SPP’s Board of Directors last week approved three tariff revision recommendations, two of which fell just short of stakeholder endorsement two weeks ago.

The two revisions requests, RR477 and RR483, were responses to previous tariff revisions that had been rejected at FERC. Both RRs also failed to gain the Market and Operations Policy Committee’s endorsement two weeks ago. (See SPP Board, Regulators to Take up Rejected RRs.)

RR477 would establish uniform local planning criteria within each transmission pricing zone. RR483 would address FERC-identified deficiencies in the grid operator’s byway facility cost-allocation process.

The Members Committee approved both measures in advisory votes for the board. RR477 passed 14-7, with an abstention, and was opposed by transmission owners and renewable energy interests. RR483 passed 12-7 with three abstentions, with TOs again in opposition.

ITC Great Plains’ Brett Leopold reiterated his company’s opposition to RR477, pointing to FERC orders addressing local TO planning in PJM. The orders found that TOs’ local planning processes must be open and transparent and allow transmission customers to participate and provide input, he said, while upholding the TOs’ right to conduct local planning according to their own established criteria.

RR477 would maintain the original construct of a transmission pricing zone’s facilitating TO (FTO) from its rejected application before FERC. However, it would introduce a formal process or ability to influence the FTO’s decision-making in establishing zonal planning criteria. It would also establish an avenue to ensure input from the zone’s other TOs, customers and stakeholders is considered and set up a two-step voting process.

“We think the solution before us is contrary to some … cases regarding local planning coming out of PJM,” Leopold said. “We’re put in a particular position where … we are not able to retain some autonomy regarding local planning, which we think we’re entitled to under the existing FERC precedent. We could be put in a position where we couldn’t do needed projects and wouldn’t be able to have those costs allocated unless we sponsored them and paid for them ourselves. I think [that is] is the box that we’re in.”

FERC rejected an earlier proposal in 2020, siding with stakeholders who argued the proposal would give a pricing zone’s FTO ”unilateral power” and “unduly” benefit them and the zone’s largest network load customer. (See FERC Rejects SPP’s Zonal Planning Criteria.)

SPP has developed another tariff revision (RR452) that would create a zonal upgrade study process proving a more expedient review of storm-damage recovery and age and condition projects that need a more urgent in-service date. The revision has been described as a backstop for local planning if a zone can’t establish its planning criteria, but Evergy said this is only true if local planning criteria is added to SPP’s planning criteria, which has yet to occur.

SPP COO Lanny Nickell said he didn’t know when RR452 would be ready for MOPC action and that “it could be something that provides some comfort for the backstop if the zonal planning criteria is not achievable.”

Members spent less time debating RR483, which promises a “surgical approach” to evaluate byway transmission projects in wind-rich zones. It would allow a byway-funded upgrade to be funded through a regionwide allocation after meeting certain criteria under the “narrow review process.” Projects eligible for this “narrow and limited process” would be required to have base plan upgrade costs eligible for cost allocation under the SPP tariff.

The revision request is a response to FERC’s rejection last June of a previous proposal. The commission found it would have given too much discretion to the board in allocating costs and did not include clear standards for making decisions. (See FERC Rejects SPP’s Cost-allocation Waiver Proposal.)

“A lot of good work went into [RR483], but the criteria that’s been established will create issues for large [transmission] zones that don’t necessarily have a lot of load. I think it will be nearly impossible for any job in our pricing zone because it’s so large,” Nebraska Public Power District CEO Tom Kent said. “It will be impossible for NPPD to take advantage [of the tariff revision] in our zone. We’re going to see our transmission costs continue to go up and continue to be impacted negatively without an ability to take advantage of this surgical exception.”

The board also approved RR476, which would accept storage resources as transmission assets. The measure defines the assets as “storage-as-transmission-only assets” and would require them to register as market storage resources in the Integrated Marketplace to account for their injections and withdrawals.

All three tariff revisions were among 21 recommendations from the Holistic Integrated Tariff Team in 2019, intended to integrate increased renewable energy, boost reliability and improve transmission planning. (See SPP Board Approves HITT’s Recommendations.)

