The U.S. will require a massive mobilization of resources and unprecedented collaboration among federal, state and regulatory authorities to build the transmission needed to the meet its aggressive offshore wind goals, a new report says.

Those goals include President Biden’s call for 30 GW of offshore wind by 2030 and a national target of 110 GW by 2050.

Such “proactive and holistic” planning efforts could save U.S. consumers $20 billion and reduce environmental and community impacts by 50%, according to the report, “The Benefit and Urgency of Planned Offshore Transmission,” compiled by The Brattle Group for a consortium of clean energy and grid advocates.

“Compared to the current process of developing and interconnecting one OSW generation project at time, each with its own cables to shore, a coordinated comprehensive transmission plan could unlock numerous efficiencies and benefits unavailable under current processes,” the report says.

But “to achieve these benefits, state and federal policymakers, industry regulators, system operators and market participants must expeditiously address” existing obstacles, such as interconnection and permitting reform, the report says. “Even modest delays in developing and implementing actionable plans for both near- and long-term transmission investments substantially reduces [sic] the benefits of such planning efforts.”

For example, the report cites a study done by National Grid in the United Kingdom finding that a delay of five years in long-term transmission planning would cut benefits — including $7.4 billion in costs savings — in half.

“If we don’t carefully plan, it’s not just the next 10 to 15 years,” said Johannes Pfeifenberger, a principal at The Brattle Group and lead author of the report, speaking at a launch webinar on Tuesday. “But with a view to 2040 and 2050, we are really prone to severely limit our future options.”

The report’s to-do list is daunting. In the next year alone, federal and state governments must increase funding and staff for offshore transmission planning, and the Internal Revenue Service must clarify the offshore wind tax credits in the Inflation Reduction Act. Offshore developers are specifically looking for the IRS to confirm that a project’s transmission infrastructure will qualify for the tax credit.

At the same time, states will have to come together to form multistate “transmission authorities,” which will “facilitate the planning and procuring of effective regional and interregional transmission solutions,” the report says. Federal leasing processes should be changed to lay out “offshore cable routes between projects,” and “network ready” standards for offshore substations and cables must be developed to ensure interoperability between projects.

A range of funding opportunities and incentives in the IRA and Infrastructure Investment and Jobs Act should be leveraged to jump-start these and other mid- and long-term recommendations in the report. Potential funding sources in the IRA include $760 million to help with siting of interstate and offshore transmission and $2 billion in financing, such as loan guarantees, for transmission projects the Department of Energy designates as being “in the national interest,” the report says.

But, Pfeifenberger said, some IRA funds, such as offshore wind tax credits, sunset in 10 years, which is about how long it takes to permit and build an offshore project and transmission; hence, the need for immediate action. “We won’t be able to take advantage of [IRA funding] unless we start to plan for what it is that we need,” he said.

A Burning Fuse

A joint project of the Natural Resources Defense Council, GridLab, the Clean Air Task Force, the American Clean Power Association and the American Council on Renewable Energy, the report’s call for urgency is rooted in the confluence of the expansion of offshore wind in the U.S. and the federal funding opportunities in the IRA and the IIJA.

In addition to Biden’s 30 GW, states on both the East and West coasts have set offshore targets totaling 77 GW by 2045, and a range of studies are projecting the U.S. could need as much as 460 GW of offshore wind to meet its 2050 climate goals, the report says.

Connecting these projects to the onshore grid requires laying underwater cable and finding onshore points of interconnection (POIs) that may run across beaches or through coastal communities, as well as interregional high-voltage DC transmission lines to get power to load centers. Projects and their transmission can take a decade to site, permit and build, making the need for forward planning more urgent, as does the siting of multiple projects near each other, as is now occurring on the East Coast, the report says.

“The days of low-hanging fruit where you have near ready-made POIs are really done, and we’re starting to brush up against some really tough nuts to crack in terms of interconnecting these resources,” said Robert Golden, senior adviser for clean energy infrastructure at the White House. “The opportunity is huge to deliver for customers, but this is really a bit of a burning fuse, and if we don’t move quickly a lot of the benefits … can vanish off the table.”

