The West’s heavy snowpack from this winter will be partly soaked up by soils parched during years of drought, limiting hydropower production throughout the summer in the Desert Southwest and Pacific Northwest, speakers said during WECC’s annual summer outlook webinar on Wednesday and Thursday.

The two-day event offered a preview of summer conditions and operations in the Western Interconnection, with subjects that also included wildfires and extended weather forecasts.

“While we may have an increased amount of runoff initially, it doesn’t mean that that runoff is just going to stay there unimpacted by the dried soils of the last couple of years,” Sunny Wescott, lead meteorologist at the federal Cybersecurity and Infrastructure Security Agency, said in Wednesday’s session. “Watching that snowpack melt, come down the mountains and get absorbed rapidly is going to be a condition that everyone needs to be aware of.”

Clayton Palmer, an environmental specialist with the Western Area Power Administration, said the Southwest’s decades-long “mega drought” has meant that since 1988, less water has reached hydroelectric reservoirs in a region where “water equals power.”

“There’s much less runoff for every millimeter of water that has fallen as precipitation during the winter period” from October through April, Palmer said.

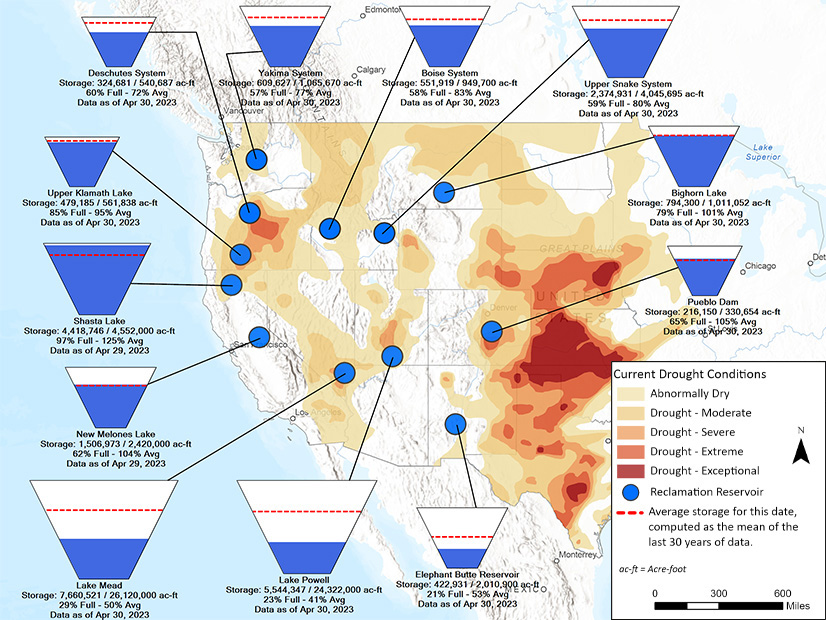

Lake Mead and Lake Powell on the Colorado River have risen this winter as snow blanketed the Rocky Mountains, but the hydroelectric reservoirs remain significantly below their historical averages, he said. The Bureau of Reclamation is examining options for maintaining hydroelectric production at Hoover Dam, which has a 2,074-MW generating capacity, and Glen Canyon Dam, with a 1,320-MW capacity, in what is expected to be a drier future for the Colorado River Basin, he said.

“We shouldn’t be using the word ‘drought’ since the word drought implies that something is temporary, that we have less water for a temporary period of time,” Palmer said. “What we have is a ‘drought,’ to use that word in quotes, caused by an increase in temperature.

“The Colorado River Basin has increased in average temperature by 2 degrees Fahrenheit, and higher temperatures cause snowmelt to be absorbed in drier soils,” he said. “The higher temperatures increase the dryness of the soils and increase evapotranspiration of the water that falls as snow … and decreases what we call the runoff efficiency. The runoff efficiency is how much of the water that falls as snow in the Colorado River Basin gets into the river.”

Forecasted annual generation in the Colorado River Storage Project, which consists of Glen Canyon and other dams in the upper Colorado basin, for 2023 through 2027 will hover around 4 million MWh, compared with an average of about 6.5 million MWh from 1971 through 2000, Palmer said.

In the Pacific Northwest, precipitation was 20% below normal this winter, but temperatures were lower, meaning “our snowpack generally throughout the Columbia River Basin is above normal,” said Geoffrey Walters, senior hydrologist with the Northwest River Forecast Center.

“On the other hand, another primary component to water supply volume forecasts is the soil conditions, and the soil conditions have been dry, and they’ve been dry throughout the winter,” Walters said. “And because of those dry soil conditions, water supply volume forecasts are lower than maybe what you would perceive just looking at the current snowpack. That’s because when soil moisture is drier than normal, it [takes] more of that melting snowpack before it allows the runoff to enter the rivers.

“Vegetation is also going to take more of the snowpack from the available downstream supply for power production or other uses,” he said.

