between a nail salon and a RiteAid.

| GoogleFERC on Wednesday denied a motion from the estate of one of the owners of GreenHat Energy for the commission to drop its enforcement action after it emerged last fall that Office of Enforcement lawyers violated regulations related to the electricity market manipulation case (IN18-9).

Lawyers for the estate of Andrew Kittell, one of three owners of GreenHat, made a filing in October, arguing that a series of emails between Enforcement’s Division of Investigations (DOI) lawyers Thomas Olson and Steven Tabackman were “not only unlawful, but deceptive.”

FERC released the emails after Olson, who is part of the litigation staff in the GreenHat proceeding, disclosed them to Enforcement management. (See Estate of GreenHat’s Kittell Lobbies FERC to End Enforcement Action.)

In November, FERC said it determined that GreenHat and its owners violated the Federal Power Act by “engaging in a manipulative scheme” in PJM’s financial transmission rights market, issuing a total of $242 million in fines for the company’s 890 million-MWh default in 2018. The commission assessed civil penalties of $179 million on the company and $25 million each on owners John Bartholomew and Kevin Ziegenhorn. It also directed GreenHat, Bartholomew, Ziegenhorn and Kittell’s estate to disgorge more than $13 million in unjust profits, plus applicable interest. (See FERC Levies $242M in Fines on GreenHat, Owners.)

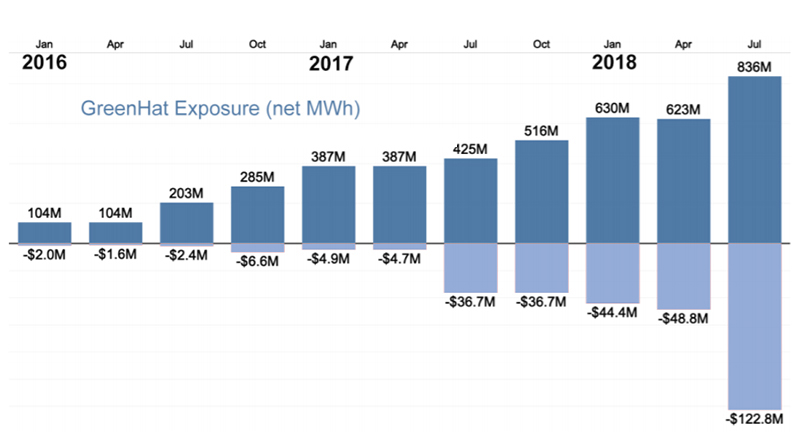

GreenHat acquired the largest FTR portfolio in PJM between 2015 and 2018, but defaulted on the portfolio in June 2018, leaving PJM stakeholders to cover more than $179 million in the market. When the company defaulted, FERC said, GreenHat had only $559,447 in collateral on deposit with PJM. (See Doubling Down — with Other People’s Money.)

GreenHat’s significant growth in exposure and MTA loss

” data-credit=”PJM” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: center;” alt=”GreenHats-significant-growth-in-exposure-and-MTA-loss-PJM-Content-2-1″>GreenHat’s significant growth in exposure and MTA loss | PJM

FERC said in Wednesday’s order that it was “troubled by the exchange of emails between decisional staff and litigation staff,” but the email exchange did not rise to the level of having to dismiss the case.

“The commission reviewed the prior allegations regarding the investigative process in this case and found such allegations to be without merit,” FERC said in its order. “With regard to the October 2021 notice, we need not decide here whether the Tabackman-Olson email exchange identified in the notice violated the commission’s regulations because we conclude that the conduct at issue here would not warrant the extraordinary remedy of dismissal.”

Email Exchange

In the email exchange disclosed in October, Olson notified the commission that he received emails through his personal Gmail accounts on Sept. 17 and 18 from Tabackman, who was serving as decisional staff in the GreenHat case. The two were discussing a pair of U.S. Supreme Court case decisions that Tabackman believed could strengthen FERC’s case.

Tabackman urged Olson not to reveal where he received the information on the cases, saying, “You never heard that here.”

Olson questioned Tabackman on whether the latter sent information on 1940’s U.S. v. Summerlin and 2006’s Marshall v. Marshall with the GreenHat case in mind, “or something else?”

Tabackman responded, “Yes — you should be familiar with them — though you should not mention how you came upon them.”

After receiving another email from Tabackman on Sept. 18 that referenced Tabackman’s work with the decisional team, Olson realized the emails “constituted a violation of the commission’s separation-of-functions regulation.”

The regulation prohibits any employee assigned to work on an enforcement proceeding or assisting in a trial “to participate or advise as to the findings, conclusion or decision, except as a witness or counsel in public proceedings.”

FERC removed Tabackman as a counsel of record in its federal court case.

In its motion, lawyers for the estate of Kittell, who killed himself by jumping off the San Diego-Coronado Bridge in California on Jan. 6, 2021, argued that the commission should drop all enforcement action against the estate, ban Tabackman and Olson from any future involvement in the investigation and “order other offices within the commission to investigate what happened.”

FERC said in its order on Wednesday that the email exchange “addressed procedural matters that might arise under California probate law in the state probate proceeding on the Kittell estate.” The commission said the procedural matters discussed in the emails were not an issue before FERC, but it decided to refer the matter to the OIG for an investigation.

The commission said the OIG “declined to take further action and deferred to the commission to proceed as appropriate” after finishing its investigation. “FERC said the commission’s Designated Agency Ethics official and staff conducted an internal administrative inquiry into any other communications regarding the Kittell matter and found no other violations.

FERC said it expects its staff to “conduct themselves in accordance with the highest ethical standards and is committed to ensuring that the subjects of investigations receive due process, both in perception and reality.”

“Because the commission ‘is charged with safeguarding the integrity of our nation’s interstate energy markets,’ it is obligated to take necessary and appropriate action when it finds violations of the statutory and regulatory prohibitions on manipulation of those markets,” FERC said in its order. “Moreover, numerous courts have recognized that administrative agencies are charged by Congress to enforce laws on behalf of the American people and thus dismissal of an agency enforcement action may run counter to the public interest. Accordingly, absent extreme circumstances such as a violation of Constitutional due process, courts generally will not set aside agency decisions based upon a violation of procedural rules.”

The commission determined that there was “no evidence” that the Kittell estate was harmed by the email exchange between Tabackman and Olson.

“To the degree that there was any harm from the email exchange, OE staff appropriately remedied that harm by immediately disclosing that exchange, thereby providing respondents with an opportunity to respond, and, as discussed, the commission both referred the matter to the OIG and tasked the commission’s designated ethics official to conduct an inquiry to assess whether additional prohibited communications occurred to confirm our decisions in this case were reasoned and unbiased,” FERC said in its order. “Accordingly, we find that dismissing the action would serve no purpose other than to deprive the public of justice in the underlying matter.”

Danly Dissent

FERC Commissioner James Danly issued a dissent in the order. Danly previously had harsh words for PJM in the case, saying the RTO was partially to blame for the result of the default and had a “share of the blame that must rightly be assigned to PJM.”

In his dissent issued Wednesday, Danly said the ethics of prosecutors “must be above suspicion,” and for the commission to do “anything less than fully consider and respond to these claims damages our credibility.”

“Under these circumstances, the movant and the public deserve an answer,” Danly said in his dissent. “And while I acknowledge that enforcement and the commission have taken some action to redress enforcement’s misconduct, our enforcement program would be better served by issuing a commission order with a clear-eyed and unflinching response to the misconduct alleged in both the Oct. 5, 2021, motion and the respondents’ answer to the order to show cause.”