FERC last week said it will take another look into whether Dynegy violated federal laws by manipulating pricing in MISO’s 2015/16 capacity auction.

Following a remand from the D.C. Circuit Court of Appeals, the commission directed its Office of Enforcement to compile a report using evidence from FERC’s earlier, nonpublic investigation that was abruptly closed in 2019. The commission said it will issue a decision following the office’s assessment (EL15-70-003).

FERC directed Enforcement staff not to collect any new evidence. It said the remand report should determine “whether Dynegy’s conduct constituted an exercise of market power and/or market manipulation, and, if so, what effect Dynegy’s conduct had on the 2015/16 auction results.”

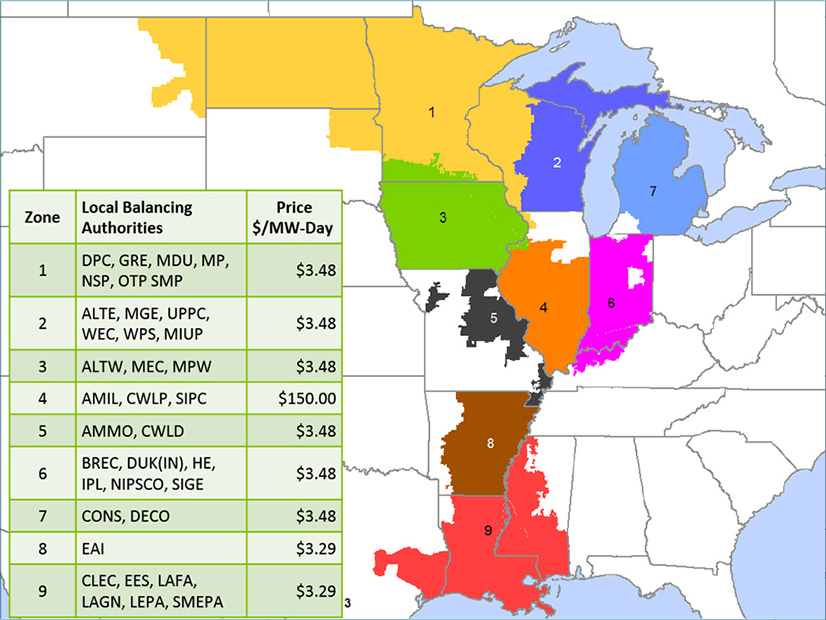

The D.C. Circuit ruled last summer that FERC hadn’t sufficiently supported its decision to let stand the Southern Illinois transmission zone’s capacity price produced in the capacity auction. The court said the commission’s repeated decisions to uphold the zone’s $150/MW-day clearing price were arbitrary and capricious because they lacked explanation. (See DC Circuit Sides with Public Citizen over 2015 MISO Capacity Auction.)

Public Citizen, Illinois’ attorney general and Southwestern Electric Cooperative all questioned Dynegy’s market behavior after the auction because the company controlled a significant portion of the zone’s available capacity.

FERC wrapped a three-year investigation into the 2015 auction, finding no market manipulation on Dynegy’s part. The commission concluded the zone’s clearing price was just and reasonable and declined to set up an evidentiary hearing to possibly recalibrate the auction results. FERC said a clearing price isn’t unjust simply because it’s higher than expected. (See FERC Clears MISO 2015/16 Auction Results.)

When the D.C. Circuit remanded the issue to MISO, stakeholders asked if the grid operator was preparing to recalibrate the auction; staff said there wasn’t anything for MISO to do until FERC reassessed its decision.

FERC said it will prevent some commission staff from making decisions when it takes a second look at the matter. The commission will block staff with previous involvement in the investigation and those involved in creating the remand report and subsequent pleadings from “communicating with any member of the commission or its decisional staff concerning deliberations in this proceeding except through pleadings.”

“Out of an abundance of caution, certain commission staff will be treated as non-decisional employees for this proceeding,” FERC said. It did not name the commission staff that the rule would apply to.

Commissioner James Danly recused himself from last week’s order. He previously served on the legal team defending Dynegy against the market manipulation accusations.