Continuing their bid to block the Southeast Energy Exchange Market (SEEM), a collection of environmental, clean energy and community groups filed an appeal of FERC’s decision to approve the market with the D.C. Circuit Court of Appeals on Tuesday.

The Southern Environmental Law Center (SELC) filed the appeal on behalf of the Sierra Club, the Southern Alliance for Clean Energy, the North Carolina Sustainable Energy Association, and others. Advanced Energy Economy, Clean Energy Buyers Association, Solar Energy Industries Association, and the Natural Resources Defense Council joined as well. The plaintiffs hope to persuade the court to set aside FERC’s approval of the market from October, along with subsequent orders stemming from the commission’s decision (ER21-1111, et al.).

AEE General Counsel Jeff Dennis said in a statement that the SEEM agreement “threatens to erode foundational principles of open access to the transmission system that have been in place for decades, and to cement monopoly control of generation markets in the [Southeast].” He called for the market to be revised “to ensure fair competition among generating resources and open access to the transmission system in the region.”

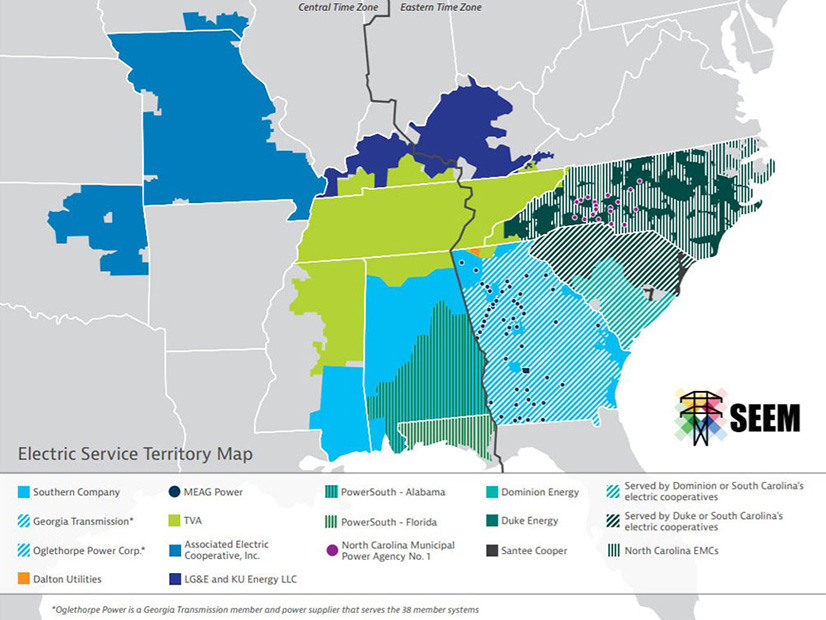

SEEM’s sponsors — a group of utilities including Southern Co. (NYSE:SO), Dominion Energy South Carolina (NYSE:D), LG&E and KU (NYSE:PPL), the Tennessee Valley Authority and Duke Energy (NYSE:DUK) — proposed the market last year, saying that the expansion of bilateral trading would reduce trading friction while promoting the integration of renewable resources. But the proposal attracted considerable opposition from environmental groups, including many of the plaintiffs in Tuesday’s appeal.

The SEEM agreement took effect Oct. 12, after FERC — at the time short a commissioner and evenly split with two Republicans and two Democrats — failed to form a majority for or against it. Under Section 205 of the Federal Power Act, the agreement became effective “by operation of law.” (See SEEM to Move Ahead, Minus FERC Approval.)

The FPA allows any parties “aggrieved” by a FERC order to apply for rehearing within 30 days of its issuance, and because FERC did not issue a formal order in the proceeding, SELC and other opponents filed rehearing requests Nov. 12 — 30 days after Oct. 13, the date FERC announced that the agreement had taken effect. But FERC denied these requests, reasoning that Oct. 11 was the deadline for the commission to issue an order and therefore the beginning of the clock for filing rehearing requests. As a result, any requests filed after Nov. 10 were out of time. (See FERC Rejects SEEM Opponents’ Rehearing Requests.)

The SEEM opponents responded by asking for a rehearing of this decision as well, which FERC again denied. In their filing Tuesday, the plaintiffs called for the court to overturn all three decisions, in addition to:

- FERC’s order of Nov. 8 approving revisions to four of the SEEM utilities’ tariffs implementing the special transmission service used to deliver the market’s energy transactions (See FERC Accepts Key Tariff Revisions to SEEM.).

- The commission’s rejection of plaintiffs’ rehearing request for this order.

“This case is about the fundamental principle of open access and the commission’s obligation to enforce that principle to protect market participants and consumers,” SELC Staff Attorney Maia Hutt said in a separate statement. “Should SEEM be allowed to move forward, it must include open-access to transmission and accountability mechanisms that ensure that SEEM does not benefit utilities at the expense of customers.”

In an email to RTO Insider, a spokesperson for Southern said SEEM members would “provide the court the information necessary regarding the FERC proceedings and the benefits of SEEM for our customers.”