MISO planners say they have pinpointed several proposed projects in this year’s transmission planning cycle that might provide more system benefits with altered designs.

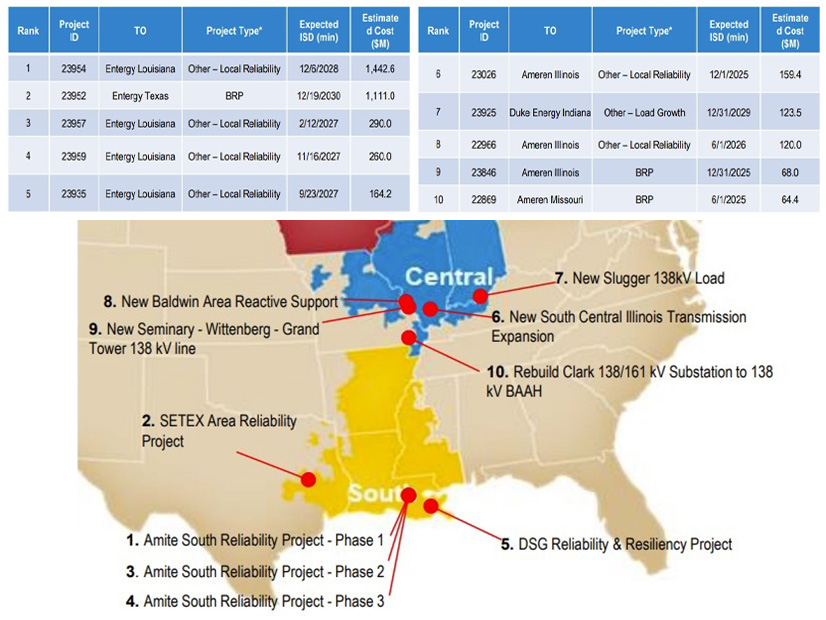

During a series of subregional planning meetings this week, staff said nine projects in the draft 2023 Transmission Expansion Plan (MTEP 23) are candidates for alternative designs because of their size and complexity. The projects account for more than 40% of the MTEP 23 price tag, currently standing at $8.8 billion across 578 projects.

During a MISO Central subregional planning meeting Tuesday, expansion planner Amanda Schiro said most of the projects singled out for alternative designs are for substation work in the southern region. They include the controversial $1.1 billion, 150-mile 500-kV line and substation project Entergy has proposed for southeast Texas and all three phases of its nearly $2 billion, 500-kV Amite South line and substation work in the state’s southern region. Entergy has said both projects are needed for reliability.

The $3.6 billion in localized reliability spending MISO South transmission owners proposed this year has sparked debate among stakeholders as to whether Entergy is attempting to dodge more efficient, regionally cost-shared projects. The grid operator this year pledged to examine the TOs’ proposals for larger, combined project opportunities. (See Initial MTEP 23 Ignites Familiar Arguments over MISO South’s Reliability Spending.)

Competitive transmission developers and clean energy groups have said the two Entergy projects resemble previous economic projects MISO recommended and ultimately canceled in 2016 and 2017. The economic projects’ costs would have been shared regionally, but reliability projects are billed only to the local transmission zone in which they’re located. (See NextEra, SREA Protest Canceled MISO Project at FERC.)

Other projects tagged for alternative exploration include Entergy Louisiana’s $164 million line and substation upgrades to alleviate the Downstream of Gypsy load pocket in southern Louisiana; Ameren Illinois’ $159 million, 138-kV substation and 29-mile line in south central Illinois; and Michigan Electric Transmission Company’s $63 million plan to construct a new 138-kV substation and related facilities to serve a new industrial customer. The projects all rank among the MTEP 23 portfolio’s most expensive.

Trevor Armstrong, manager of MISO South’s expansion planning, said during another subregional planning meeting Thursday that staff are evaluating the nine projects’ effectiveness and will announce any alternative recommendations in early September. MISO is hosting its final round of subregional planning meetings at the same time and will present its final MTEP 23 project recommendations.

Some alternative project costs might be higher than the original projects. The RTO’s planners said larger project costs aren’t necessarily a dealbreaker if the project can satisfy additional benefits criteria. They stressed that a higher price tag doesn’t necessarily mean the project is a worse option.

The proposed $4.3 billion investment for 68 projects in MISO South exceeds the entire MTEP 22’s $4 billion cost.

Armstrong said MISO is introducing an economic screen in the region this year for the five most expensive projects. The screen replaces the normal market congestion planning study, currently on hold while staff chart its four long-range transmission planning (LRTP) portfolios.

“In order to do our due diligence on these very large projects, we’re putting a screener on them to see if they warrant further economic study … and get insights into congestion relief,” Armstrong said. The screen could designate some of the proposals as market efficiency projects, with their costs allocated regionally.

Different project designs will be pursued if they are a “better alternative in terms of cost and performance,” Armstrong said. “MISO’s focus isn’t just keeping the lights on. We also plan for other benefits.”

“The Amite South project area is a hotbed of load growth. There are industrial requests along the Mississippi River … and they’re related to electrification,” MISO’s Clayton Mayfield said, noting that much of the state’s load growth is in a load pocket. “We’ve studied in excess of 8 GW of load growth. It’s really the foot of the wave coming our way, and customers have aggressive timelines. They’re looking to come online in 2026 through 2028.”

Armstrong said he would consider a request from stakeholders to share the economic screen’s results before announcing any alternative projects.

Southern Renewable Energy Association’s Simon Mahan urged MISO to search for alternatives that will “future proof the system.” He reiterated that stakeholders weren’t privy to the grid operator’s new generation and retirement data, which could have helped them propose more suitable project alternatives. Stakeholders had until the end of May to submit project alternatives.

Mahan also asked whether staff’s extensive alternative project analysis will cause MISO to abandon the LRTP’s third portfolio, the first to consider planning needs in the southern region. Jeanna Furnish, MISO’s director of expansion planning, said staff remain committed to examining South system needs with the LRTP.

The RTO is also including an exploratory study to alleviate near-term congestion in MTEP 23. The study will review historical congestion data and recreate system conditions in production cost models to distinguish between persistent trouble spots and temporary ones.

Because the study is informational, MISO won’t recommend any transmission projects. Stakeholders had requested that the grid operator come up with smaller, congestion-relieving projects like its interregional targeted market efficiency projects with PJM and SPP. Some expressed disappointment that the study won’t result in a new class of projects. (See MISO Adding Near-term Congestion Study to MTEP.)

MISO has said it first needs to better understand the nature of its near-term congestion before proposing a new project type and potential cost allocation.