“Current interconnection points are not sufficient to accommodate all the offshore wind that is expected to come online over time,” agreed Lopa Parikh, head of electricity policy for offshore wind developer Ørsted, which is currently working on eight projects off the Atlantic coast. “So, any proposals for transmission projects that are considered really need to consider the full scope of potential offshore wind development to ensure that they can be accommodated over the long run. … This is especially true since most of the offshore wind is currently being developed close to load centers, which greatly increases the need to create more efficient transmission planning.”

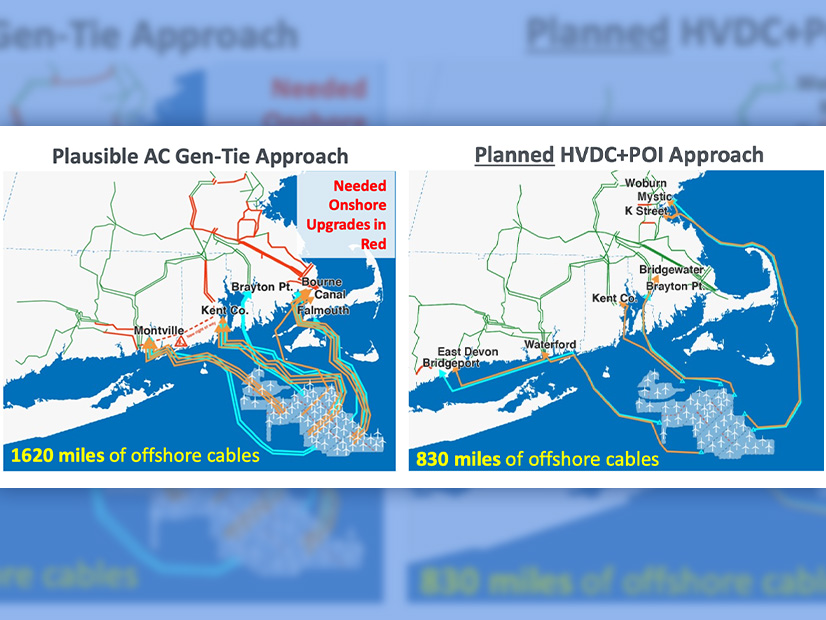

The benefits of such coordinated planning could include a 60% to 70% reduction in the need to upgrade onshore transmission lines or run lines across beaches or through coastal communities. The amount of underwater cable needed for projects could also be cut by as much as 2,000 miles, the report says.

“Every time you have to go back and disturb [an] area, that impacts the communities,” said Suzanne Glatz, director of strategic initiatives and regional planning at PJM. “There’s a lot of value to be extended if we can minimize the number of times we have to go back to those areas.”

Suedeen Kelly, a former FERC commissioner and now a partner at law firm Jenner and Block, believes that offshore wind development should be seen as a “unique effort in America. … We shouldn’t necessarily try and pigeonhole this planning process into existing frameworks and existing silos.”

“We don’t really know what the best configuration of an offshore grid is,” Pfeifenberger said. “Is it just meshed radial lines? Is it a backbone? Is it some sort of combination of these things? We need a planning process to figure out what is the best configuration for a given region.”

At the same time, Pfeifenberger sees interregional offshore transmission planning as providing new opportunities for improving grid reliability and resilience. “We can use the offshore infrastructure to reinforce the onshore grid, and there is a lot of interregional transmission that studies find would reduce total costs faced by consumers significantly, and offshore links may be the most cost-effective way to provide that regional and interregional transfer capability.”

He also envisioned “multipurpose connectors … that not only bring offshore wind to shore but also create reinforcement to the onshore grid,” he said. The problem, however, is that the HVDC lines that would be used in such networks have a higher capacity than the standard maximum most RTOs and ISOs can handle, even in a “most severe single contingency,” Pfeifenberger said.

“That kind of [HVDC] network would really improve the reliability of delivering offshore wind. It allows for higher capacity transmission cables that are … able to reroute power and avoid large impacts on individual grid nodes,” he said.

