With above-average temperatures expected across most of the continental U.S. this winter, FERC staff on Thursday said the grid seems well positioned to weather the cold months. However, rising demand for natural gas in Europe, coupled with lower-than-average domestic storage inventories, is expected to drive gas prices higher than last year’s.

Natural gas storage inventories are expected to begin the winter below both last year’s level and the five-year average. | EIA

Natural gas storage inventories are expected to begin the winter below both last year’s level and the five-year average. | EIAPresenting FERC’s Winter Energy Market and Reliability Assessment at the commission’s October open meeting, Alexander Ovodenko of FERC’s Office of Energy Policy and Innovation said that data from NERC indicated “all planning regions forecast enough generation available to meet their planning reserve margins” — the available electric generation capacity in excess of expected peak demand — “through the winter.” Projected net internal demand for all regions is about the same as it was last winter, and resources and net transfers tell the same story.

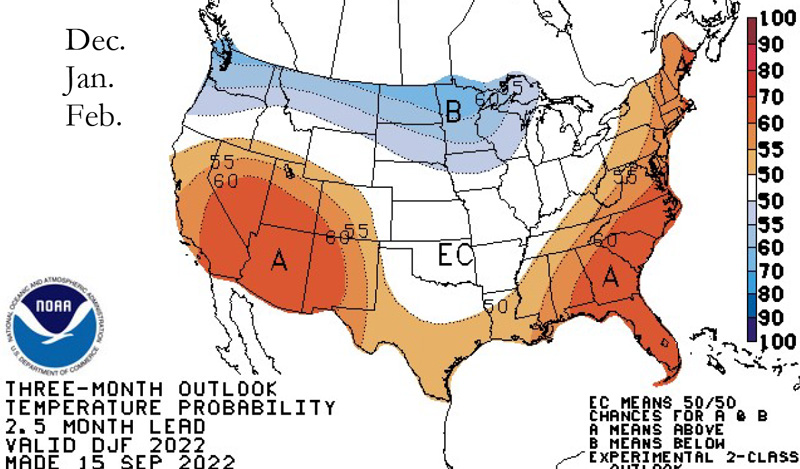

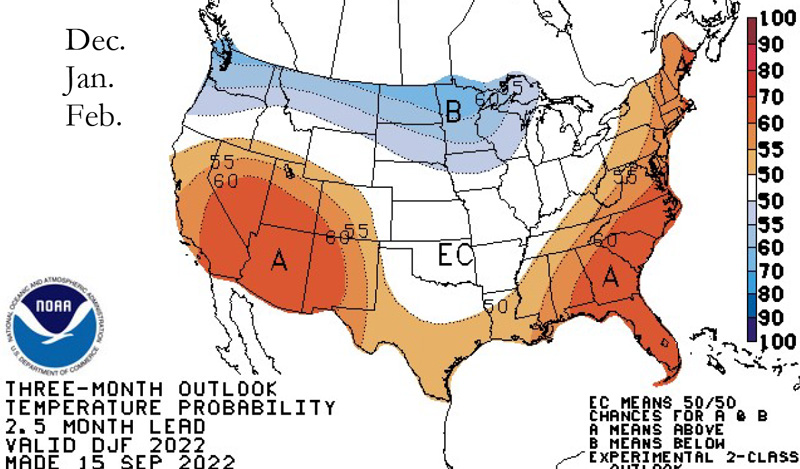

One reason for the reassuring reliability forecast is the relatively mild temperature expectations for the months of December, January and February in most of the U.S. According to data from the National Oceanic and Atmospheric Administration, the West, Southwest, Southeast and Northeast all have a 55% chance or higher of above-normal temperatures, while only the Northwest and West Central have a 55% or higher likelihood of below-normal temperatures. The upper South and Central regions have equal chances of above-normal and below-normal temperatures.

ERCOT, MISO Vulnerable to Winter Weather

While FERC Chair Richard Glick and his fellow commissioners expressed relief about the overall positive weather outlook, Sasan Jalali from the Office of Electric Reliability warned that these projections assume normal operating conditions, and that “capacity may be especially tight in several regions due to extreme weather conditions” — particularly ISO-NE, ERCOT and MISO.

NOAA’s winter 2022-2023 temperature forecast shows high probabilities of below-average temperates in the Northwest and West North Central U.S. and high likelihood of above-average temperatures in the West, Southwest, Southeast and Northeast U.S. | NOAA

NOAA’s winter 2022-2023 temperature forecast shows high probabilities of below-average temperates in the Northwest and West North Central U.S. and high likelihood of above-average temperatures in the West, Southwest, Southeast and Northeast U.S. | NOAAJalali said that ISO-NE “has implemented several measures” to prepare for the winter, including delaying the retirement of the Mystic 8 and 9 natural gas-fired units and continuing its 21-day Energy Assessment Forecast, which the RTO began in 2018 to enhance its preparedness for severe weather. However, FERC’s report showed that the region could still need to use mitigations such as energy imports and voluntary or mandatory conservation to address emergency conditions.

