Stakeholders Approve Winter Weekly Reserve Target

VALLEY FORGE, Pa. — The PJM Operating Committee last week endorsed the winter weekly reserve target (WWRT) values, used to coordinate planned outages scheduled during winter, as recommended in the 2022 reserve requirement study (RRS).

Patricio Rocha Garrido, PJM | © RTO Insider LLC

Patricio Rocha Garrido, PJM | © RTO Insider LLCThe RRS also recommends values for the installed reserve margin and the forecast pool requirement, both of which were approved by the Markets and Reliability Committee on Oct. 24.

The WWRT is used to cover against uncertainties associated with load and forced outages during the winter month with a large enough reserve to handle any contingencies.

This year’s study recommended a reserve of 21% for December, 27% for January and 23% for February.

“When we get to the winter period, we want to make sure that the available reserves are sufficient so that we can handle those uncertainties,” PJM’s Patricio Rocha Garrido said. The values are fairly similar to last year’s, he said.

Maximum Emergency Status Change Advances to MRC

The committee endorsed changes to Manual 13 to allow coal generation owners to offer their units as maximum emergency if their fuel inventories fall below 10 days because of issues outside their control and not relating to economic decisions. The proposal is set to go before the MRC for endorsement on Nov. 16.

For a unit to be able to enter into maximum emergency under the proposal, PJM cannot have declared a hot or cold weather alert or conservative operations, and the RTO can deny the use for any reason. A unit granted maximum emergency can remain in that state until they have 21 days of fuel inventory or until either of the previous conditions are met.

Independent Market Monitor Joe Bowring said the proposal could effectively put PJM in the position of managing the fuel supply risk on behalf of companies.

Synchronized Reserve Dispatch

The committee approved a revised problem statement and issue charge by acclamation to examine synchronized reserve event actions.

The issue charge argues that during an all-call to deploy synchronized reserves, the “market tools for dispatching resources based on economic order are not consistently utilized.” Additional lack of clarity around the process for approving real-time security-constrained economic dispatch around a synchronized reserve event presents challenges that the work stemming from the issue charge would attempt to resolve.

The revisions made to the issue charge include education on FERC responses to filings on synchronized reserve deployment and evaluating pricing throughout the deployment events.

Monitor Presents CIP Cost Recovery Proposal

Bowring presented a slate of proposed revisions to PJM’s issue charge on cost recovery for facilities identified as critical infrastructure, which he said would address the issue charge moving too far into the direction of proposing solutions.

The modified issue charge was initially listed under the OC’s first reads, but it was moved to the informational items because no member sponsored the item. Motions to do so will be considered at the committee’s next meeting.

Bowring also suggested in the revisions that it should be considered whether non-market approaches under the expected deliverables should be used, even though he believes they shouldn’t.

PJM Presents Winter Capacity and Load Projections

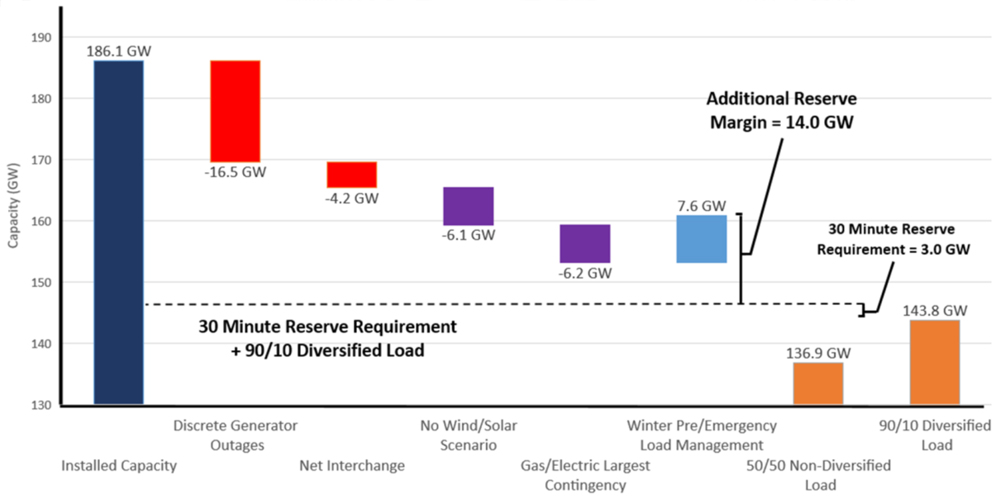

PJM’s Todd Bickel presented the Operations Assessment Task Force study of the capacity projections for the upcoming winter season, which found that the RTO is expected to meet the 30-minute reserve requirement of 3 GW, while having an additional 14 GW on hand.

