FERC Chair Richard Glick made his first in-person visit to SPP’s Arkansas headquarters last week, joining the grid operator’s stakeholders for their regular quarterly governance meeting.

The trip wasn’t Glick’s first to Arkansas. He served as former U.S. Sen. Dale Bumpers’ (D-Arkansas) legislative director and chief counsel for seven years, which brought him to The Natural State several times.

“The first question I would always get was, ‘You’re not from here, are you?’” Glick, a son of the North, said during the meeting.

He watched from the sidelines as the Board of Directors and the Regional State Committee, comprised of SPP’s state regulators, conducted their business in meetings that were closed to non-rostered members. Glick came away impressed with the RSC’s deliberations on resource adequacy.

“It was a real education because there’s a lot of other regions that have different approaches to state input and state stakeholder processes, and this is definitely unique,” he said. Nodding to SPP’s expanding Western market services, Glick added, “I can see why that’s attractive to others … especially in the West.”

Glick said SPP’s approach to state regulatory input will play a role as the RTO competes with CAISO to offer market services in the Western Interconnection.

“I’m pretty sure everyone would probably agree that eventually, there’s going to be at least one if not more than one RTO developed in the West. It’s certainly moving in that direction, and you all are playing a significant role,” he told stakeholders. “I think just providing an alternative to the California ISO, a structure which is obviously hobbled by the way that the ISO deals with independence or doesn’t have independence in terms of [its] board relationship. I think … the Regional State Committee approach is something that’s very attractive to a lot of the state regulators.”

Glick stressed the importance of accrediting generating resources’ capacity — and not just that of intermittent resources — to maintain grid reliability. He noted that in recent years “more traditional generating plants” have shut down when they should have been available, mostly because of extreme weather.

“It’s something that everyone needs to think about and be much more precise in how we define and accredit capacity,” he said.

Glick said FERC has devoted two years of technical conferences and internal discussions about the best way to structure markets going forward, given the challenges of ensuring reliability and the transition to clean energy.

“One of the questions is [whether] the markets are currently operating in a way that really achieves or maximizes the benefits associated with the transition,” he said. “We’ve had discussions about capacity markets, about ancillary services, about energy markets and other market reforms as well, and the one recurring theme that comes up in all of them is flexibility, the need for more flexibility as we go forward. It can be flexible natural gas; it can be storage; it could be other technologies as well.

“When I first came to FERC … at the beginning of the Trump administration, there was a lot of discussion about, ‘We need more baseload generation, we need to subsidize baseload generation,” Glick said. “To me, that’s the debate that’s kind of not really relevant for today. Today, the relevance to me is how do we incentivize flexibility? I don’t anticipate the commission coming up with anything in the near future on that issue, but it’s something I think we still think about and wanted to move on at some point in the future.”

$245M Operating Budget Approved

The board approved SPP’s 2023 operating budget, net revenue requirement and capital budget following unanimous endorsement by the Members Committee.

The $245.6 million budget is a 6.2% increase over the current year — about two-thirds less than last year’s 17.7% — with salaries and benefits representing the largest share of growth. SPP instituted a one-time, across-the-board raise for staff this year to compensate for inflation.

American Electric Power’s Richard Ross raised concerns that SPP is “too ambitious with our activities that are not a part of our core functions.” Ross often refers to those functions as the grid operator’s “food and shelter” responsibility.

“I’m concerned that we are too ambitious with our activities that are not part of our core functions, in particular, the Western expansion,” he said, citing “recent studies” that indicate the current footprint will see “minimal” benefits from the effort. “I think we need to strongly evaluate whether or not we need to continue the major push that we’re under and whether or not that is truly in the best interest of the core functions of SPP in the long-term.”

“It’s definitely a known item, and there is focus on how that is going to get addressed, because resourcing is critical,” CEO Barbara Sugg responded.

She said SPP has onboarded 81 new staffers this year, but that the turnover rate remains high. She said leadership is taking steps to recruit the “best and the brightest, but also to increase retention.”

