MISO and the Organization of MISO States’ 2022 resource adequacy survey again sounded the supply alarm that the RTO rang in early April when it published its 2022/23 capacity auction results.

The survey projects the footprint will have a 2.6-GW capacity deficit below the 2023 planning reserve margin requirement. The shortage would more than double up the 1.2-GW shortfall unearthed in the 2022/23 Planning Resource Auction. (See MISO’s 2022/23 Capacity Auction Lays Bare Shortfalls in Midwest.) As with the auction results, the survey foresees the shortfalls confined to MISO Midwest.

“Our efforts must be accelerated and reinforced to reliably manage the portfolio transition,” MISO Executive Director of Resource Planning Scott Wright said during a special teleconference Friday to discuss the results.

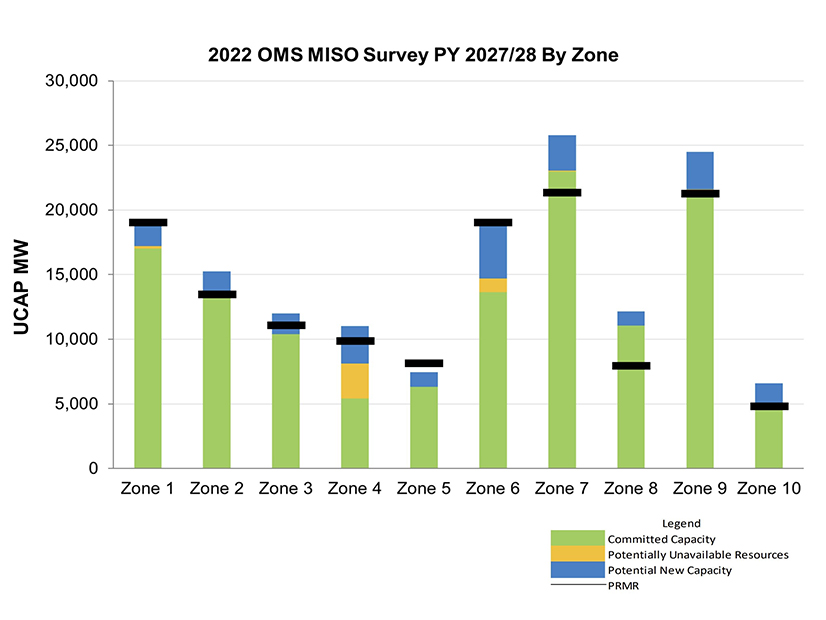

The five-year OMS-MISO survey foresees more bad news on the horizon, as well, with possible capacity deficits that are expected to deepen through 2027. The survey showed MISO could be short 4.4 GW in the 2024/25 planning year, 6.5 GW in 2025/26, 7.4 GW in 2026/27 and nearly 11 GW by 2027/28.

MISO’s Local Resource Zone 6, in Indiana and a portion of Kentucky, stands to have the widest capacity deficit in 2023. By the 2027/28 planning year, Zone 7 in Michigan’s Lower Peninsula and Zone 8 in Arkansas are the only zones that appear to have a comfortable padding of committed capacity.

However, MISO and OMS said much depends on how market resources respond to this year’s capacity auction results. If resources act, MISO Midwest could have a 2.4-GW capacity surplus in 2023, they said.

“We think there are a lot of things that could help mitigate the risk and even have a surplus in 2023,” Wright said.

2022 OMS-MISO Survey results | MISO and OMS

2022 OMS-MISO Survey results | MISO and OMS

The survey put MISO’s 2023 demand growth at 1 GW (a 0.8% increase year-over year) as the pandemic recovery finishes. It predicted “modest growth thereafter” at 0.2% per year through 2027. The survey didn’t contemplate MISO’s new seasonal capacity design and availability-based resource accreditation pending before FERC.

Last year’s survey anticipated the grid operator would have anywhere from 3.4 to 13.9 GW of extra unforced capacity beyond its summer peak planning reserve margin requirement. That supply estimate didn’t pan out in the 2022/23 auction, which left MISO Midwest short of its 101.2-GW requirement. The 2021 survey also predicted anywhere from a 3.3-GW shortage to a 13.3-GW surplus through 2025. (See 2021 OMS-MISO Resource Adequacy Survey Shows Less Cause for Concern.)

MISO predicted it will be increasingly reliant on emergency and non-firm imports going forward. The grid operator said that while those resources are not reflected in the survey, they “have historically been important and available to MISO.”

However, if new generation can interconnect, MISO could have a few gigawatts to spare in 2024-2027. MISO and OMS said the impending threat “can be meaningfully mitigated” depending on the tempo of new generation and retirements.

“We have a very active queue process,” Wright reminded stakeholders. “I feel like we’ve had a good track record of adding about 2.5 GW of [unforced capacity] every year.”

OMS President and Indiana Utility Regulatory Commissioner Sarah Freeman noted that there are “tons of generation in the queue” waiting to replace retiring resources.

Freeman also said the results are a “very static glimpse” in time, and that MISO’s and states’ planning processes are dynamic.

But Clean Grid Alliance’s Natalie McIntire pointed out that the new transmission capacity MISO is planning under its long-range transmission portfolio is still years away. She said the new lines are needed in order to interconnect new generation.

Freeman opened the floor to suggestions on how to improve next year’s survey structure.

“It’s only as accurate as the questions we have on it,” she said.