Stakeholders Reject Proposal to Expand Reactive Power Task Force Scope

VALLEY FORGE, Pa. — PJM’s Market Implementation Committee voted against endorsing a proposal by the Consumer Advocates of PJM States (CAPS) to expand the scope of the Reactive Power Compensation Task Force to include discussion of existing service rates.

CAPS Executive Director Greg Poulos argued that FERC’s January order eliminating the compensation for reactive power in MISO should force PJM to revisit the scope of the task force. That order found that generators participating in MISO’s markets do not have to be compensated for providing reactive service because it is a condition of interconnection. (See FERC Ends MISO Compensation for Reactive Power Supply.)

The proposal would have modified the task force’s issue charge to strike out a line in the “out-of-scope” section barring discussion of “any existing FERC-approved or pending reactive service rates.”

Paul Sotkiewicz, president of E-Cubed Policy Associates, said the comparison to MISO doesn’t hold up, as most of that region’s load is served by vertically integrated utilities. He added that FERC has already approved reactive rates in PJM.

Constellation Energy’s (NASDAQ:CEG) Adrien Ford said the change would have little impact on the task force’s work, as existing reactive charges are FERC-approved and could not be changed by proposals it may produce.

Carl Johnson, representing the PJM Public Power Coalition, said his members and CAPS approach the issue from the same common belief: that there isn’t a need to compensate generators operating within the common bandwidths for providing reactive power. However, he disagreed that the task force’s scope should be modified when it’s already far into its work.

Discussion Continues on Capacity Offers for Generators with Co-located Load

Package sponsors continued to refine their proposals on how generators can represent co-located load in their capacity offers to reflect how configurations with service from the grid would be handled.

Past discussions largely focused on arrangements without grid service — whether load in those circumstances would be under FERC or state jurisdiction and whether generators should be able to offer the energy supplied to that load as capacity. (See “Stakeholders Continue Discussion on Co-located Load Packages,” PJM MIC Briefs: May 10, 2023.)

PJM’s proposal would retain its status quo provisions, reducing generators’ capacity interconnection rights (CIRs) in line with the amount of co-located load, imposing transmission service payments to the load serving entity (LSE) and basing settlement on the net injection at the point of interconnection.

Proposals from the Independent Market Monitor (IMM), Exelon and Advanced Energy Management Alliance (AEMA) would all measure the generator and load separately to arrive at settlements for each. The IMM would follow the status quo for reducing CIRs and transmission service charges, while Exelon and the AEMA would not reduce generators’ CIRs.

Exelon’s proposal would classify the generator as an LSE for the co-located load and the AEMA package would require the generator to procure firm point-to-point transmission service with both injection and delivery set at the generator’s point of interconnection.

Much of the discussion around defining co-located load as not receiving transmission service centered on whether such load would then fall under state jurisdiction.

PJM Senior Counsel Chen Lu said the RTO considers such arrangements to be a retail sale directly from the generator to the load. Its proposal would define the load as being state jurisdictional but would pass charges for frequency regulation, reserves and black start service to the load through the generator.

Economist Roy Shanker said he doesn’t believe it’s appropriate to determine that load is state jurisdictional while still creating mechanisms to impose PJM charges on it through the generator.

Four proposals are on the table for co-located load without grid service — from PJM, the IMM, Exelon, and a joint package from Constellation Energy and Brookfield Renewable Partners.

MIC Chair Foluso Afelumo said a vote on the proposals is planned for next month, with separate votes for proposals addressing load with and without transmission service. The committee held a poll last November that found little support for either the Monitor or Constellation Energy/Brookfield Renewable Partners proposals. (See “Limited Support for Co-located Load Proposals,” PJM MIC Briefs: Dec. 7, 2022.)

PJM Presents Expected Impact of Creation of Fifth CONE Area

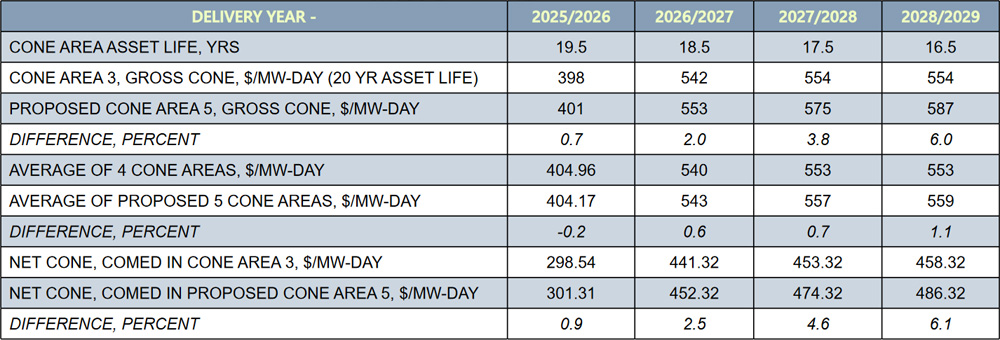

PJM’s Gary Helm said analysis shows that creating a fifth cost of new entry (CONE) area for the Commonwealth Edison region would not have a significant impact on the price of resources in that area for the 2025/26 delivery year (DY), but prices could increase by 2028/29. (See “PJM Proposes Creation of Fifth CONE Area,” PJM MIC Briefs: May 10, 2023.)

PJM analysis of the impact of creating a fifth cost of new entry (CONE) area for the Commonwealth Edison region, shown to the Market Implementation Committee on June 7, 2023. | PJM

PJM analysis of the impact of creating a fifth cost of new entry (CONE) area for the Commonwealth Edison region, shown to the Market Implementation Committee on June 7, 2023. | PJM

The ComEd locational deliverability area (LDA) is located in CONE area 3, which has a gross CONE of $398/MW-day for the 2025/26 DY. If the ComEd region were carved out as its own area, PJM estimates that it would result in a $401/MW-day gross CONE value, a 0.7% increase. By the 2028/29 delivery, the difference between the two is estimated to be around 6%. Helm said staff are still discussing whether PJM will seek to implement the prospective change for 2025/26.

During the May 10 MIC meeting, Helm said the proposal arose out of comments on PJM’s quadrennial review FERC filing about the impact of the Illinois Climate and Equitable Jobs Act on net CONE.

Sotkiewicz said he plans to bring a second proposal before the committee during its July meeting.