FERC on Monday rejected PJM’s proposal to change how it handles synchronized reserve events, saying it would likely result in higher prices and lead the RTO to procuring more energy than the system actually needs during emergencies (ER22-1200).

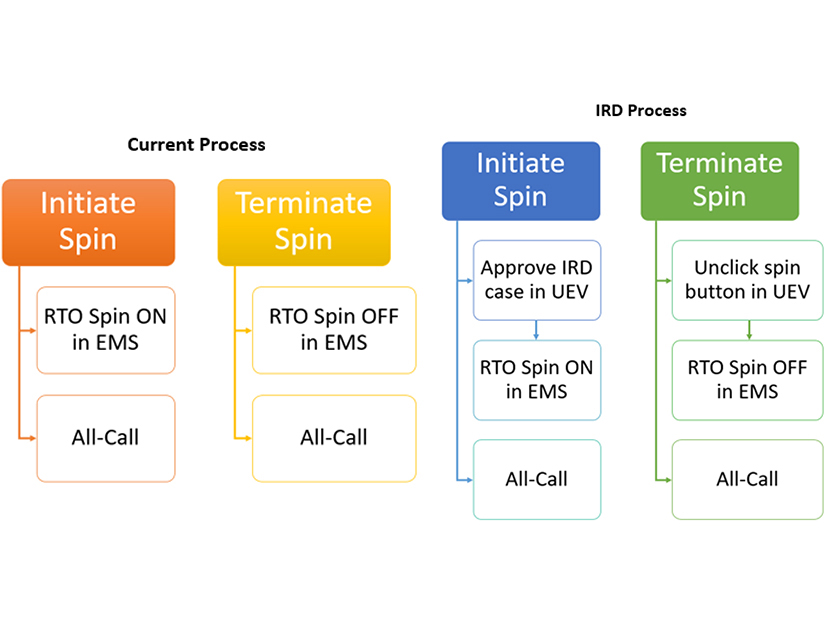

Called Intelligent Reserve Deployment (IRD), PJM’s proposed construct would have it use a real-time security-constrained economic dispatch (RT SCED) case that simulates the loss of the largest generation unit on its grid during a synchronized reserve event. Such events can be caused by the loss of generation, loss of transmission or sudden increase in load.

Currently, PJM responds to these emergencies by issuing an “all-call” message to all market participants to deploy their available resources. The RTO argued that IRD would be more efficient and that, by using RT SCED, it would better align prices with actual grid conditions and trigger resource-specific responses.

But FERC was unpersuaded, ruling 4-1 that IRD “fails to model actual system conditions.

“It therefore is likely to result in artificially inflated prices and thus prevent PJM from achieving a least-cost dispatch solution to address synchronized reserve events, which could in turn produce a misalignment between prices and actual system conditions.”

IRD would simulate the loss of the generator by effectively increasing the load forecast by the equivalent capacity. Thus, FERC found, it would not lead to accurate dispatch, as most reserve events are likely to be smaller in nature.

“IRD would result in PJM setting prices as though the largest contingency had occurred, and then immediately procure additional reserves accordingly, without regard for the size and location of the actual system event,” the commission said. Even if the emergency were the result of the largest contingency, “the IRD SCED case might not be representative of actual system conditions if the contingency event occurs near a constraint or within a reserve sub-zone … because IRD would model an RTO-level increase in load,” FERC said.

PJM filed its proposal in March under Section 205 of the Federal Power Act, after it received final stakeholder approval in January, though with 18 objections. (See “Consent Agenda,” PJM MRC/MC Briefs: Jan. 26, 2022.) FERC acknowledged that the current all-call approach could be improved upon, but the RTO “must show that any such proposed methodology produces just and reasonable rates.”

FERC agreed with arguments by the RTO’s Independent Market Monitor and the PJM Industrial Customer Coalition that the proposal would result in unjustly higher prices. But it also noted that, in response to their protests, PJM had acknowledged that the price resulting from IRD cases “is not perfect,” though it emphasized that it would be more accurate than under the all-call approach.

“Even if that characterization were true, that does not render this particular proposal to use the largest contingency in the IRD case just and reasonable,” the commission said.

Danly Dissent

Commissioner James Danly dissented, arguing that PJM “easily met its Section 205 burden” and rejecting the majority’s conclusion that IRD would “artificially inflate prices.”

“I see nothing wrong with modeling the single largest reliability contingency during a reserve shortage, for example, when the system is dangerously exposed to a subsequent reliability event,” Danly said.

Danly argued that IRD would clearly be an improvement over the all-call approach, which he said “is essentially an email blast” that “apparently is routinely ignored by resources not subject to nonperformance penalties. It does not take an engineer to identify a legitimate reliability risk here.”

“I would not reject a clear reliability enhancement merely because it results in potentially higher (albeit more efficient) prices,” he said. “FPA Section 205 contemplates broad discretion for utilities to grapple with challenges and opportunities as they see fit. This filing easily fits within the range of acceptable filings.”

He concluded that, despite rejecting the proposal, “we at the commission will enthusiastically join the throngs blaming PJM if, down the road, it suffers a blackout caused by back-to-back reliability events.”

The majority responded to Danly’s dissent by noting that PJM acknowledged that the system would remain reliable without IRD. It also argued that part of Danly’s argument was apparently based on the fact that Tier 1 synchronized reserve resources are not subject to nonperformance penalties, but it noted that the commission had already approved PJM consolidating Tier 1 and 2 resources into a single product, which will be subject to penalties and go into effect Oct. 1. (See FERC Approves PJM Reserve Market Overhaul.)