California Gov. Gavin Newsom is looking to earmark $380 million for long-duration energy storage (LDES) incentives in his proposed 2022/23 state budget. For California energy officials, the state’s grid operator and LDES developers, that money can’t arrive soon enough.

California defines “long-duration” as any storage resource able to discharge energy to the grid for at least eight hours at full output, but the state also has a “stretch goal” of 20 to 100 hours. While otherwise technology-neutral, Newsom’s incentive program would seek to boost the commercial prospects of alternatives to lithium-ion batteries and pumped hydro. Priority would be given to technologies on the verge of commercialization or positioned for widespread deployment within the next five to 10 years.

Speaking Tuesday at an interagency workshop exploring ways to advance the adoption of non-lithium-ion LDES, California Energy Commission Chair David Hochschild acknowledged that the $380 million in funding “still has a little ways to go” before passing the legislature.

“But part of the reason for coming together today was feeling an incredible sense of urgency about getting this right, particularly on program design,” Hochschild said.

Two issues are driving that urgency, according to speakers at the workshop.

The first is that California’s grid, increasingly reliant on variable renewable generation, will soon push its reliability limits by relying on four-hour batteries as a substitute for gas-fired peaking resources.

The second factor is more global in nature, with competition for worldwide lithium supplies heating up as more consumers purchase electric vehicles and government policies across the world encourage the electrification of most forms of transportation and heavy-duty equipment.

‘Incredibly Versatile’

Two years ago, CAISO had about 200 MW of battery storage on its grid. Today it manages 3,100 MW, most of which is lithium-ion. By summer, that number is expected to reach 4,000 MW.

During Tuesday’s workshop, Hochschild praised the state’s ability to integrate that kind growth in such a short time.

“We’re not finished, of course; there’s a lot more to go; but just to actually have that installed and dispatchable is incredible,” he said.

“Not only is California leading the way in terms of [storage] technologies that are on the grid, and what we’re operating today, we’re also leading the way in terms of the tools that we have to actually manage and operate these resources,” said Gabe Murtaugh, storage sector manager at CAISO.

California’s battery storage resources, predominantly four-hour in duration, are “incredibly versatile,” helping CAISO manage peak loads and “operational uncertainty” on the grid, Murtaugh said. The ISO has committed much time to developing market models that manage the state of charge of those resources, he said, ensuring they’re available when needed most, such as on the hottest summer days.

But the continued emergence of storage requires a dynamic approach to managing the resources, Murtaugh said. The California Public Utilities Commission’s 2032 integrated resources plan calls for 15 GW of storage by 2032, with 30 to 50 GW looking further out, according to Jonah Steinbuck, deputy director of the CEC’s Energy Research and Development Divsion.

“Just because we have a model that works today, and we’re sharing that model with other ISOs and RTOs across the country, doesn’t mean our work on storage is done by any means,” Murtaugh said. “We know that there’s other different kinds — different flavors — of technology: long-duration technology; other short-duration batteries as well. And as we’ve mentioned before, the ISO is technology-agnostic, so we really need to design our models to be able to accommodate all kinds of technologies potentially.”

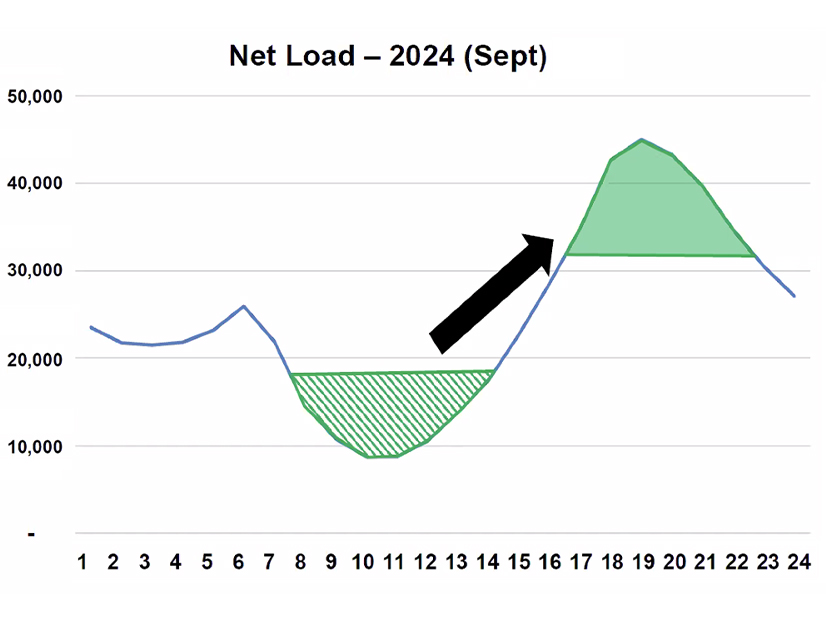

The growing prevalence of variable generation in California will alter the shape of CAISO’s “duck curve,” the iconic graph that depicts the deep trough in the ISO’s “net load” during the middle of the day (formerly the period of peak demand) as solar resources reach full output, followed by the steep rise in net load heading into evening as those same resources taper and cease production.