The net revenue requirement (NRR) will rise 4.7%, from $176.3 million to $184, Finance Committee Chair Susan Certoma said. SPP’s tariff limits the NRR to a ratio of estimated annual transmission usage, capped at $0.465/MWh. That rate has been set at $0.448/MWh for 2023 but is projected to peak at $0.494/MWh in 2025 before decreasing.

CFO Dunn Retires

Directors and members honored SPP CFO Tom Dunn, who is retiring after 21 years on Dec. 2.

“So, there’s still plenty of time to harass him,” Sugg said.

She said SPP’s headcount increased by 500 employees and its operating budget by $175 million under Dunn’s leadership, and he secured more than $400 million in financing to fund the RTO’s growth while maintaining the lowest cost of service by any system operator.

“Tom has been an invaluable resource to me as well as to all of SPP. I’m thrilled that Tom hung in there with me as the new CEO,” Sugg said. “He has taught me so much about his area of responsibility, but he’s also such an asset to the executive team … who can present different alternatives and suggestions and just kind of help us think out of the box a little bit, which I think is a tremendous asset for all of our executives.”

At first reluctant to speak after the board’s resolution, Dunn recalled one of his first staff meetings. Former CEO Nick Brown asked him to explain finance to the employees. Dunn complied.

“I spent 30 minutes, and [Brown] never invited me to do it again,” he said. “I enjoyed my time at SPP. It’s the best career move I’ve ever made.”

Membership Elects 2 New Directors

The RTO’s membership elected two new directors and one incumbent to the board during SPP’s Annual Meeting of Members.

Joining the board are former ISO-NE general counsel Ray Hepper and Steve Wright, a former Bonneville Power Administration CEO and general manager of Washington’s Chelan County Public Utility District. Bronwen Bastone was elected to a second three-year term.

Wright’s term is effective immediately, as he replaces long-time director Julian Brix, who recently retired from the board. He gives SPP a second director with experience in the Western Interconnection in addition to John Cupparo, which could come in handy as the RTO expands its Western services.

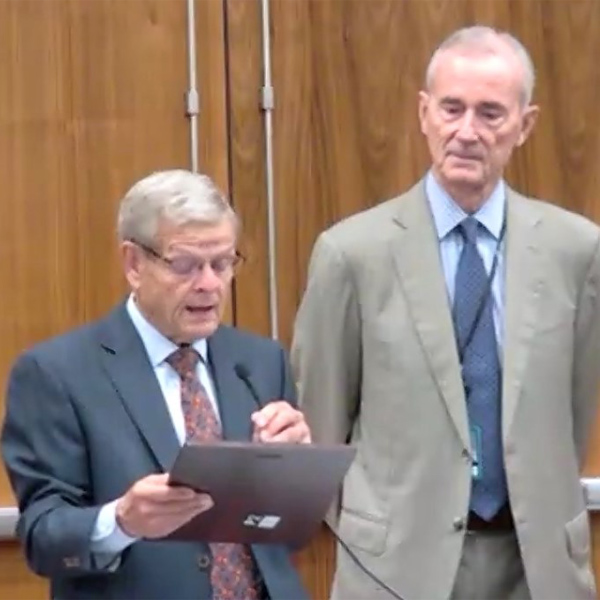

Board chair Larry Altenbaumer reads a resolution honoring six-year director Mark Crisson (right). | SPP

Board chair Larry Altenbaumer reads a resolution honoring six-year director Mark Crisson (right). | SPPWright said in a press release that he hopes to “strengthen the bridge” to SPP’s potential Western members. “SPP is at the center of our nation’s ambitious efforts to attain a reliable, affordable and clean electric power system,” he said.

Hepper’s term will begin Jan. 1. He was elected to ERCOT’s board in 2020 but only served a few weeks before the 2021 winter storm came within minutes of collapsing the Texas grid. After several days of outages, Texans directed their ire at the ISO’s out-of-state independent directors, who also resigned.

