Next week’s Forward Capacity Auction in ISO-NE will likely have similar outcomes to last year’s, observers say, even as debate swirls in the region around the future of the market.

The clearing price in FCA 16 will probably be about equal to or lower than last year’s, said experts and analysts who spoke to RTO Insider.

There are two primary changes acting on the market that are likely to largely offset each other: a significant decrease in the installed capacity requirement (ICR) and falling supply.

This year’s ICR is 32,568 MW, down about 1,600 MW from last year’s value of 34,153 MW. That’s because of a decrease in ISO-NE’s peak load forecast, said Joe Prosack, an analyst at ESAI Power.

The decrease stems from changes to the RTO’s methodologies, particularly in the incorporation of energy efficiency capacity. Historically, that calculation has been based on energy efficiency resource performance.

But “the performance of EE resources often exceeded the actual capacity supply obligations that they had,” Prosack said. “So in essence, they were adding back way more demand than energy efficiency resources were adding in terms of supply.”

The new methodology change brings those two into alignment. “And as a result, they’re essentially adding back less energy efficiency capacity compared to previous years, and that resulted in a large decline in the peak load forecast,” Prosack said.

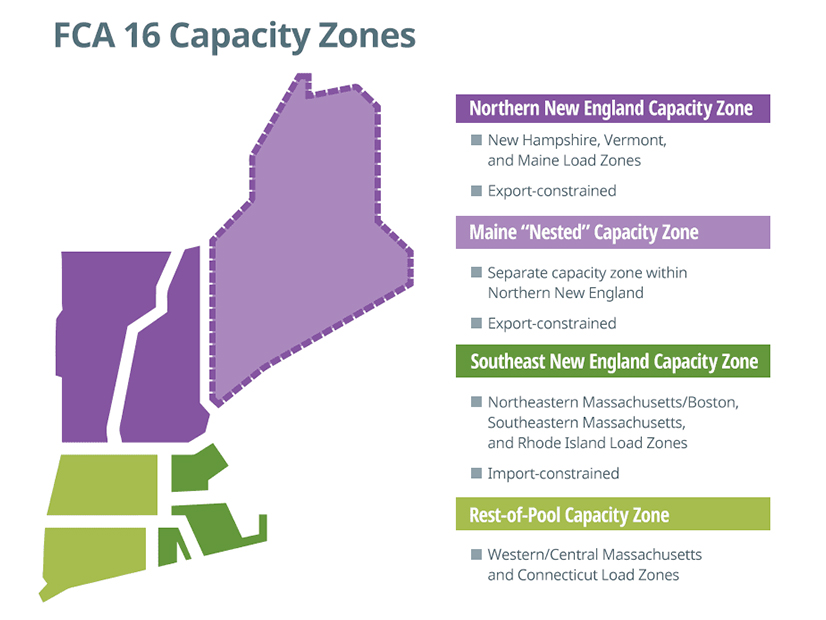

ESAI thinks there will be a large surplus of capacity, even with the known supply decrease, which will push prices below last year’s clearing prices of $3.98 kW-month in the Southeast New England zone, $2.61 kW-month in the Rest-of-Pool zone, and $2.48 kW-month in the Northern New England and Maine zones.

That’s not a universal opinion, however.

Dan Dolan, president of the New England Power Generators Association, said he believes the supply decreases — particularly the loss of the Killingly Energy Center in Connecticut that had its capacity supply obligation terminated by ISO-NE last year — will largely offset the lower ICR. Dolan spoke before the D.C. Circuit Court of Appeals on Friday stayed FERC’s order ending Killingly’s capacity supply obligation, allowing the proposed plant to take part in the auction. (See Killingly Stays Alive After DC Circuit Halts FERC’s Termination Order.)

“In a market as small as New England, any large power plant coming in or out has a big impact on the auction results,” he said. But overall, “my guess is we have a relatively stable auction,” Dolan said.

Another Year of the MOPR

Renewable and battery storage developers face continuing uncertainty about the auction as the region’s minimum offer price rule, intended to mitigate the price-dampening effects of state-sponsored resources, remains in effect.

Some of those companies have also argued that the capacity market disadvantages renewable projects more broadly.

“There is a perception that the bids with state subsidies are the only ones that get inflated, but [the Internal Market Monitor] actually has done this for unsubsidized projects as well,” said Theodore Paradise, executive vice president of the transmission and storage company Anbaric. “The result has kept not only renewables with state contracts out of the market … but it’s hampered the clean energy transition.”

Anbaric and the Massachusetts Municipal Wholesale Electric Co. had a bid for a 100-MW battery storage project increased by the Monitor for this upcoming auction, a decision that FERC upheld, although its Democratic commissioners said that the companies made a “persuasive case” in their protest.

Some state-sponsored resources should be able to clear the auction because of “generally low enough” offer review trigger prices, the offer floors for new resources, ESAI’s Scott Niemann said.

The exception is offshore wind projects, which have to use the auction’s starting price. That makes it “very difficult [to clear] unless they get a unit-specific exemption,” Niemann said.