The Southern Renewable Energy Association (SREA) said last week that while MISO may have a robust transmission planning process, FERC should know that the RTO’s South region does not share in it.

The sentiment was made in comments to the commission under its transmission planning notice of proposed rulemaking. SREA accused Entergy, which comprises the majority of MISO South, of impeding and delaying transmission planning to benefit its bottom line. (See Battle Lines Drawn on FERC Tx Planning NOPR.)

“Overall, transmission planning in the south is lagging behind other regions,” SREA said. “We are not prepared for the energy transition already underway, and some utilities in the region are actively opposing reasonable transmission planning practices. This places [President] Biden’s Inflation Reduction Act at risk of not reaching its full potential.”

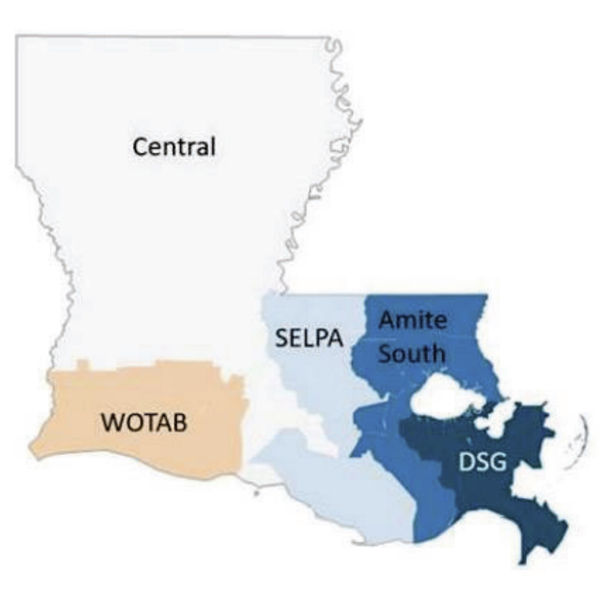

The association said MISO South is a patchwork of load pockets that include Amite South, Downstream of Gypsy, West of the Atchafalaya Basin (WOTAB), Texas East and Texas West. SREA said Texas uses the load pockets to its advantage, constructing new generation in them and using the load pockets to justify “underinvesting in transmission to the benefit of its generators.”

SREA said power outages were more prevalent in MISO South during the February 2021 winter storm. All eight of the transmission lines into New Orleans failed or collapsed during Hurricane Ida last year, leading to nearly a week of power outages. Estimates for Entergy grid repairs have topped $4.4 billion, about a third of all of MISO North’s proactive long-range transmission plan (LRTP) projects, the group said.

SREA said that while Entergy’s 2013 incorporation into MISO was meant to put an end to the utility’s anticompetitive business practices, the RTO “has not been entirely effective at increasing competition.” It said MISO South consultants bogged down planning that could have come from the grid operator’s 2017 regional overlay study.

“When MISO South slows down transmission planning at MISO, the entire region is negatively affected. Opposition to MISO’s transmission planning effectively delayed transmission by three years while MISO retooled to start the LRTP process,” SREA said.

SREA pointed out that MISO was forced to bifurcate cost allocation between the Midwest and South in its LRTP so it could move forward on new transmission lines in the Midwest without risking delay from the more hesitant southern stakeholders.

MISO approved the first of four LRTP portfolios in late July. It contains 18 projects costing more than $10 billion, all destined for MISO Midwest. (See MISO Board Approves $10B in Long-range Tx Projects.)

SREA also touched on the fact that the RTO has been unable to build any market efficiency projects in the South. Its lone competitive market efficiency build, the Hartburg-Sabine Junction project, is all but certain to be cancelled because Entergy added the 993-MW Montgomery County Power Station in southeast Texas and plans to construct the 1.2-GW natural gas and hydrogen-powered Orange County Advanced Power Station by 2026. The Hartburg-Sabine line was meant to alleviate the WOTAB load pocket. (See MISO on Verge of Cancelling Hartburg-Sabine Tx Project.)

The organization said there is a “demonstrated need to introduce transparency and competition in the region to mitigate the use of utility market power to thwart transmission solutions that would increase reliability and lower customer costs.”

“I think the big idea here is MISO stakeholders went through a really long and arduous process to get where we are on LRTP,” SREA Executive Director Simon Mahan said in an interview with RTO Insider.

Mahan said there’s no need for MISO to “reinvent the wheel” on its transmission planning but emphasized that the grid operator’s long-term planning needs to gain traction in MISO South.

Mahan said he felt a bit “jilted” that MISO Midwest is first in line for long-range transmission planning while MISO South utilities and regulators appear to favor a delay.

“I really hope that the regulators down here read our comments and really take them to heart,” he said.

MISO so far envisions four LRTP portfolios. It doesn’t plan on addressing MISO South needs until the LRTP’s third iteration.

Mahan pushed back on the notion that the Midwestern portion of MISO needs more urgent transmission planning because it contains an aging coal fleet and a healthier appetite for renewable energy.

“The reality is we have a lot of old gas generation in MISO South that operates similarly to aging coal plants,” he said, noting the region is undergoing its own renewable energy transition.

For years, Mahan said he’s wanted the two regions to share a better transmission connection so they can better share resources. Not addressing the Midwest-South constraint is to the detriment of MISO itself, he said.

“We can plainly see with Winter Storm Uri that getting that connection fixed is a matter of life and death,” Mahan said.

He said building new import capability in MISO South for the sake of reliability is a must. While little load pockets in the wetlands, forests and swamps of Louisiana made sense decades ago, it isn’t a reliable practice today, he said.

MISO South load pockets in Louisiana | Entergy

MISO South load pockets in Louisiana | Entergy

“We need to connect these regions because as hurricanes are pummeling our coast, it’s becoming clear that generators can’t take the direct hits,” Mahan said.

Mahan said Entergy has a troubling pattern of supplanting transmission lines with new generation.

“This is a clear pattern that we’ve seen with Entergy proposing generation when lines are recommended. People need to know that this is going on so we can come up with solutions for it,” he said. “We’ve seen it enough: Entergy plopping generation at the end of a new, large-scale transmission project, and the project dies. I’m very concerned that this strategy is working, but the generators rarely turn on.”

Mahan said the St. Charles Power Station gas plant, built in place of a 2016 MISO-recommended 230-kV line spanning two substations in the New Orleans area, was derated to about half its capability during the winter storm. He also said Entergy’s new Montgomery Power Station failed to come online during the same extreme weather event.

“Time and time again, Entergy keeps building power plants in these load pockets, and during these extreme events for whatever reason, they can’t turn on. … This isn’t old generation. They’re brand-spanking new power plants,” Mahan said. “The reality is that the lights keep going out in MISO South, and transmission keeps not getting built. Those are pretty damning examples of what’s going on in MISO South.”

Mahan said he hopes that FERC’s ultimate rulemaking will “codify the good work we’ve done here at MISO to ensure that no region is going to be left behind in the future.”

Entergy had not returned a request for comment at press time about its philosophy on transmission planning.