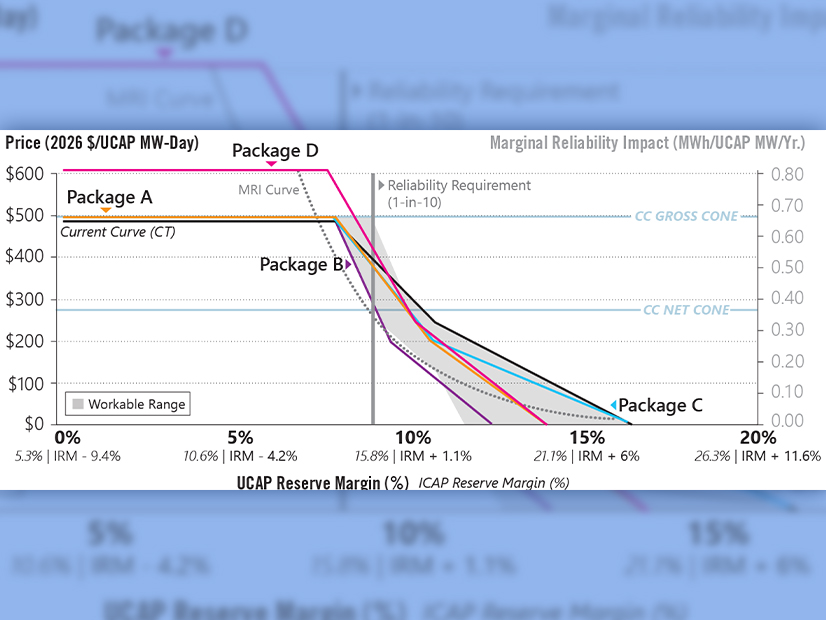

Proposed VRR curves from PJM (Package A), the Independent Market Monitor (B), Calpine (C) and Cogentrix (D)

| PJMMarkets and Reliability Committee

2022 Quadrennial Review

The PJM Markets and Reliability Committee last week received a briefing on four alternative sets of capacity auction parameters as part of its 2022 Quadrennial Review.

Members will be asked to select one of the packages from PJM, the Independent Market Monitor, Calpine and Cogentrix at the MRC’s Aug. 24 meeting, which will be followed by a vote at a special Members Committee meeting. The votes are advisory, however; the Board of Managers will make the decision on what parameters to propose to FERC.

The parameters — which include the shape of the variable resource requirement curve, the cost of new entry for each locational deliverability area, and the methodology for determining the net energy and ancillary services (E&AS) revenue offset — would be effective with the July 2023 capacity auction for delivery year 2026/27.

Cogentrix’s proposal was the overwhelming favorite in a vote of the Market Implementation Committee on July 19-22, winning 73% support, with 62% saying they preferred it over the status quo. The PJM and Calpine packages tied at 28% each, while the Monitor’s proposal garnered only 15% support. (Members were permitted to vote for more than one option.)

The Cogentrix proposal, which was presented by GT Power Group’s Jeff Whitehead, adopts the status quo:

-

-

- reference technology (combustion turbine);

- variable operations and maintenance (VOM) parameter (major maintenance and operating cost included);

- simulation method for calculating net energy revenues (peak hour dispatch); and

- net E&AS (historical-looking inputs).

-

Cogentrix’s proposal also adopts PJM’s fuel assumption (firm transportation) and for the three points on the VRR curve but with the use of a CT rather than the RTO’s combined cycle reference technology.

The Cogentrix curve would result in a price of about $600/MW-day for an unforced capacity (UCAP) reserve margin of about 7.5%, up from about $500/MW-day with the current curve, according to PJM. The curve is almost identical to the RTO’s proposed curve above a 10% UCAP reserve margin.

Whitehead said Cogentrix chose a CT as the reference technology because it is less dependent on E&AS revenue than combined cycle plants. “We’ve seen how much E&AS revenues can change … in a relatively short period of time,” he said, a danger when parameters are being set four years in advance of delivery. LMPs, which hovered around $20/MWh “around the clock” during the coronavirus pandemic, averaged about $67/MWh in June, he noted.

He said CTs are also the most likely generation to be built in a “capacity crunch.”

David “Scarp” Scarpignato, Calpine | PJM

David “Scarp” Scarpignato, Calpine | PJMHe acknowledged energy storage may be a more appropriate reference technology in the future, noting they are “extremely dependent” on capacity revenue, with regulation their only other revenue source.

David “Scarp” Scarpignato of Calpine said his company’s proposal was based on PJM’s and the recommendations of the RTO’s consultant, The Brattle Group. However, Calpine favored a historic E&AS offset rather than the forward-looking approach proposed by PJM and the Monitor.

“It’s a bad time with all the volatility in the gas markets to be switching to the forward” approach, Scarp said.

Calpine chose PJM’s proposal for the first two points on the VRR curve and the status quo for the third point.

“The bottom part of the curve makes a lot of sense,” Scarp said. “MISO has a vertical curve. And we saw how that worked out in the last auction.” (See MISO Capacity Auction Values South Capacity at a Penny.)

Monitor Joe Bowring made a case for his proposal to use only operating costs in the VOM calculation. “Ideally the VOM would all be in avoidable costs, but we recognize it’s not currently” he said. As a result, the IMM proposed including major maintenance in energy offers. “If they are in the energy offers, they should not be in avoidable costs,” Bowring said.