No reliability issues were identified for the base case and N-1 analysis, though re-dispatching and switching is expected to be required in some areas to control local thermal or voltage violations.

The results of PJM’s Operations Assessment Task Force 2022-23 Winter Study show the RTO is expected to have adequate reserves through the upcoming winter season. | PJM

The results of PJM’s Operations Assessment Task Force 2022-23 Winter Study show the RTO is expected to have adequate reserves through the upcoming winter season. | PJM

“For this winter we have sufficient margins and no reliability concerns,” Bickel said.

There is expected to be 168.1 GW of capacity available this winter, which is offset by 16,510 MW of discrete generator outages. There is also expected to be 4,200 MW lost in net interchange, and 6,100 MW which could be unavailable should there be no wind and solar available. The largest gas/electric contingency is expected to amount to 6,200 MW in capacity that could be unavailable.

The Load Analysis Subcommittee’s forecasted peak load is 136.9 GW, while the 90/10 diversified load is projected at 143.8 GW.

Fuel Inventories Remain a Concern

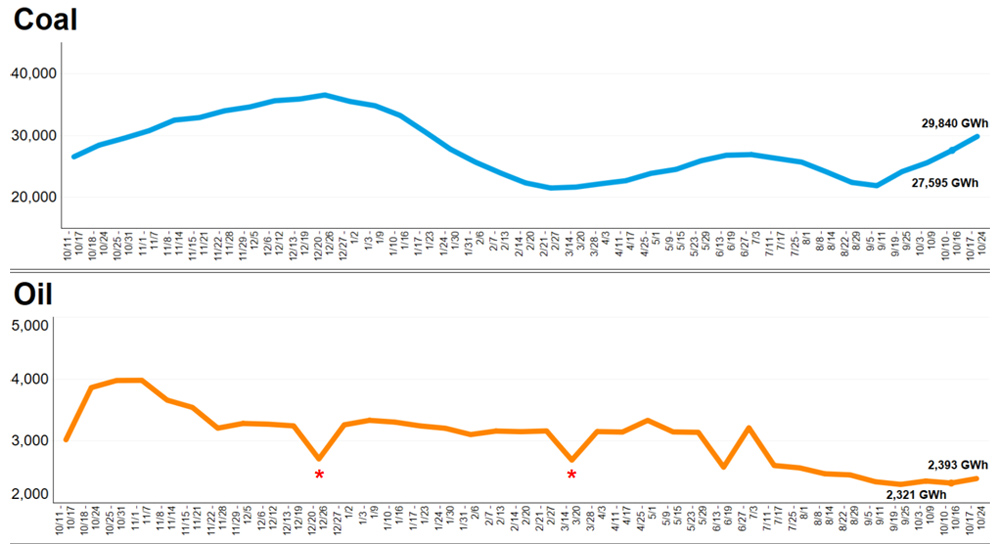

Fuel inventories are overall improving, though natural gas prices remain volatile, and the possibility of a railroad strike makes coal transportation a concern, according to PJM Principal Fuel Strategist Brian Fitzpatrick.

According to the latest Energy Information Administration update, the natural gas storage deficit is now 3.7% below the five-year average, compared to 5.5% in its previous update, Fitzpatrick said. PJM expects that the starting winter inventory will be around 2.5% below the five-year average.

Coal and oil reserves, as shown in GWh of fuel inventory, remain below their 5-year averages according to PJM’s fuel supply update. | PJM

Coal and oil reserves, as shown in GWh of fuel inventory, remain below their 5-year averages according to PJM’s fuel supply update. | PJM

Coal production remains high, he said, but prices remain significantly elevated over the first half of 2021. EIA remains optimistic about inventories, but there are many contingencies that could “derail” those expectations. Chief among the concerns is the possibility of a railroad strike as half of unions in the industry have yet to ratify a contract, with a Nov. 17 deadline approaching.

“It certainly could be a crippling effect,” Fitzpatrick said.

Distillate and residual fuel oil inventory also remain below their five-year averages, and price volatility remains high, with prices in the $80 to $90/barrel range. Recession fears, a strong U.S. dollar, low inventories and geopolitical tension are all driving prices, but Fitzpatrick said there are no specific concerns at this time.

PJM Cybersecurity Update

PJM Chief Information Security Officer Steve McElwee said distributed denial of service attacks remain one of the most prominent digital security issues being seen at this time as offensives continue against NATO allies. While the RTO may not be the primary target, he said there could be collateral impacts seen as the Russian invasion of Ukraine continues.

The RTO is also exploring ways to collect contacts for members’ security teams so that in the event of an emergency, that information is more readily at hand. While those contacts are currently asked for in the contact management feature, it is not mandatory to provide and has primarily been used for invitations to events like conferences.