The SPP board will undergo several other changes next year. Current chair Larry Altenbaumer, who has been on the board since 2005 and has one year left on his term, will step aside in favor of Certoma. Elizabeth Moore will replace Certoma as vice chair.

Mark Crisson is also retiring after six years on the board. The board and members honored Crisson with a standing ovation and a resolution recognizing his service.

“I told Mark it’s been an honor for me to serve with someone like him. … He is perhaps one of the most quietly effective individuals you will encounter,” Altenbaumer said. “He is a very straightforward individual, and if he disagrees with you, he will very constructively let you know that he disagrees with you. I really value that in terms of his role as a board member and the guidance that he sometimes shared with me, even when it wasn’t guidance.”

The membership also elected six new members and six incumbents to the 22-person Members Committee.

Joining the committee for the first time are EDP Renewables’ David Mindham (Independent Power Producer/Marketer segment); Tri-State Generation and Transmission Association’s Mary Ann Zehr (Cooperative); Arkansas Electric Cooperative Corporation’s Buddy Hasten (Cooperative); Google Energy’s Will Conkling (Large Retail); American Clean Power Association’s Daniel Hall (Alternative Power/Public Interest); and Southwestern Public Service/Xcel Energy’s Adrian Rodriguez (Investor-owned Utility).

Re-elected to the committee are American Electric Power’s Peggy Simmons (Investor-owned Utility); Northwestern Energy’s Bleau LaFave (Investor-owned Utility); City Utilities of Springfield’s (Mo.) Chris Jones (Municipal); Dogwood Energy’s Rob Janssen (IPP/Marketer); ITC Great Plains’ Brett Leopold (Independent Transmission Company); and Basin Electric Power Cooperative’s Tom Christensen (Cooperative).

Board Approves 2022 ITP, Consent Agenda

The board approved staff’s 2022 Integrated Transmission Plan, a reliability-only portfolio. The 17-project, $35.4 million plan solves 25 system needs in rebuilding 11 miles of transmission but will not result in any new transmission.

Its unanimously approved consent agenda included chairs for the following stakeholder groups: Credit Practices Working Group, Caleb Head (Northeast Texas Electric Cooperative); System Protection & Control Advisory Group, Chris Angland (Omaha Public Power District); Project Cost Working Group, Brian Johnson (AEP); and Market Working Group, Richard Ross (AEP).

The agenda included the Corporate Governance Committee’s nominations for several committee assignments: Golden Spread Electric Cooperative’s Mike Wise to the Finance Committee; GridLiance High Plains’ Noman Williams to the Human Resources Committee; and AEP’s Ross, Basin Electric’s Christensen, NextEra Energy Resources’ Matt Pawlowski, and Golden Spread’s Natasha Henderson to the Strategic Planning Committee.

It also included several modified and withdrawn notifications to construct, an amended and restated Western Joint Dispatch Agreement to facilitate three Black Hills Corp. subsidiaries’ 2023 membership into the Western Energy Imbalance Service market, and six revision requests previously endorsed by MOPC:

-

- RR499: Adds new language to the planning criteria concerning terminology and their definitions, new capability and new operational testing requirements, out-of-season capability testing, capability and operational testing for new or upgraded units, and accreditation for thermal and hydro units.

- RR508: Allows LREs to use deliverable capacity to meet their winter season obligation.

- RR512: Requires LREs to submit used and unused capacity on behind-the-meter resources that have qualified as accredited capacity that can be used to respond to emergency conditions.

- RR514: Updates the operating constraint and spin violation relaxation limits by increasing the values of all operating reserve constraints not subject to market-to-market coordination to $1,500

- RR516: Codifies the increase of the planning reserve margin from 12% to 15%.

- RR520: Gives the balancing authority greater ability to forecast and measure non-registered, available demand response by analyzing data submitted daily from affected LREs.