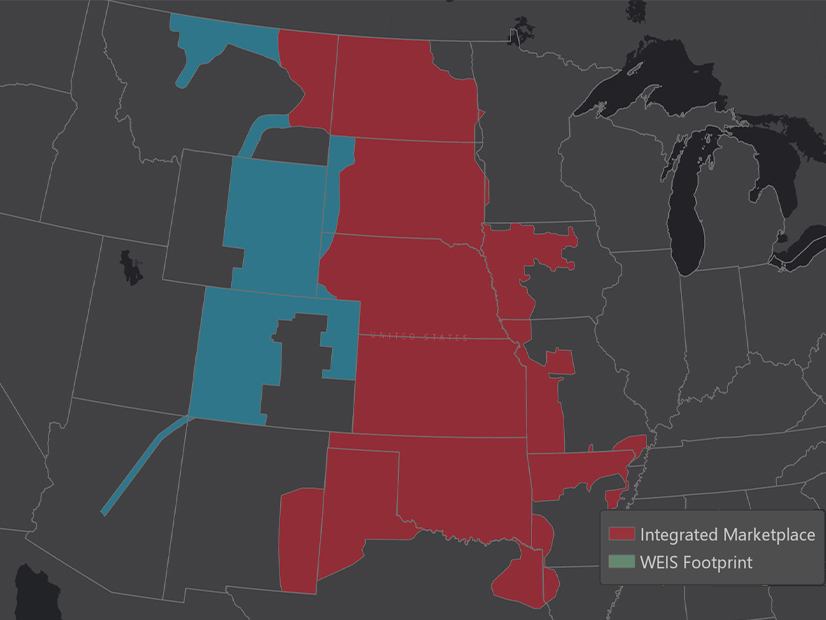

SPP’s Western Energy Imbalance Service (WEIS) market saw “very limited growth” in its first 13 months, SPP’s Market Monitoring Unit said in its first annual report on the market.

Unlocking renewable resources in the market’s region — which spans six states in the West, from Montana south to Arizona — has been cited as one of the market’s key benefits. But the footprint’s nameplate capacity increased by only 207 MW, all of it wind. Coal generation produced more than 62% of the market’s total generation. Hydro was second at 22% and wind third at 9%.

The market continues to struggle with limited capacity and ramp constraints and is often unable to procure sufficient power in real time to balance, the MMU said. It has urged the market to address ramping issues, through either a minimum requirement per participant or a fully developed ramp capability product, and supply adequacy.

WEIS has been a net exporter of energy since its inception, with an hourly average of 800 MWh of net exports. The addition of Colorado Springs Utility this month and three more participants next April will essentially double the amount of generation and load within the market.

The market began service Feb. 1, 2021, just prior to the historic winter storm that month. Prices that month averaged $90/MWh, but the storm’s impact was limited because of the generation mix and a limited ability to export to the east. The MMU found that market prices averaged around $36/MWh for the first 13 months, but that drops to just over $31/MWh when February 2021 is removed.

The MMU also recently released its spring Quarterly State of the Market report, which found that day-ahead prices were $31.66/MWh during the quarter (March through May), double last year’s average of $15.97/MWh. Average real-time prices also more than doubled, up 112% to $29.37/MWh.

Wind generation accounted for 48% of total generation, up from 45% for the same period a year ago. Coal generation remained flat at 28%, and combined cycle and simple cycle gas generation fell from 18% to 14%.

Average gas prices at the Panhandle Eastern hub were more than double from where they were last spring, up 146% to $6.02/MMBtu this year from $2.45/MMBtu. Gas prices peaked at $7.59/MMBtu in May, an all-time high if not for the winter storm in February 2021.

The MMU is hosting a webinar Wednesday at 2 p.m. to discuss both reports.

SPP Releases VRL Analyses

SPP last week released its annual analysis of violation relaxation limits (VRLs) for the Integrated Marketplace and the WEIS.

The grid operator is recommending changes to the operating constraint VRL blocks and increasing the spinning reserve constraint VRL to $250 from $200. Its analysis showed the slight increase reduces the number of scarcity intervals and product shortage with only a slight increase to cost.

SPP did not recommend any changes to the WEIS VRL block, penalties or VRL related to resource capacity.

The RTO says that its market clearing engine (MCE) attempts to enforce all constraints when generating a solution. When this results in solutions that are not feasible, SPP will apply VRLs in the MCE solution. The VRLs and their associated values attempt to achieve a reasonable balance between honoring operating requirements and constraints while mitigating large price excursions or other extreme prices.

The security-constrained economic dispatch (SCED) for day-ahead and real-time balancing markets optimizes constraints to determine the most efficient and reliable solution, SPP said. When system limitations cause a constraint’s shadow price to exceed a defined VRL, the constraint’s limit is relaxed and the shadow price is replaced with the VRL penalty, allowing SCED to solve more economically.