American Electric Power (NASDAQ:AEP) reiterated its strategy to de-risk the company and prioritize investments during the company’s quarterly earnings call Thursday with financial analysts.

The call came a day after AEP announced it has entered into an agreement to sell its 1,365-MW unregulated, contracted renewables portfolio in a transaction that will net the company $1.2 billion in cash. The portfolio includes 14 projects representing 1,200 MW of wind and 165 MW of solar in 11 states.

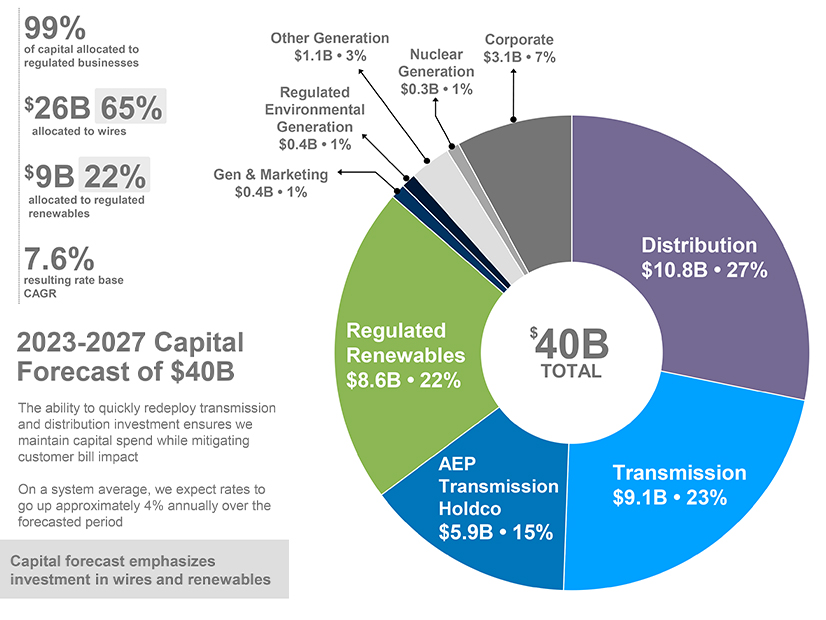

The transaction’s proceeds will be funneled into supporting the company’s regulated businesses. AEP plans to invest about $40 billion over the next five years in its regulated wires and generation business. It hopes to add 17 GW of new generation resources, with 15 GW of new renewable resources added over the next decade.

“We’re strengthening our focus on these regulated investments and de-risking the business through active management of our portfolio,” AEP CEO Julie Sloat said. “This transition allows us to add fuel-free generation. … At the same time, the $26 billion we plan to invest in our transmission and distribution systems over the next five years will help ensure the continued delivery of safe, reliable and affordable power to serve our communities.”

The transaction with IRG Acquisition Holdings, a partnership between Invenergy, Quebec state pension fund CDPQ and funds managed by Blackstone, is expected to close in the second quarter, pending regulatory approvals. AEP announced its intentions a year ago. (See AEP to Sell Unregulated Renewables Portfolio.)

The Columbus, Ohio-based company projects the transaction to result in a loss of between $100 million and $150 million for the quarter.

AEP reported fourth-quarter earnings of $384 million ($0.75/share), down from earnings of $539 million ($1.07/share) for the previous year’s quarter.

For the year, earnings were $2.3 billion ($4.51/share). A year ago, they were $2.5 billion ($4.97/share).

Sloat told analysts AEP is continuing to work “diligently” on completing the sale of its Kentucky operations to Algonquin Power & Utilities by an April 26 contractual deadline. The companies recently made fresh filings at FERC to add more customer protections. (See AEP, Liberty Utilities Try Again on Kentucky Territory Deal.)

“Our near-term focus remains closing on our two pending sale transactions,” Sloat said. “Once both transactions are complete, we plan to revisit the equity needs in our current multiyear financing plan.”

AEP reaffirmed its 2023 operating earnings guidance range of $5.19 to $5.39/share. Its share price closed Thursday at $90.71, an 11-cent loss from the previous close after a late rally.