Concerns also remain about the ability of generators in Texas to ride out extreme winter conditions, though Jalali acknowledged that many of the grid improvements made since last year’s winter storm “should reduce the likelihood and severity of” the state’s severe weather risks. He cited new state regulations requiring generators and transmission owners to winterize their equipment and facilities, along with more than 300 winter readiness inspections conducted by ERCOT over the last two years.

While MISO has sufficient reserves for normal conditions, FERC’s report suggested that under extreme conditions, the RTO might experience a shortfall of up to 15.6 GW, even with operational mitigations. MISO said that maintaining reliability in this state would require “triggering [load-modifying resources], non-firm transfers into the system, using energy-only interconnection service resources not receiving capacity credit, or internal transfers” between MISO North/Central and MISO South.

European Demand for US Gas Rising

On the natural gas side, the report said production “will likely outpace domestic natural gas demand growth” in the upcoming winter, with overall production expected to rise 3.2% from last winter to 99.1 Bcfd and demand growing 2.4% to 121.2 Bcfd. The biggest share of demand once again is expected to be residential and commercial heating, at 44 Bcfd, followed by industrial and other at 34 Bcfd, electric generation at 30 Bcfd and net exports at 13.4 Bcfd.

Liquid natural gas and gross pipeline exports are both projected to rise from last winter’s levels, while imports are expected to be around the same as last year. | EIA

Liquid natural gas and gross pipeline exports are both projected to rise from last winter’s levels, while imports are expected to be around the same as last year. | EIAThe level of exports of both pipeline gas and LNG is expected to rise 24% from last year because of increased overseas demand. This year the demand from Europe has outstripped that from East Asia, typically the primary destination for U.S. gas exports, because of the cutoff of Russian natural gas flows amid the ongoing Russo-Ukrainian War.

At the same time, the Energy Information Administration expects U.S. natural gas storage inventories to begin the winter below both last year’s level and the five-year average. During the 2022-2023 withdrawal season, which begins in November 2022 and ends in March 2023, gas storage levels will peak at 3,472 Bcf despite a 10.3% increase in injections in 2022. However, the expected winter withdrawals of about 2,012 Bcf are also anticipated to be about 7.4% less than the five-year average thanks in part to the mild temperatures.

No Agreement on Blame for Gas Prices

With the rising demand expected to keep gas prices high throughout the winter, attendees at Thursday’s meeting had divergent opinions on the best way to address the likely hardships for consumers. Commissioner Mark Christie suggested that recent “premature” retirements of coal-fired facilities have left a hole for dispatchable generation that utilities frequently fill with natural gas plants.

Mark Christie, FERC | FERC

Mark Christie, FERC | FERC“When you retire a coal generating unit that still may have 15, 20 years of useful life remaining — and let’s say it’s a 2,000-MW unit — you’ve got to replace the 2,000 MW of capacity that you just lost,” Christie said. “So what’s been replacing the premature retirements of coal has been gas. … NERC has been very vocal about that: We’re going to have to have gas through the transition. But it’s adding to demand for gas.”

In a press conference following the meeting, Glick acknowledged Christie’s concerns but said the question of utilities’ generating resources was “not for FERC to decide.”

“It’s been an issue we’ve talked about for many years, [but] it’s for the states to decide what the resource mix should be,” Glick said. “To say, ‘Oh, they should put the coal units back, and that would solve everything,’ that’s a fantasy. That’s like saying, ‘I should try out for the Mets because I could make the Mets’; it’s not going to happen.”

James Danly, FERC | FERC

James Danly, FERC | FERCGlick also pushed back on Commissioner James Danly’s criticism of the “significant delays in the processing” of gas pipeline applications, in some cases from environmental reviews that Danly called “unprecedented” and “unnecessary gilding the lily.” The chairman disputed Danly’s assertion that the delays in pipeline construction had anything to do with rising natural gas prices, though he acknowledged that New England needs additional capacity.

“The problem [there] is … that for a variety of reasons, it’s never going to get built, in large part because pipelines want long-term contracts, and generators don’t want to pay for long-term contracts when they only need the gas 10 to 14 days a year,” when it’s coldest, Glick said. “So [high prices have] nothing to do with the amount of pipeline capacity. … It’s simple supply and demand, and demand in particular is going up at a very great rate.”