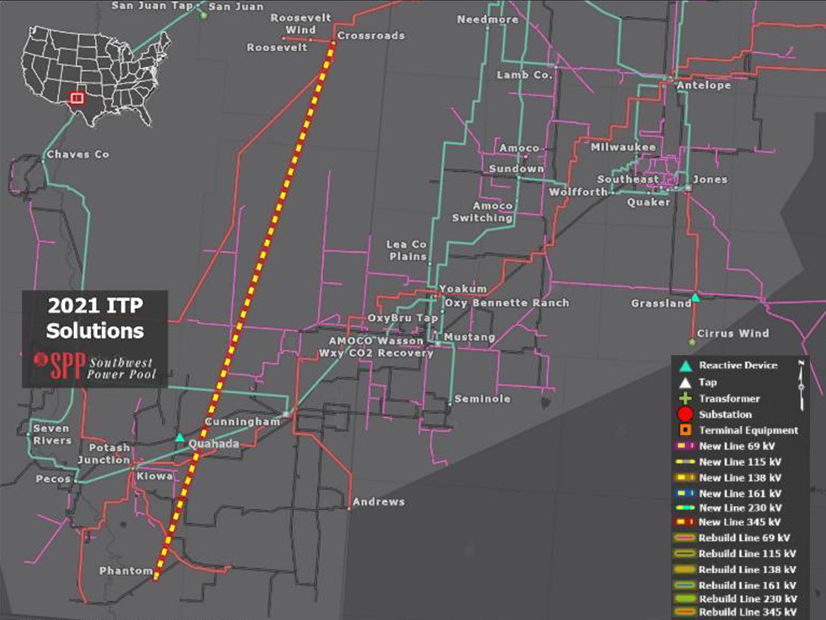

Board Approves 2021 ITP, Holds NTCs

The directors followed MOPC’s lead two weeks ago in approving the 2021 Integrated Transmission Planning (ITP) study, while withdrawing notifications to construct (NTCs) for a 150-mile, 345-kV project in West Texas and a pair of transformer projects in New Mexico. (See SPP Markets and Operations Policy Committee Briefs: Jan. 10-11, 2022.)

According to the 10-year assessment, the Crossroads-to-Phantom project would provide a low-resistance, parallel path for delivery of low-cost energy to Southwestern Public Service’s SPS South load. The study found that the double-circuit project would provide twice the capacity of a single circuit, while “incrementally” increasing the engineering and construction costs from $330.2 million to $409.9 million, a 23.9% increase.

The project, easily the most expensive in the $1.04 billion portfolio, addresses one of two targeted areas in the 2021 ITP where SPP found voltage-stability issues because of isolated load and above-average load projections. Both targeted regions, the Permian Basin in West Texas and eastern New Mexico, and the Bakken Formation oil fields in North Dakota, are the result of oil and gas growth.

However, load-projection errors, related to how load was allocated to individual substations, were discovered late in the process. Working group stakeholders said the error was found in the 2022 ITP models, too late for staff to do a full impact analysis.

The working groups spent hours trying to resolve the issue in December before recommending the NTCs not be issued.

Public Service Company of Oklahoma President Peggy Simmons asked whether enough information was provided to MOPC before the decision was made.

“We think the results we came up with, based on the information we had at the time of the study, suggest that the project is the right solution to address the issues,” said Antoine Lucas, SPP’s engineering vice president. “We did receive information that those assumptions and some of the assumptions SPS believes are material to the project’s decision differ from what was studied. That information came along at time where we were too far along in the process where we were able to go back and re-evaluate. That created some uncertainty around the selection of Crossroads-Phantom.”

Lucas said staff have agreed to resume discussions with stakeholders “to update their assumptions and see whether a different and better solution can be found to resolve this.”

The NTC’s withdrawal gives staff further time to evaluate the Crossroads-Phantom project and bring it back to MOPC for its July meeting.

The ITP portfolio includes 28 projects and 380 miles of new 345-kV lines, including Crossroad-Phantom. The projects would solve 185 system needs with a 5.3 to 5.7 benefit-to-cost ratio.

Members Elect 2 New Directors

Ben Trowbridge’s (left) and John Cupparo’s elections to SPP’s Board of Directors adds cybersecurity, IT and utility experience. | SPP

Ben Trowbridge’s (left) and John Cupparo’s elections to SPP’s Board of Directors adds cybersecurity, IT and utility experience. | SPPThe membership elected Ben Trowbridge and John Cupparo as directors during a special meeting of members, filling the board’s two vacancies. Their three-year terms will expire Dec. 31, 2024.

“Together, they bring a wealth of experience and valuable perspectives in matters related to transmission planning, cybersecurity, finance and other topics that are particularly relevant to our organization right now,” CEO Barbara Sugg said in welcoming the board’s newest members. “I’m 100% sure you’ll be very pleased with their ability to serve SPP as an independent director.”

She said Trowbridge fills the board’s need for cybersecurity and IT expertise. He was the global leader of Ernst and Young’s Cybersecurity as a Service practice, founded the technology advisory firm Alsbridge and has served in other similar positions.

“I’m committed to board service now,” Trowbridge told members. “This role means a lot to me. Thank you for allowing me to contribute and make SPP a little better for all the members and stakeholders.”

Sugg said SPP was also very specific in searching for candidates with utility experience “who could hit the ground running.” As former CEO of Berkshire Hathaway Energy’s U.S. Transmission subsidiary and having held leadership positions with PacifiCorp and Koch Industries, Cupparo checked that box.

“As the energy needs of the country become more complex, SPP will play a vital role in achieving its collective membership’s objectives,” Cupparo said. “My focus will be on leveraging my industry experience to contribute to SPP delivering its mission.”

Board Chair Larry Altenbaumer said Director Susan Certoma will be his vice chair. “She has immersed herself in to the nuts and bolts of everything that is SPP,” he said.