The center is predicting water supply that is 83% of the normal April-to-September volume at Grand Coulee Dam, which has a generating capacity of 6,809 MW. At the Dalles Dam, which has a 1,780-MW capacity and is a key measuring point for Columbia River water flow, supply will be 85% of normal this summer, Walters said.

Wildfire Outlook

On Thursday, WECC took up the topic of wildfires.

While wildfires are not exclusive to the West, they are “a particularly Western concern,” Vic Howell, WECC director of reliability risk management, said Thursday in opening a panel on summer wildfire preparations.

Howell asked panelists about the biggest concerns their utilities have related to fires.

Chris Potter, control center real-time manager with AltaLink, said it’s all about “location, location, location” for the Alberta, Canada-based transmission provider, indicating that risks vary by geography.

Potter described the region’s “Chinooks,” a weather phenomenon occurring in the southern part of the province in which warm and dry westerly winds blow off the Rocky Mountains onto the prairie, rapidly elevating temperatures by as much as 50 F. Wind speeds during those events can reach 60 mph, he said.

“The biggest risk for us is that wind, because if we were to have a line that goes down, which is obviously more probable, in the high wind conditions … [if it starts a fire], it’s going to spread very, very quickly and cover a lot of ground,” Potter said.

Alberta also faces a risk of utility pole fires, he said, particularly along highway corridors lined with wood poles supporting wooden cross-arms. These fires are usually the result of automobiles kicking up dust containing road salt, which causes deterioration on the transmission line insulators, increasing the risk of line arcing under damp conditions, which can set fires to the poles.

“Wind-driven events” present the biggest risk in Southern California Edison’s 50,000-square-mile territory, nearly 30% of which is considered at high risk of wildfire, according to Raymond Fugere, the utility’s director of wildfire safety. Fugere pointed to two “big drivers” of wind-driven fires for SCE: when airborne “foreign objects” come into contact with power lines, causing them to fall; and “line slap,” which can eject molten particles onto the ground and ignite fires.

Christopher Sanford, senior system operator with the Bonneville Power Administration, vouched for the foreign object risk.

“When I was a system operator, getting a call that a trampoline is hanging in a line 40 feet above the ground, it’s kind of bizarre, but those things do happen,” Sanford said, adding that BPA is seeing high winds more frequently now than even 10 years ago.

“We can see a microburst with 100-mph winds and dry lightning, and that’s a great combination for starting fires,” he said.

As a federal power agency that operates about 15,000 miles of transmission but no distribution lines, BPA is also concerned about having clear communication and coordination with other entities in the region during high fire-threat events.

“BPA’s actions are influenced by what other utilities do, whether it’s an adjacent [transmission operator], or it’s one of our distribution customers. … Our impact when we take out a line under a public safety power shutoff [PSPS] can be far greater than a local area impact. [If] we take out significant transmission for wildfire prevention, that could impact down into California and up into Canada,” Sanford said.

System Hardening

Turning to the subject of potentially new challenges Western utilities will face during the upcoming wildfire season, Fugere pointed to the fact that while 95% of California was in drought conditions a year ago, that figure has dropped to zero after a winter of heavy rain and snow.

“So that is going to present some very unique challenges,” Fugere said, including an increase in “grass crop growth,” which elevates the risk of roadside fires ignited by cars. This will require the utility to adjust its schedule for “structural brushing,” the process of clearing grass and brush around the base of utility poles to prevent sparks from setting fires. The increase in soil moisture this year means the grass will grow back after an initial clearing.

Sanford said that while Northwest winter precipitation levels were not as extreme as in California, the season was wet enough to pose particular concerns for the grasslands of central Oregon and Washington.

“We do take on similar actions with system hardening with clearing around wood poles, [and] clearing and using other techniques to preserve wooden poles to reduce the impact of an outage,” Sanford said. “We’ve also done a lot of hardening around our substations,” including clearing brush to a perimeter of 50 feet where permitted. He said such actions have in the past created “well defended” areas that can function as a fire command post.

Fugere and his colleague Cameron McPherson extolled the success of SCE’s wildfire prevention efforts. Fugere said the utility has seen a 98% reduction in the number of structures burned within its territory since initiating fire-hardening measures in 2017, even while facing more extreme drought conditions.

“Our insurance company has told us that we reduced our risk for catastrophic wildfires probably by about 80% — of have a fire that will hit a billion dollars [in costs]. So that’s the mark we’re really driving towards also. We want to continue to drive that down as far as we can,” Fugere said.

McPherson, SCE’s principal manager for PSPS operations, said the utility’s efforts have significantly reduced the need for shutoffs, relegating their use to the most extreme weather events.

“Although used sparingly, due to the impact it has on our customers, there’s no doubt it’s extremely effective once we de-energize the lights,” he said. “The question then becomes, was there a potential fault condition on the line, had it been energized, that could have led to a catastrophic wildfire?”

McPherson said the findings from post-PSPS patrols indicate that SCE’s hardening efforts are paying off. He thinks the utility may even have the opportunity to raise the wind-speed thresholds for invoking PSPS in order to reduce their “scope, frequency and duration.”