Warm weather in its service territories led to lower earnings for Duke Energy (NYSE:DUK) in the first quarter at $1.20/share, but CEO Lynn Good told investors Tuesday that the firm should make up for it this summer.

“These results reflect a 22-cent headwind from weather, with January and February ranking among the warmest winter months on record across our service territories,” Good said. “In fact, DEP [Duke Energy Progress] had its warmest January and February in the last 32 years.”

Duke is working to make up lost ground on ratings and reaffirmed its annual projections, given that its strongest quarter is coming up this summer.

The firm is working on a sale of its commercial renewable business, with separate sales for its utility-scale subsidiary and another for one that focuses on distributed generation.

“We are in the late stage of the process for both transactions, and we’ll look to update you in the near future,” Good said on a conference call Tuesday. “We continue to anticipate proceeds in the second half of the year.”

The firm took an impairment charge on the sale of its commercial business of $175 million in the first quarter, which follows a $1.3 billion impairment in the fourth quarter that was also related to the sale of its commercial renewables business. Asked about the second impairment, Good said that the firm is nearing the end of the process.

“I would say to you, though, that the estimated value that we see in this process remains within our planning assumptions,” she added. “So, there’s nothing here that I would point to as a surprise for us, as we’ve moved through the process.”

The firm is in discussion with “select bidders” and is nearing the end of the process, with Good saying her team is anxious to announce a deal and give the market more information once that is appropriate.

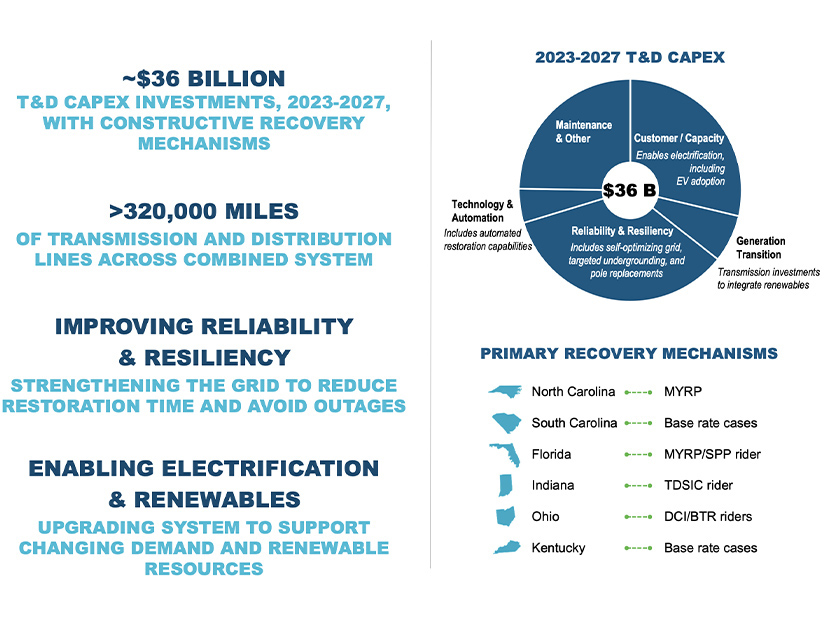

Duke is getting started on a major spending spree on transmission and distribution, investing $36 billion through mid-decade on its system.

“The grid is a critical part of our energy transition, and with more than 320,000 line-miles, we operate the largest transmission and distribution system in the nation,” Good said. “The foundation of our grid plan is focused on improving reliability and resiliency, preparing the grid for renewables and enabling electrification.”

The investments are aimed at addressing threats from storms and attacks on the grid, as well as improving Duke’s ability to restore power, she added. The company is allocating capital for self-optimizing grid technologies, targeted undergrounding, physical and cybersecurity upgrades, and upgrading lines and substations.

“Our investments are already making a difference as evidenced by our response to Hurricane Ian last fall, where we restored power in less than half the time of our Hurricane Irma restoration efforts in 2017,” Good said.

Duke has received approval for recovery mechanisms in place for that transmission investment in all its states, she added.