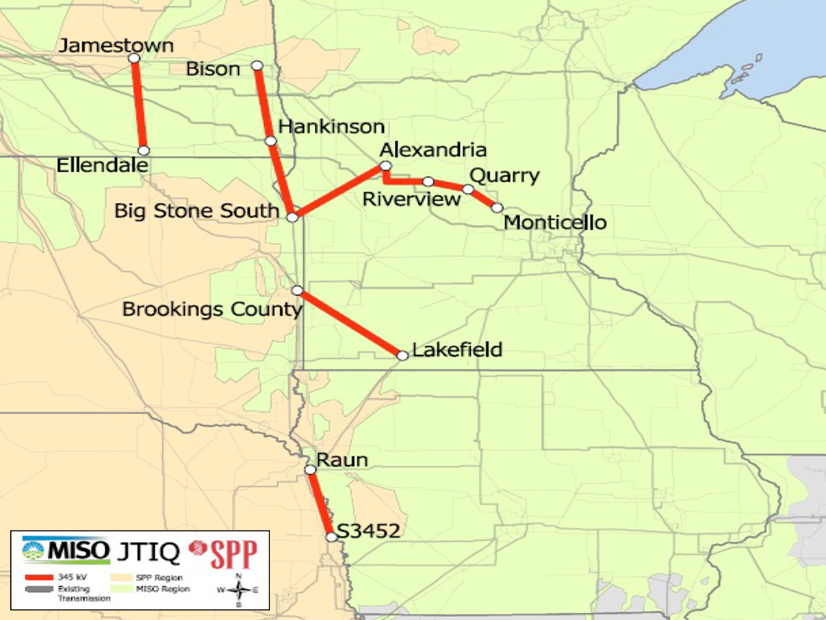

SPP and MISO began gathering stakeholder feedback Friday on ways they can pass the hat for the projected $1.65 billion in transmission projects that resulted from their joint targeted interconnection queue (JTIQ) study.

RTO officials began their meeting by acknowledging uncertainties over how much additional generation could be connected as a result of the new transmission, comprising seven projects that are projected to resolve 48 reliability constraints and deliver about $724 million in adjusted production costs savings to MISO and $247 million to SPP.

MISO’s Andy Witmeier speaks at the Gulf Coast Power Association’s MISO South/SPP Conference in March. | © RTO Insider LLC

MISO’s Andy Witmeier speaks at the Gulf Coast Power Association’s MISO South/SPP Conference in March. | © RTO Insider LLCWhile MISO’s model estimated a total of 28 GW (10.5 GW in SPP and 17.5 GW in MISO), SPP’s model estimated almost twice as much benefit, a total of 53 GW (11.1 GW in SPP and 41.9 GW in MISO).

Andy Witmeier, director of resource utilization for MISO, said the discrepancies may have resulted from how SPP’s model dispatched MISO generation to serve MISO load and the impacts on loop flow.

To simplify the cost allocation, the RTOs said they settled on using each RTO’s model for its own generation: 11.1 GW in SPP and 17.5 GW in MISO, for a total of 28.6 GW.

“MISO knows how they dispatch their generation … and similar for SPP,” Witmeier said. “Let’s just use the SPP number based on how they’re serving their own load with their generation to try … and remove some ambiguities.”

In an example offered by the RTOs, generator interconnection requests with a 5% or greater DFAX (solution-based distribution factor) impact on the JTIQ portfolio could pay a charge of $35,000/MW. So, a 270-MW generator with a 10% DFAX impact would pay $945,000 (27 MW x $35,000).

Rafik Halim of National Grid Renewables asked the RTOs to share the details of their modeling. “There needs to be a study that’s transparent” before decisions are made, he said.

Stakeholder-driven Methodology Sought

SPP’s Neil Robertson at the Gulf Coast Power Association’s MISO South/SPP Conference in New Orleans. | © RTO Insider LLC

SPP’s Neil Robertson at the Gulf Coast Power Association’s MISO South/SPP Conference in New Orleans. | © RTO Insider LLCNeil Robertson, SPP’s coordinator of system planning, emphasized that the per-megawatt charge and DFAX threshold were used to illustrate the concept and not a firm proposal, saying the RTOs seek a “stakeholder-interactive approach” to developing the methodology.

“SPP and MISO did not intend to come up with a fully developed methodology and then simply ask for stakeholder input,” he said. “We want to take stakeholder input on key concepts and use them as building blocks to build out this methodology.”

“We are not naive enough to think we have all the answers,” added David Kelley, director of seams and tariff services for SPP.

The actual cost multiplier will be designed to collect all of the costs of the portfolio “while, at the same time, fully utilizing the capacity, not underselling or overselling the capacity that we are creating,” Robertson said. Whatever the methodology, “prior to executing a GIA [generator interconnection agreement], you would know what the JTIQ charge would be, just like you would know any of the other upgrades involved in the generation interconnection process.”

Robertson said RTO officials are seeking a balance between a subscription-based model and one in which load would initially pay for the projects and generation would reimburse as it interconnects. Such a balance could involve the requirement of a “critical mass” of generator agreements: for example, 50% of total JTIQ portfolio funding agreed to by GI customers in signed GIAs. Funding for the other 50% could come from local transmission owners or be regionally funded and later reimbursed as additional generators sign up.

Steve Gaw of the Advanced Power Alliance, which represents wind, solar, and energy storage companies, expressed concern that the critical mass approach could delay interconnections of projects already in an open study.

Robertson acknowledged that while the model could mitigate risk to “any particular segment of the stakeholder base,” it could also “increase the uncertainty” for some generators.

Brenda Prokop of LS Power said she agreed with the concept of a critical mass. “I think it’s pretty necessary to set some kind of threshold for proceeding with projects.”

But she said MISO and SPP should not “assume that the JTIQ projects would be reserved for local TOs and eligible to be funded by them” because not all of the projects would be in states that permit TOs a right of first refusal (ROFR). The projects would be built in Minnesota, North Dakota and South Dakota, which all have ROFR laws, as well as in Nebraska and Kansas.

Antoine Lucas, SPP’s vice president of engineering, closed the meeting by acknowledging that the two RTOs had forgone the “certainty” of their existing cost allocation processes in seeking an “ad hoc” methodology for JTIQ.

“But we felt like it was worth it to have the flexibility to be able to craft a mechanism customized to fit the specific projects and specific circumstances that we would see from the JTIQ,” he said.

Next Steps

The seven projects have a projected cost of $1.65 billion, but the JTIQ cost allocation likely won’t apply to two of the projects, which MISO has included in its tranche of long-range transmission projects. (See MISO, SPP Finalize JTIQ Results with MISO Tx Duplicates.)

MISO and SPP hope to submit their cost allocation formula to FERC by the end of this year, with RTO approvals of the JTIQ projects by the second quarter of 2023.

Additional joint stakeholder meetings are tentatively scheduled for 10 a.m. to 12 p.m. CT on May 20, June 27 and July 29. Comments may be sent to GI-AFS@misoenergy.org and interregionalrelations@spp.org.