PJM’s real-time load-weighted average LMP for 2022 was a record-high $80.14/MWh, more than double that of 2021, the RTO’s Independent Market Monitor reported Thursday.

The 101.4% increase was itself a record, beating 2021’s 82.8% increase from 2020, during which prices were at their lowest amid the COVID-19 pandemic. (See PJM Monitor: Prices, Coal Power Bounced Back in 2021.)

The previous high was in 2008, which saw an average LMP of $71.13/MWh. Monitoring Analytics’ annual State of the Market report attributed nearly two-thirds of the increase to rising fuel costs, particularly for coal and natural gas, the prices for which doubled in the eastern part of the RTO’s footprint.

Real-time hourly average load only increased by 1.5%. While there was an increase in data center load, this was offset by increased use of behind-the-meter solar, according to the report.

The rise in fuel prices was from an increase in global demand for both coal and gas, Monitor Joe Bowring said during a press conference Thursday.

“The cost of coal was up very dramatically,” he said, citing the closures of coal mines in the U.S. Meanwhile, the U.S. exported more LNG last year, he said.

Nevertheless, the Monitor found the results were indicative of a competitive market.

“Market performance was evaluated as competitive because market results in the energy market reflect the outcome of a competitive market, as PJM prices are set, on average, by marginal units operating at, or close to, their marginal costs in both day-ahead and real-time energy markets, although high markups for some marginal units did affect prices,” the Monitor said.

But as he has in the past, Bowring noted that “during extreme weather” — such as the December winter storm, also known as “Elliott” — “there is market power being exercised on the gas side. And that’s outside our direct bailiwick, but nonetheless, we believe that’s something [FERC] needs to pay attention to.”

Bowring also criticized components of how PJM forms LMPs. “Largely because of Elliott … we see emergency demand response contributed 4.3% [of the increase over 2021]. … We don’t think that’s the way it should work.” The transmission constraint penalty factor’s contribution of 3.2% is “a result of PJM de-rating transmission lines in a way that it shouldn’t do.” And 12% was market power-related, which “obviously we don’t think that should occur,” Bowring said.

Capacity Performance a ‘Failed Experiment’

The Monitor found the performance of PJM’s capacity market to be overall competitive in 2022, but Bowring noted that the analysis did not include the latest Base Residual Auction, the results for which were released in February after a delay. (See PJM Capacity Prices Jump in 5 Regions.)

Still, Bowring said that generators’ performance during Elliott indicated that the Capacity Performance construct — a response to an extreme cold weather event in 2013/14 — has not worked as intended. PJM has said that generators may face penalties totaling between $1 billion and $2 billion for as much as 46,000 MW in capacity being offline during the late December storm, including more than one-third of gas resources.

“The CP design is a failed experiment,” the report says. “The fundamental mistake of the CP design was to attempt to recreate energy market incentives in the capacity market. The CP model was an explicit attempt to bring energy market shortage pricing into the capacity market design.”

“Given that the market seller offer cap has already been removed by FERC,” Bowring said, “the remainder of the fundamental element of the [CP] design should be removed. The whole notion of PAIs [performance assessment intervals] and having these extreme penalties … putting resources at risk, creating this huge administrative nightmare for PJM, including subjective elements of when PAIs occur … it’s simply not a rational way to run a market.”

Bowring has proposed his own replacement design. (See PJM Stakeholders Discuss Capacity Market Changes After Winter Storm.)

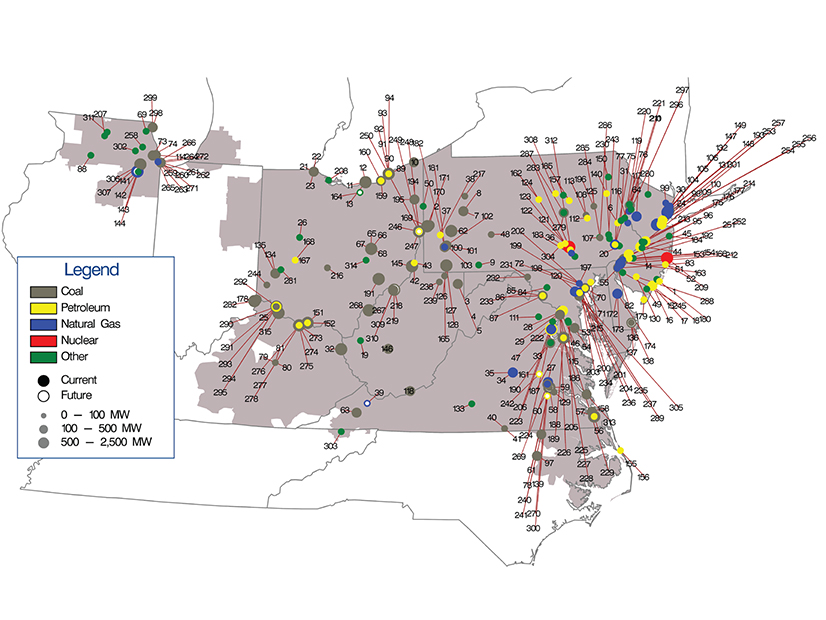

The Monitor also highlighted its concern with the amount of capacity at risk of retirement by 2030: about 51.8 GW. For comparison, it noted that about 47.5 GW retired between 2011 and 2022.

The high level of retirements is outpacing the entry of new generation, as highlighted by PJM in a white paper released last month. (See PJM Board Initiates Fast-track Process to Address Reliability.)

Of the amount the IMM says is at risk, about 23.5 GW is for regulatory reasons. The plants are primarily coal, Bowring said, and the regulations are primarily from EPA.

PJM and the agency have been working together to “try and ensure that all the resources don’t shut down instantly; that resources are given the opportunity to fix their problems, particularly with wastewater treatment, and some have done that,” he said. “Some are not going to do it. So the EPA and PJM have been trying to make sure that any ultimate retirements are spread over time so that they don’t affect reliability.”

Bowring also said that the Monitor is “very concerned about the increase in” reliability-must-run agreements. Some generators “have interpreted the RMR rule as allowing them to recover costs which have already been sunk. …

“So we’re extremely concerned that this high level of retirements could lead to more RMRs, and we think that the PJM RMR tariff needs substantial revision to ensure that units that are required for reliability are paid and paid appropriately — that is, paid every penny of the costs they incur to provide that service, plus an incentive payment — but not paid more than that; not paid two to three times that, which are the kinds of requests we have seen over the last 10 years.”