Planning Committee

Reserve Requirement Study Assumptions Approved

The PJM Planning Committee last week unanimously endorsed study assumptions developed in the Resource Adequacy Analysis Subcommittee (RAAS) for the RTO’s 2022 Reserve Requirement Study (RRS).

The assumptions, which are similar to those used in the 2021 RRS study, will be used to reset the installed reserve margin (IRM) and forecast pool requirement (FPR) for delivery years 2023/24, 2024/25 and 2025/26, as well as to set the initial IRM and FPR for 2026/27, PJM’s Jason Quevada told the committee.

PJM uses each generating unit’s capacity, forced outage rate and planned maintenance outages to develop a cumulative capacity outage probability table for each week of the year, except the winter peak week. For the winter peak, PJM uses historical RTO-aggregate outage data from delivery years 2007/08 through 2021/22.

The new assumptions reflect FERC’s approval in August of PJM’s effective load-carrying capability (ELCC) method for determining capacity values for variable, limited-duration and combination resources (ER21-2043). (See FERC Accepts PJM ELCC Tariff Revisions.)

PJM told FERC that the ELCC construct recognized the “diminishing returns associated with greater levels of deployment for most ELCC resource types,” ensuring that the RTO doesn’t become overdependent on a single resource with “inherent limitations.”

Wind, solar, hydro and landfill gas variable resources and storage resources will be excluded from the 2022 calculations.

PJM will present the final RRS report to the RAAS and PC in September and will seek members’ approval in October. Posting of the final values is expected in February.

Interconnection Process Subcommittee Charter OK’d

Members unanimously approved the draft charter of the Interconnection Process Subcommittee, which is being formed to continue work on interconnection process improvements following the sunsetting of the Interconnection Process Reform Task Force (IPRTF).

Stakeholders approved a new interconnection queue process and a related transition plan developed by the task force in April. (See PJM Stakeholders Endorse New Interconnection Process.) The proposed rules will be filed with FERC by June 16.

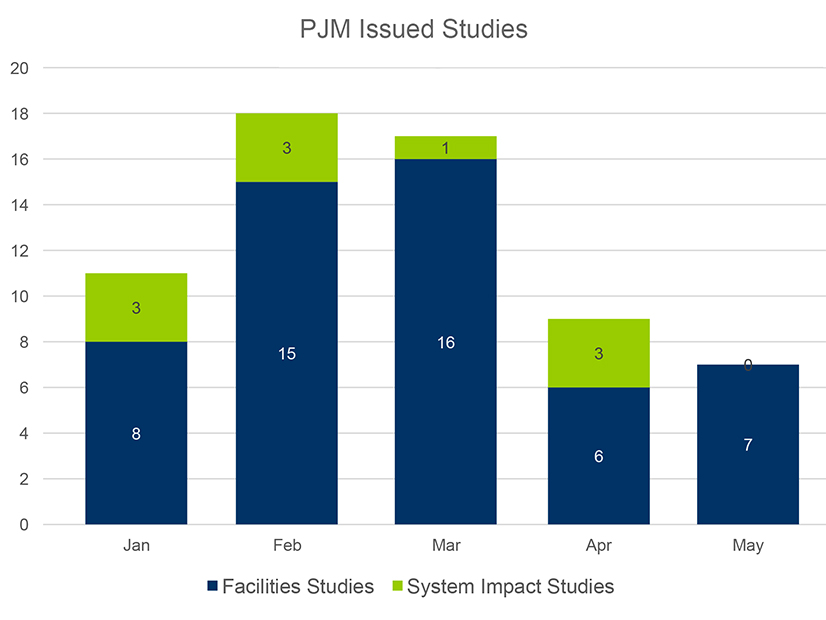

Also at the PC meeting, Jason Shoemaker, manager of interconnection projects, provided an update on the RTO’s efforts to reduce the interconnection queue backlog.

Shoemaker said queues AG2 and AH1 will continue to be delayed, and AH2 and AI1 are also expected to be delayed. As a result, PJM is deferring project modification requests in those queues. PJM’s backlog priorities are AD2 and prior queues (65 studies); backlogged system impact studies (about 190); and queues AE1 through AG1 (about 800), he said.

