The costs and benefits of virtual power plants compared to batteries and natural gas plants, according to a recent Brattle Group study.

The Brattle Group released a study Tuesday that found virtual power plants (VPPs) are cheaper than other currently viable options for resource adequacy, namely storage and natural gas peaking plants.

“Real Reliability: The Virtue of Virtual Power” was prepared for Google (NASDAQ:GOOGL). It found that using distributed energy resources including rooftop solar, smart thermostats (which Google makes), smart water heaters, electric vehicles and batteries also provide additional benefits that the alternatives do not.

The last decade saw utilities spend $120 billion on resource adequacy investments, which was dominated by coal, but saw battery storage rise rapidly in the last few years.

“Electrification, coal retirements and dependence on resources with limited capacity value (wind, solar) will continue to result in a persistent need to maintain sufficient system ‘resource adequacy’ by adding new dispatchable capacity,” the study said.

VPPs involve customers allowing their DERs to be controlled by their utility or a third-party aggregation firm, which then operate them in a way to provide the grid benefits, such as cutting demand during peak hours. That allows the power system to be expanded and operated at a lower cost, reliability to be maintained and emissions cut while the benefits are shared among customers, the aggregator and/or utility, and society at large, the report said.

DER ownership is expected to grow substantially in the next decade with smart thermostats on 34% of homes by 2030 compared to 10% today; rooftop solar growing to 83 GW from 27 GW; light-duty electric vehicles growing to 26 million from 3 million; and behind-the-meter batteries growing to 27 GW from just 2 GW today. That comes on top of friendly policies such as the Inflation Reduction Act, with its promotion of electrification and efficiency, and FERC Order 2222, which requires all organized markets to open up to DER aggregations.

Demand response programs have operated like VPPs for decades in some regions, but many firms are setting up new ones that leverage the expansion of DER technologies in recent years. Portland General Electric is setting up a 4-MW behind-the-meter battery VPP involving more than 500 customers; CPower has introduced a smart thermostat-based VPP to participate in PJM; and ERCOT has set up an 80-MW VPP pilot targeting a variety of end uses.

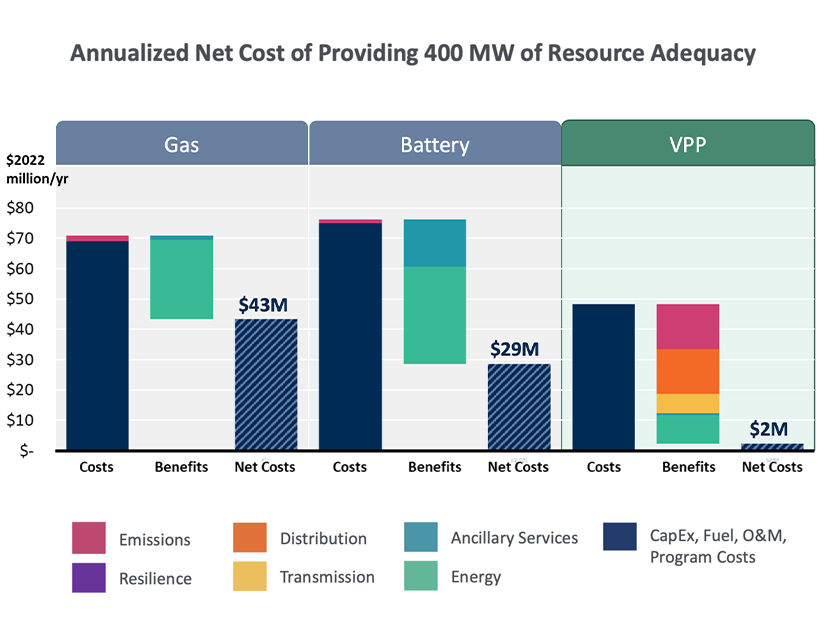

Brattle’s analysis focused on four commercially proven technologies: smart thermostats, smart water heating, managed charging for EVs and behind-the-meter battery-enabled DR. It compared the costs of providing 400 MW of resource adequacy from VPPs made of those technologies to a utility-scale battery and a natural gas peaking plant.

The different plants were studied in the same utility system where 400 MW produced about 7% of the peak demand and half the generation was made up of renewable power. Brattle designed the model utility to represent some challenging requirements for the VPP, like needing to offer resource adequacy during many hours in both the winter and summer. The resources all had to perform 63 hours a year and seven hours during one peak summer day.

VPPs can curtail load during the highest demand hours and shift it to lower hours, while any smart water heaters in the aggregation are capable of producing ancillary services. The VPPs also cut greenhouse gas emissions and delay the need for transmission and distribution upgrades, with the batteries able to provide backup generation during distribution outages.

“The VPP could provide resource adequacy at a net utility system cost that is only roughly 40% of the net cost of a gas peaker and 60% of the net cost of a battery,” the study said.

RMI has estimated that 60 GW of VPPs could be deployed across the country by 2030 and that would meet future resource adequacy needs at a cost that is $15 billion to $35 billion lower than the alternatives.

“Decarbonization and resilience benefits are incremental to those resource cost savings,” said the study. “Consumers would experience an additional $20 billion in societal benefits over that 10-year period.”