Manual Revisions OK’d

The MRC endorsed:

-

-

- changes to Manual 01: Control Center and Data Exchange Requirements, Manual 18: PJM Capacity Market and Manual 28: Operating Agreement Accounting to conform with new testing requirements for demand response and price-responsive demand. The changes, which were approved by FERC in June 2020, will become effective with delivery year 2023/24 (ER20-1590).

- updates to Manual 14D: Generator Operational Requirements to support the process timing changes for generation deactivations. (See “‘Quick Fix’ Changes OK’d for Manual 14D,” PJM Operating Committee Briefs: July 14, 2022.)

- revisions to Manual 28: Operating Agreement Accounting to support the start-up cost offer development proposal the MRC approved in May, which allows costs associated with a resource’s initial ramping megawatts and soak costs to be included in its start cost. The MC later endorsed related changes to Manual 15: Cost Development Guidelines, tariff definitions, Attachment K, Operating Agreement definitions, and Schedules 1 and 2. (See “Start-up Cost Offer Development Proposal Endorsed,” PJM MRC Briefs: May 25, 2022.)

-

Members Committee

Application of Designated Entity Agreement

PJM’s notice that it planned to make a Federal Power Act Section 206 filing asserting that the OA’s provisions on designated entity agreements (DEAs) are unjust and unreasonable prompted the cancellation of scheduled MRC and MC votes on competing issue charges on the matter.

One issue charge was proposed by consumer advocates for Delaware and New Jersey, and a second was by East Kentucky Power Cooperative on behalf of transmission owners. The latter would make out of scope any consideration of changes to the rights and responsibilities of PJM and the TOs under the Consolidated Transmission Owners’ Agreement.

Greg Poulos, CAPS | PJM

Greg Poulos, CAPS | PJMThe sponsors withdrew their proposals after PJM gave notice of its planned FERC filing on the MRC and MC agendas. PJM also gave the MC “notice of consultation” of a potential filing under FPA Section 205 to revise the pro forma DEA in Attachment KK of its tariff.

“It didn’t make sense to have both a FERC proceeding and a stakeholder proceeding going on at the same time,” explained Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS).

On July 26, a group of load-side stakeholders beat PJM to FERC, filing a complaint asking the commission to force the RTO to require incumbent TOs to sign DEAs on “immediate need” projects. The complainants contended the RTO has violated the OA by refusing to do so. (See related story, PJM Challenged on Oversight of ‘Immediate Need’ Tx Projects.)

PJM attorney Pauline Foley said the RTO received the stakeholders’ complaint late last Tuesday afternoon. “PJM is reviewing the complaint and assessing its path forward,” Foley told the MRC on Wednesday.

‘Seeding’ the Matrix

Members endorsed a proposal to allow PJM and stakeholders to add options to a Consensus Based Issue Resolution (CBIR) matrix before posting the matrix for discussion.

The change will allow PJM and stakeholders to offer options after completing the identification of design components (Step 1) and before posting to facilitate creation of the options matrix (Step 2) prior to solution package development (Step 3).

PJM’s Dave Anders said the proposal by John Horstmann of Dayton Power & Light and Adrien Ford of Old Dominion Electric Cooperative to modify Manual 34: PJM Stakeholder Process would address the “writer’s block” that sometimes occurs at the beginning of the matrix development.

Bowring said his prior concern that the proposal would give PJM an advantage were addressed by assurances that any options proposed by the RTO could be ignored. (See “Members Debate Change to CBIR Matrix Procedure,” PJM Stakeholders Pump the Brakes on ‘Clean Energy Expertise’ for Board.)

Steve Lieberman of American Municipal Power said he thought the change was unnecessary because the individuals sponsoring a problem statement and issue charge should be prepared to initiate discussion of options. But he said he was “not willing to fall on my sword” by opposing it.

The measure passed by acclimation with one objection and two abstentions.

PJM Annual Meeting

PJM will hold its first off-site Annual Meeting since the pandemic on Oct. 24-26 at the Hyatt Regency Chesapeake Bay in Cambridge, Md. Registration will be conducted online between Aug. 1 and Oct. 19. No walk-up registrations will be permitted. The fee for guests will be $400.

‘Clean Energy Expertise’ Requirement

The Illinois Citizens Utility Board presented three proposed revisions to the OA to add a requirement that one member of the PJM board have “clean energy resource expertise.”

Albert Pollard, who heads CUB’s CLEAR-RTO project, said one of the proposed revisions — requiring “expertise and experience in the development, integration, operation or management of clean energy resources” — was nearly identical to language the RTO is using in its current search for a replacement for Manager Sarah Rogers, who attended her final MC meeting Wednesday.

Pollard said the change is needed because the transition to carbon-free generation is a “top priority” for the RTO.

ODEC’s Ford questioned whether the OA should be revised. Cybersecurity expertise is also important to the board but is not mentioned in the agreement, she said.

“If the [requirements] matrix gets too big, it might result in focusing on some areas of expertise and neglecting of others,” she said.

MC Chair Erik Heinle said the issue will likely be on the agenda for the committee’s Sept. 21 meeting.