FERC on Friday accepted PJM’s revisions intended to increase transparency into and the efficiency of the RTO’s auction revenue rights (ARR) and financial transmission rights markets (ER22-797).

The commission’s decision marks a milestone for PJM after it and its stakeholders spent several years discussing changes to the markets after the GreenHat Energy default in 2018.

PJM filed the proposal in January after stakeholders endorsed the revisions at the Markets and Reliability Committee and the Members Committee in the fall with majority support. The FTR portion of the tariff revisions will take effect on Sept. 1, and the ARR portion on Feb. 1, 2023.

“We find that PJM’s proposal is just and reasonable because it enhances hedging opportunities for load and helps enhance market liquidity and future price discovery,” the commission said.

PJM’s proposal included revisions to its tariff and the Operating Agreement that were guided by the findings of a report developed by London Economics International (LEI).

Proposed enhancements to PJM’s current ARR/FTR market design. | London Economics

Proposed enhancements to PJM’s current ARR/FTR market design. | London Economics

The RTO said its proposal aimed to recognize recommendations made in the LEI report and address concerns raised by the Independent Market Monitor and stakeholders. The proposal also sought to maintain the consultant’s conclusion that the existing FTR product is “reasonable and generally achieving the intended purposes” of serving as a financial equivalent to firm transmission service and to ensure “open access to firm transmission service by providing a congestion-hedging function.”

“The LEI report found that PJM’s FTR/ARR market design is achieving its dual purposes of facilitating the return of congestion charges to load and enabling hedging and supporting forward market activity, and overall is ‘creating overall positive value for load,’” the commission said. “However, the LEI report outlined potential enhancements to PJM’s FTR/ARR market design, focused on the themes of equity, efficiency and transparency, which PJM reflected in the instant proposal.”

The revisions make it so ARRs are allocated based on 60% of network service peak load, rather than zonal base load. They also provide additional self-scheduling options for ARR holders; add new FTR class types for on-peak weekday, on-peak weekend and holiday, general everyday off-peak and 24-hour products; increase the bid limits in all FTR auctions from $10,000 to $15,000; and add a $1/MW-period class clearing price floor for all FTR option products.

Protests

Several stakeholders protested portions of PJM’s proposal.

A group of consumer advocates — including the D.C. Office of the People’s Counsel, the Citizens Utility Board, the Delaware Division of the Public Advocate, the Maryland Office of People’s Counsel, the New Jersey Division of Rate Counsel, the Pennsylvania Office of Consumer Advocate and the PJM Industrial Customer Coalition — said they supported PJM’s proposal but maintained that it “does not go far enough in some respects.”

The advocates argued that even though a more direct alignment of congestion revenues and costs is “undoubtedly a step towards a more efficient and equitable FTR/ARR market,” the change doesn’t address situations where surplus congestion or auction revenues occur and “should be returned to the load that paid for the transmission upgrades that made those surplus revenues possible.”

Dominion also expressed support for portions of the proposal, but it argued that the revisions don’t fully address the “under-allocation of congestion revenues” for load and an inability of certain load-serving entities to “come close to covering their congestion costs.” Dominion said PJM’s filing “does little” to address “disparate outcomes” under the current ARR/FTR construct that “persistently creates results where the congestion cost recovery by LSEs varies greatly.”

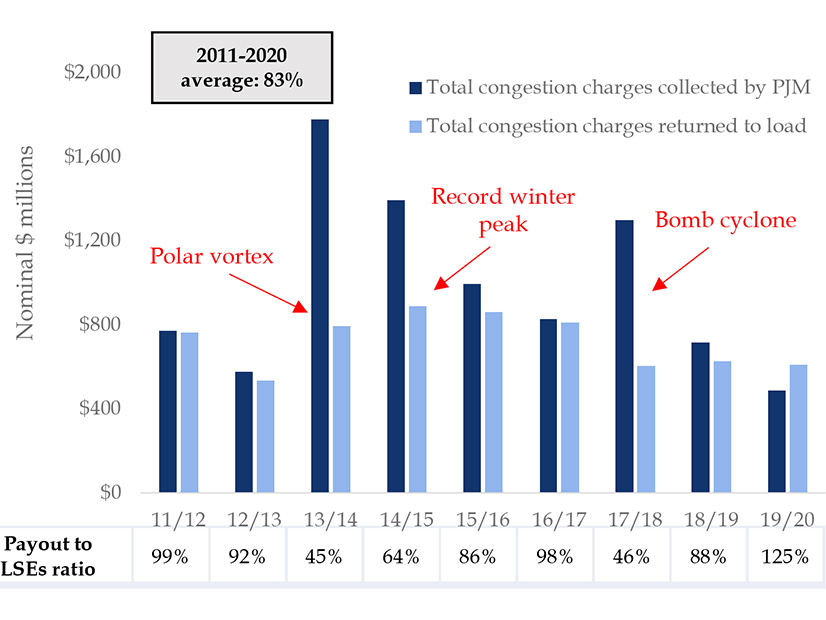

The Monitor alleged that PJM’s filing “perpetuates or worsens fundamental flaws in the existing PJM FTR/ARR market,” saying the current market design “consistently failed to return the congestion revenues to the load that paid it.”

It also argued that the total congestion offset paid to load is “inequitable and varies by zone,” with some zones receiving more in offsets than the total congestion payments and other zones receiving less in offset. The offsets “are a function of the assignment of ARRs and the valuation of ARRs in the FTR auctions” and that the expansion or modification of the path-based rights available to load and the market will “simply change the arbitrary allocation of congestion among ARR holders and participants in the FTR market and will not correct the arbitrary allocation of congestion.”

FERC Determination

The commission said it determined the ARR market construct were just and reasonable and that the expansion of the source/sink combinations of the ARR allocation process “provides load the first rights to the transmission system before FTR holders can purchase such rights and, therefore, increases the network capacity allocated to load.”

“While not the sole purpose, one of the purposes of the FTR/ARR market is to return congestion charges to load, and this proposed change is consistent with that purpose,” FERC said.

FERC said the proposal’s call to replace zonal base load “protects zonal native load hedging ability by increasing up-front capability to load.” The commission said PJM’s selection of the 60% standard was a “reasonable limit at which additional value could be guaranteed” without significantly increasing violations or producing additional transmission constraints.

It also said that “PJM’s proposal to not award FTR options with a market-clearing price of less than $1 mitigates risk-free profit by ensuring all FTR options that clear have, at least at the time they were bid and awarded, actual value,” the commission said. “We also find that PJM’s proposal to create new FTR class types provides more flexible hedging opportunities.”

The commission said it disagreed with the challenges to how congestion surplus is allocated and the “fundamental nature” of a path-based FTR/ARR construct. It said the protests citing concerns regarding provisions of the existing FTR/ARR market construct were outside the scope of the proceeding.

FERC also disagreed with the Monitor’s argument that the revisions in the proposal do not return “sufficient” congestion revenue to load, saying it rejected the “foundational argument” that the “sole purpose of FTRs is to return congestion revenue to load and the market should therefore be redesigned to accomplish that purpose.”

“PJM’s proposal is not rendered unjust and unreasonable simply because the IMM thinks a further allocation to load would be desirable,” FERC said. “Consistent with commission precedent, we reiterate that ‘the purpose of FTRs to serve as a congestion hedge has been well established.’ FTRs were designed to serve as the financial equivalent of firm transmission service and play a key role in ensuring open access to firm transmission service by providing a congestion-hedging function.”