Response to DOE Notice of Inquiry

PJM’s Pauline Foley briefed the committee on the RTO’s plan to respond to the Department of Energy Grid Deployment Office’s May Notice of Inquiry and request for information on how it should implement the “anchor tenant” and revolving loan programs under its Transmission Facilitation Program (TFP). The TFP is intended to aid the construction of grid infrastructure that improves reliability and resilience or increases interregional transfers. (See DOE Seeks Input on Tx Loan, ‘Anchor Tenant’ Programs.)

The program, authorized under the Infrastructure Investment and Jobs Act (IIJA), allows DOE to purchase up to 50% of the proposed transmission capacity of an eligible transmission line for up to 40 years. It can also make loans for the costs of carrying out an eligible project: new lines of at least 1,000 MW (500 MW for projects in an existing transmission corridor).

The IIJA also authorized DOE to enter into public-private partnerships to advance an eligible project in a National Interest Electric Transmission corridor or that is necessary to accommodate an increase in transmission demand across more than one state or transmission planning region. DOE is authorized to borrow up to $2.5 billion from the U.S. Treasury at any one time.

Responses to DOE were due Monday.

Transmission Expansion Advisory Committee

Generation Deactivation Update

PJM reported that it completed reliability analyses and identified no violations for the following generation deactivations:

- Morgantown combustion turbines 1 and 2 (32 MW) in the PEPCO transmission zone (Oct. 1);

- Carbon Limestone landfill (19.3 MW) in the American Transmission Systems Inc. (ATSI) zone (July 31); and

- Cape May County landfill (0.6 MW) in the Atlantic City Electric zone (Aug. 5).

Members also heard second reads on proposed solutions to:

- an N-1 thermal violation on the 345-kV Beaver-Hayes line resulting from the planned retirement of Sammis 5, 6 and 7 (1,504 MW) in the ATSI zone on June 1, 2023. The recommended solution includes replacing four 345-kV disconnect switches with 3000A disconnect switches; replacement of substation conductors; upgrades of transformer protection relays; and relay settings changes. The estimated cost is $2.1 million.

- the March 31 deactivation of Avon Lake 9 and 10 (648 MW) in ATSI. The plan includes removing five 138-kV bus tie lines and one 345-kV bus tie line from the Avon Lake Substation; adjusting relay settings; and installing new fiber between the 345-kV and 138-kV yards to re-establish relay protection. The project, expected to be completed by April 28, 2023, has an estimated cost of $2.5 million.

Supplemental Projects

Members heard presentations on the following supplemental projects:

- FirstEnergy outlined a 230-kV service request for a 30-MW load near the 230-kV line Doubs-Monocacy, with a requested in-service date of November 2022 (Need # APS-2020-012).

- Dominion Energy presented more than a dozen supplemental requests, including new substations and additional distribution transformers to serve data centers and other sources of load growth.

NJ Offshore Wind SAA

Remaining reliability studies will be completed in July and August for selected scenarios in the 2021 State Agreement Approach proposal window to support New Jersey’s offshore wind projects, PJM’s Jonathan Kern told members. Scenario development and initial reliability studies are expected to be completed this month.

PJM is considering about 26 point-of-interconnection scenarios.

The New Jersey Board of Public Utilities is reviewing comments that were submitted in its OSW transmission docket (QO20100630), including responses to questions posted following four stakeholder meetings the agency held to collect feedback on the evaluation of the transmission proposals. (See NJ Seeks Efficiency, Savings in OSW Transmission Process.)

60-day Proposal Window Opened

PJM opened a 60-day window June 7 to receive proposals to address reliability and market efficiency needs on the 345-kV Crete-St. John, Crete-E. Frankfort, University Park N-Olive and Stillwell-Dumont lines.

Multi-Driver Proposal Window 1 will reflect the removal of queue project U3-021/AB2-096 and the inclusion of project AB1-089, PJM’s Sami Abdulsalam told members. PJM will evaluate the proposals in coordination with MISO. The window closes Aug. 8.

PJM noted an overlap in flowgates from the new window and 2021 Proposal Window 2 and said entities wanting to modify their 2021 proposals should submit new entries in the new window. Entities wanting to withdraw proposals from consideration must notify PJM to avoid future billing.

Abdulsalam said PJM is planning to open a proposal window for the 2022 Regional Transmission Expansion Plan between the last week of June and first week of July. PJM posted the latest preliminary models on May 23 and is reviewing FERC Form 715 analysis results from transmission owners while working on N-1-1 and load deliverability analyses.