Longer-term peak load forecasts from the CEC indicate the middle of the duck curve will become even deeper and wider as California brings on more solar resources, while net loads in the late afternoon and evening will become even steeper with increased electrification of the state’s economy.

The key for the ISO is to shift the solar oversupply in the trough period to the high needs during the ramp. Using the CEC’s forecasts, CAISO predicts that, by 2024, four-hour batteries discharging at full capacity will be insufficient to provide the energy flows necessary to meet demand across a longer and steeper evening peak. Long-duration storage will be needed to cover that gap and avoid continued reliance on peaking plants.

“Obviously, you can take a four-hour battery and operate it at something less than its full output for a longer period of time, but you’re probably losing some efficiency there,” Murtaugh said.

More challenges loom beyond 2024, as the state pursues its policy of achieving a zero-emissions grid by 2045, requiring use of even longer-duration storage of up to 100 hours, Murtaugh said. That’s because CAISO expects the grid will shift from a summer- to winter-peaking system.

“The hardest times will be during multiday periods when we have low wind and low solar availability, which is more prevalent in the winter than it is in the summer,” he said. “And in those kinds of situations, when we’re very heavily reliant on renewables to produce the energy that’s going to be consumed in the state, then you need storage or some other solution to generate new energy in order to keep the lights on across those periods.”

Other factors will compound the need to adopt long-duration storage by the middle of this decade, according to James McGarry, a senior analyst in integrated resource planning at the CPUC.

Among them is the expected retirement in 2024 of 1.3 GW of gas-fired capacity 40 years or older and the closure of 3.7 GW of thermal plants relying on once-through cooling, followed by the 2025 retirement of the 2.3-GW Diablo Canyon nuclear plant.

“And throughout this time period, West-wide heat and drought conditions paired with neighboring states increasing their own clean energy commitments are leading us to expect tighter availability of imports during peak demand periods,” McGarry said.

“As we look across different use cases and applications, long-duration storage has a major role to play in the ISO’s local capacity requirements,” said Jin Noh, policy director for the California Energy Storage Association. “Studies are already showing a significant need to look at long-duration storage if we really want to replace local gas generation.”

Noh said long-duration storage could provide more of the “diverse capabilities” the ISO is seeking to manage a system increasingly dominated by inverter-based resources, including offering inertia support and helping to “better optimize and utilize the other resources on the grid.”

‘Dirt Cheap’

According to Noh, long-duration storage technologies already benefit from “pretty significant” private investment. But Gov. Newsom’s proposed incentives would “serve as that tipping point for technologies that are really on the verge of commercialization” while easing the “first-mover burden” on those organizations adopting the new technologies.

CEC Vice Chair Siva Gunda pointed out that part of that burden includes testing — then rapidly scaling — the new technologies. Lithium-ion batteries benefited from about 10 years of deployment and providing operational data before attracting broad private investment, he said.

To help alleviate the proof-of-concept burden for LDES, the U.S. Department of Energy has proposed the Rapid Operational Validation Initiative, designed to accelerate testing and have resources ready for commercialization by 2030, ahead of the Biden administration’s 2035 target for a clean U.S. electricity system, said Eric Hsieh, DOE’s director of grid systems and components.

“We’re looking to use these demonstrations to collect data from them [and] combine them with accelerated testing procedures in the lab with domain knowledge and [artificial intelligence/machine learning] algorithms, with the intent of being able to provide investment-grade performance projections with just one year of data,” Hsieh said.

And another key development adds to the time pressure to deploy LDES, according to Larry Zulch, CEO of Invinity Energy Systems, a flow battery developer.

“I talk to a lot of metals companies, people who are in the trade, and they keep telling me, ‘You have no idea what kind of lithium shortage is coming along because of the [transportation sector] requirements,’” Zulch said.

Zulch said the applications that will rely on energy-rich lithium-ion batteries, which include EVs, airplanes and construction equipment, “far exceed the increased production capabilities” of lithium and nickel mines.

Invinity’s flow batteries rely on vanadium, which Zulch said is more abundant than copper and found throughout the world, preventing it from becoming a “conflict” mineral.

Other LDES company representatives speaking during a workshop panel also touted the relative abundance of the critical minerals used in their systems. Mateo Jaramillo, CEO of Form Energy, said his company’s iron-air design relies on the most heavily mined mineral on Earth, present on every continent. Henrik Stiesdal, founder of Stiesdal A/S, said the storage medium in his company’s thermal energy system is crushed basalt, which he called “dirt cheap.”

Unsurprisingly, company executives were unified in their belief that the moment has already arrived for LDES.

“I think the [LDES] batteries that all of the panelists, along with myself, are able to produce and provide are addressing a specific market need that’s already there,” said Balki Iyer, chief commercial officer of Eos Energy.

“What we see here is the fact that we actually have a longer-duration need from the market [that’s] driving the shift, moving away from lithium to non-lithium, longer-duration batteries,” he said.