The pace of capacity being installed on PJM’s grid may not keep up with the rate of retirements and accelerating load growth over the next eight years, according to a white paper PJM plans to release Friday.

“There is a concern that we may not be replacing the exiting generation at the rate needed to maintain resource adequacy,” PJM’s Scott Benner told the Markets and Reliability Committee during a presentation on the white paper’s findings.

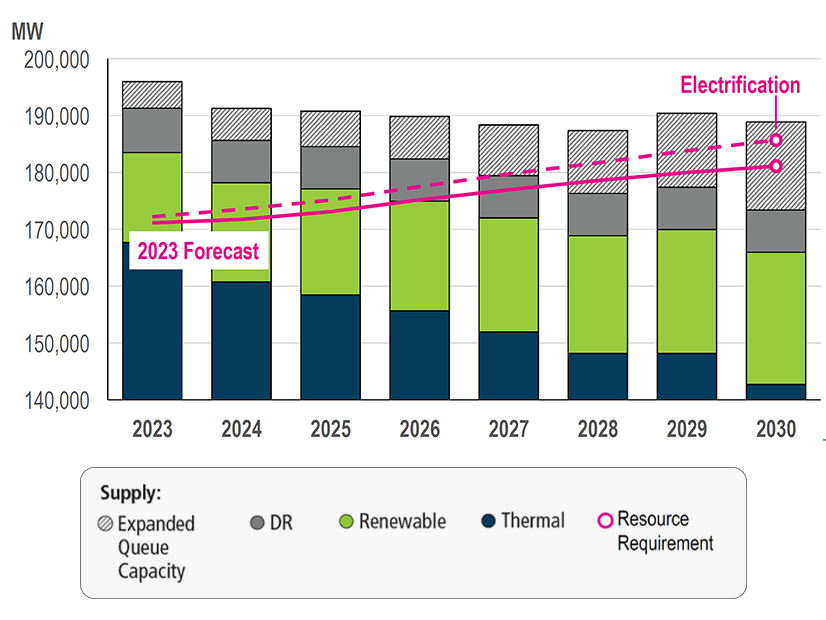

About 40 GW of generation in the RTO is forecast to retire by 2030, representing 21% of currently installed generation. The white paper lays out two scenarios for the development of additional capacity over the same period, with a conservative estimate at just over 15 GW installed and a more optimistic forecast seeing nearly 31 GW of development.

Brenner said while 46 GW left the market over the past eight years, the period saw sharp growth in natural gas resources that made up for lost coal generation. Natural gas installations are expected to drop off after 2023, with renewables only picking up a share of the slack.

“We’re blessed in PJM to have an abundant natural gas supply, but there’s a concern over the next 10 years that we won’t have that backstop to cover the retirements,” Brenner said.

PJM Vice President of Market Services Stu Bresler said staff have been looking at the future supply-demand balance since October, when CEO Manu Asthana shared concerns about the pace of retirements and development at the 2022 Annual Meeting of Members. (See “PJM CEO Manu Asthana Warns of Potential Generation Shortfalls,” PJM MRC Briefs: Oct. 24, 2022.)

“We cannot take the reliability that we enjoy in our region for granted through this energy transition; we have to take concrete steps to ensure that it will continue,” Asthana said before the Markets and Reliability Committee on Oct. 24.

The development forecasts combine analysis of projects in PJM’s queue with analysis conducted by S&P Global. The conservative scenario assumes that about 5% of projects that enter the interconnection queue reach commercial operation, while the more optimistic estimate assumes more projects enter service. Of the 40 GW expected to retire, Benner said coal would account for about 60% and natural gas 30%.

State clean energy policies are expected to drive about 24 GW of the retirements, with PJM’s analysis assuming that owners will choose to retire facilities rather than make the upgrades required to comply with new regulations and laws.

The retirements are expected to accompany a growth of demand from data centers and the electrification of vehicles and buildings. Benner said those trends could collide later this decade, causing installed generation to fall below the 14% reserve margin unless the rate of new resources accelerates.

“With the expected retirements and rates of replacements, there’s a risk that we move into a higher rate of demand response usage in around 2027,” he said.

Carl Johnson, of the PJM Public Power Coalition, said the RTO must implement firm and transparent rules to avoid reliability problems and creating a scenario where reliability must-run (RMR) contracts are seen as a solution.

“We’re going to need some sort of reliability backstop that isn’t the current RMR rules,” he said.

Noting that Benner’s presentation pointed to the Resource Adequacy Senior Task Force as one of the forums to discuss market changes to continue the conversation, David “Scarp” Scarpignato of Calpine said the task force has already been mired in intractable discussions, and PJM may need to take a more active role in addressing the issues it’s highlighted.

“PJM might have to exert even more leadership than you already have to push this forward … because I’m not sure the stakeholders are going to reach consensus,” he said.

Abe Silverman, of the New Jersey Board of Public Utilities, said he was glad to see that development of new generation is being treated as an equal priority to the issue of retirements. States and companies with clean energy goals have significant demand for renewable resources and obstacles limiting their entry to the market, including the interconnection queue, should be treated as part of the solution, he said.