FOXBOROUGH, Mass. — As New England’s gas and electric providers and regulators prepare for another dicey winter, gas industry representatives threw out solutions ranging from market fixes to upgraded pipeline infrastructure at a day-long gathering last week.

The Northeast Energy and Commerce Association’s Fuels Conference focused heavily on the fuel supply challenges that continue to bedevil the Northeast in winter.

ISO-NE recently said that the Everett LNG facility must be maintained for grid reliability, even past 2024 when its anchor tenant, Mystic Generating Station, is set to retire. (See ISO-NE: Reliability Still Depends on Mass. LNG Import Terminal).

That’s narrow-minded, argued an executive for one of the other LNG import terminals that helps brings gas into New England.

“The solution needs to be a market fix that resolves the mismatch between how LNG is contracted for and how generators are compensated, not another subsidy for a singled-out facility,” said Karen Iampen, vice president at Repsol, which operates the Saint John LNG terminal in New Brunswick, Canada.

She called the previous actions by ISO-NE “Band-Aids” that don’t address the region’s larger issues.

“Removing this obstacle to more long-term contracting is the most economic way to ensure fuel security by bringing in more cargoes that more fully utilize the storage and send-out facilities at the LNG terminals,” Iampen said.

Pipelines Want to Build Out

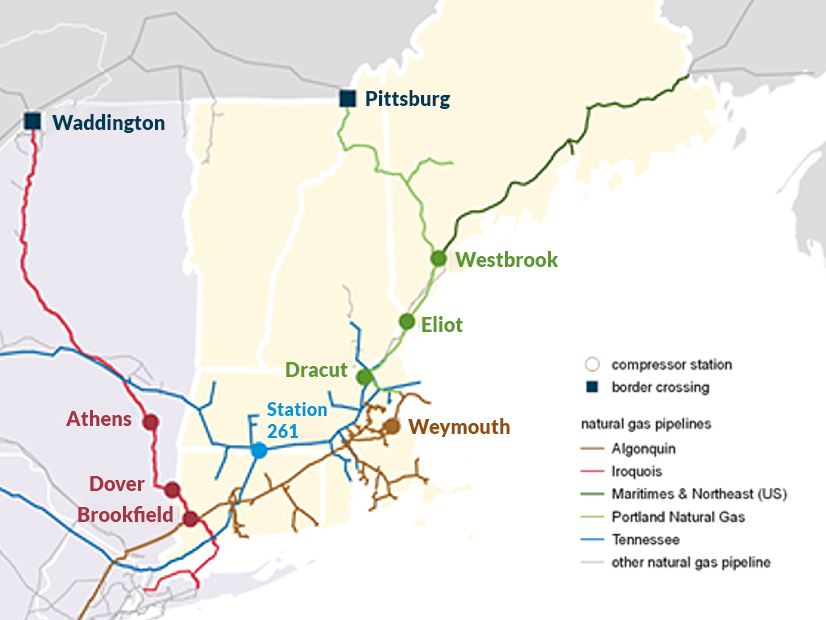

The other way to get more gas into the region is by land, and pipeline companies think that they’ll have a key role to play in New England even as renewables ramp up.

“Renewable growth requires operational flexibility,” said Jim McCord, account director at Kinder Morgan.

He pointed to California, where natural gas systems have helped back up rapidly growing renewable penetration by increasing or decreasing output when necessary.

“As an industry, natural gas will work hard to play this critical role in ensuring energy reliability,” McCord said.

Nobody is trying to build new pipelines to New England, but the existing ones could use upgrades, said Michael Dirrane, director of marketing for Enbridge.

“I’m advocating for brownfield pipeline projects, where we take out the smaller diameter pipe and replace it with higher diameter pipe, and perhaps add some additional horsepower on the system,” Dirrane said.

Those improvements would have minimal impact on the environment or to landowners, Dirrane said.

“That is the best way to drive down costs in New England.”

Tom Lockett of TransCanada said his company also is eyeing brownfield expansion.

LDCs Worried

Meanwhile, the utilities are increasingly concerned that reliability challenges facing the electric system in New England this winter could threaten the gas side, too.

National Grid Director of Gas Supply Planning Elizabeth Arangio | © RTO Insider LLC

National Grid Director of Gas Supply Planning Elizabeth Arangio | © RTO Insider LLCElizabeth Arangio, director of gas supply planning for National Grid, said that the “dots are connected.”

“We don’t want anything to happen on the electric side,” Arangio said. “Certainly it will impact us.”

“It’s an unfortunate situation. It’s not a good situation,” said John Rudiak, senior director of energy supply for Avangrid (UIL).

He called it a “spillover risk” that in particular could affect low-pressure gas customers.

“There’s a risk that if there were rolling blackouts, when those blackouts are restored, the gas lines could [face] reduced pressure” if not managed correctly, Rudiak said.

Eversource Director of Gas Supply Eric Soderman | © RTO Insider LLC

Eversource Director of Gas Supply Eric Soderman | © RTO Insider LLCEric Soderman, Eversource’s director of gas supply, echoed that fear.

“While the [local distribution companies] have adequately planned to serve their customers for this winter, as they do each winter, we have concerns that a cascading effect in New England could affect lower pressure areas on the pipeline that are extended laterals or don’t have backfeed areas,” Soderman said.

From the LDCs, the dominant feeling is frustration about how the electric side has been handled.

“The bottom line on this one is I feel comfortable about our companies, in terms of our preparation, in terms of our resources and our infrastructure and our capabilities,” Rudiak said. “But I’m really disappointed in [ISO-NE] not having solved the problems of market design and fuel supply reliability after so long.”