Switching Trains

The report’s call for urgent action on transmission planning for offshore wind comes at a time when FERC and RTOs/ISOs are all wrestling with planning and interconnection issues, though their focus has been regional, rather than the interregional coordination the report sees as critical. In addition, Pfeifenberger said, these bodies will also need to work on new frameworks for regulations, contracts and markets.

Brattle has done a number of studies advocating for coordinated planning for offshore wind for New York and New England, comparing the cost and impacts of traditional, siloed planning with a holistic, networked approach in which multiple projects can be linked or can share cables and POIs.

“Before we have a networked offshore grid, we will need the regulatory and contractual framework for shared network operations,” he said. “The regional grid operators need to tune up their operations and market design because right now they are not ready to handle HVDC links, either within their region or across regions,” he said.

FERC’s anticipated rulemaking on regional transmission planning “will be very helpful, at least if the final rulemaking is anything like the [Notice of Proposed Rulemaking] itself,” Pfeifenberger said. “However, FERC rulemaking won’t be effective unless there is also leadership from the regional grid operators and the states.”

The lack of collaboration between states and grid operators was one of the factors behind the failure of FERC Order 1000, the grid planning order the commission issued in 2011, he said.

“We’re basically trying to develop a process that allows us to switch trains while both trains are moving at high speed from the current process to a better planning process, and that requires a lot of additional thought and preparation,” Pfeifenberger said.

Not yet finalized, the NOPR would direct transmission providers to revise their planning processes to, among other things, identify infrastructure needs on a long-term, forward-looking basis and propose a list of benefits on which they would base their selections of proposed projects to meet those needs. It has had a mixed reception among industry stakeholders. (See Battle Lines Drawn on FERC Tx Planning NOPR.)

Following the departure of Richard Glick as FERC chair, the commission is now potentially deadlocked with two Democratic and two Republican commissioners, leaving the future of the rulemaking uncertain.

Kelly sees the regional NOPR as a first step but stressed that it will not cover the kind of interregional planning needed for offshore wind. FERC could, she said, “play a pivotal role initially by becoming a national forum for the provision of information prior to talking about any kind of regulation.”

By hosting a series of technical conferences, FERC could provide “a single place where interested developers, states [and other] stakeholders could come” to discuss the issues, she said.

Equal Access Is Key

But developing any new transmission planning processes must not slow down or delay projects already underway, Parikh said. “Making changes to projects that have already been awarded could negatively impact the viability of these projects and the ability for them to interconnect in a timely manner.”

PJM’s state agreement approach (SAA) with New Jersey is one way forward, Glatz said. Under the SAA, PJM ran a solicitation for the New Jersey Board of Public Utilities for transmission projects to connect 6,400 MW of approved offshore wind projects to the grid. According to the report, the solicitation and the resulting projects chosen by the BPU saved the state $900 million. (See NJ BPU Oks $1.07B Transmission Expansion.)

She also pointed to PJM’s interconnection reforms, recently approved by FERC, that will shift the RTO from its current first-come, first-served methodology to instead studying new service requests with a first-ready, first-served approach that clusters proposed projects together to determine network impacts and allocate network upgrade costs. (See FERC Approves PJM Plan to Speed Interconnection Queue.)

The reforms mean “we can be looking out to not only the first project, what it would take to interconnect that one, but also the one after and the one that comes two or three years after that,” Glatz said. “What is that holistic solution to meet the interconnection of those projects?”

But forward planning also carries certain risks. “You are planning for multiple projects, some of which may not be very far along or even yet entered into the interconnection queue,” she said. “So, there’s a possibility that those will not materialize, and you may have more transmission built that could be more costly.”

Glatz also stressed the independent role RTOs play as “organizations that plan the system to meet the needs of all system users, which would mean studying all generation requests in a nondiscriminatory manner and to provide equal access to all of them.”

The RTOs’ wholesale markets must also provide equal, nondiscriminatory access, Glatz said. “Assuring that the planning process still serves that purpose is really key to anything we’re going to consider in terms of potentially prioritizing any resources.”