Billions of dollars and thousands of jobs are tied up in PJM’s generator interconnection queue, which could be unlocked if the RTO efficiently reformed it, the American Council on Renewable Energy said in a report released Wednesday.

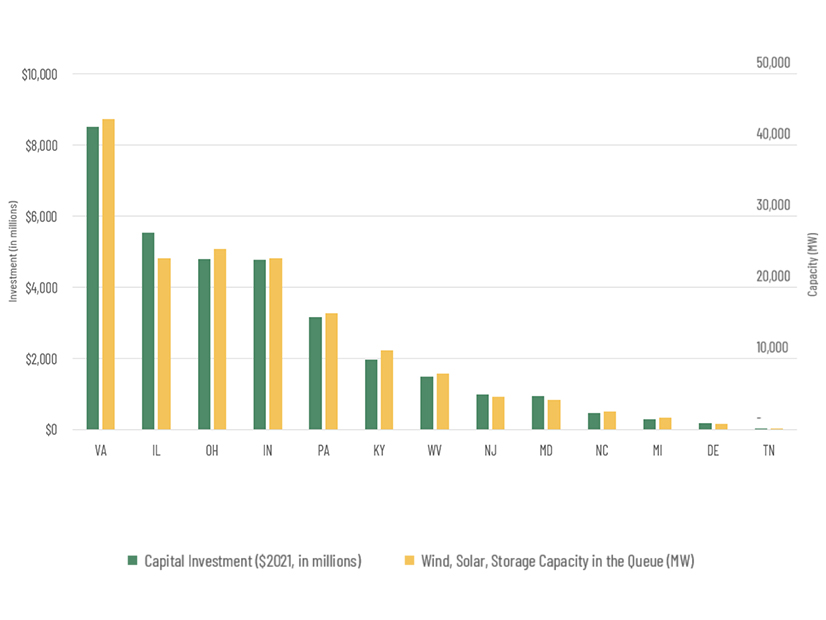

The report, “Power Up PJM,” found that moving forward with just the changes already approved by FERC could lead to $33 billion in investment and 199,000 job-years, defined by ACORE as the full-time equivalent of one job for one year. (See FERC Approves PJM Plan to Speed Interconnection Queue.)

If PJM had proactively developed sufficient transmission capacity as well as enacting the revisions, it could have enabled another 100,000 job-years and $17 billion in additional capital investments in the next four years, according to the report.

PJM is just starting to implement the changes, which will move its queue from a first-come, first-served serial process to a first-ready, first-served cluster study approach, said Noah Strand, ACORE policy associate and a co-author of the report.

“Under this first-come, first-served approach, each project withdrawal would prompt a restudy of the preceding applications without the departing project in the model,” Strand said on a web conference with reporters.

That worked when the queue was mainly hooking up new natural gas plants located relatively close to load, but now it needs to connect many more renewable projects that are often farther away from load — meaning they face higher interconnection costs, as transmission planning does not account for future generation.

“Data has shown that renewables pay disproportionately high upgrade costs relative to conventional fuels such as natural gas,” Strand said. “And those costs have multiplied in recent years, sometimes enough to exceed the costs of building the projects themselves.”

Often developers do not find out how much they will have to pay for upgrades until late in the process, which can kill off otherwise commercially viable projects, he added.

As of March, the queue had grown to more than 2,600 projects totaling 260 GW; about 85% of those were renewables — enough to replace all the generation in the RTO, Strand said.

The queue data in ACORE’s report does not reflect offshore wind because of the use of FERC Order 1000’s State Agreement Approach, which has been used by New Jersey and is likely to be picked up by Maryland, Strand said. (See NJ BPU Backs Plan for 2nd Grid Upgrade Process with PJM.)

Based on how much is in the queue and the historic completion rates of planned projects, a reasonable estimate is that PJM will add about 34 GW of new renewables as it implements the approved changes in the next few years, Strand said.

“We don’t expect that 100% of the renewable projects in PJM’s queue will be completed, but our report holds that the development of new transmission is key to increasing the number that do get built, namely if PJM opts for the large-scale, high-voltage lines that are most needed,” Strand said.

Getting that long-range transmission built would require additional changes to PJM’s process, which are the subject of a pending Notice of Proposed Rulemaking at FERC. (See FERC Issues First Proposal out of Transmission Proceeding.)

But getting the needed transmission buildout will require more than FERC action, with the American Clean Power Association’s Brendan Casey saying congressional action is required.

“I think permitting reform is essential, especially when we talk about long-range transmission,” Casey said. “Some of these projects are taking 10 to 20 years from inception to start construction, and it’s just not sustainable.”

Getting transmission built out to meet some state policies in an RTO as diverse as PJM will be tricky, with 13 states that have varying levels of commitment to combating climate change. But several speakers on the webinar argued that the economic benefits highlighted in ACORE’s queue report are enough to entice any state to build out transmission.

“The projects waiting in PJM’s queue have economic benefits to offer all states and all communities where they’re being developed, red or blue. That’s one piece,” the Rocky Mountain Institute’s Katie Siegner said. “And the electricity cost benefits of these increasingly affordable new generation sources is another piece that should incentivize a bunch of different stakeholders across party lines and across different states to come together to figure out transmission planning.”

A PJM spokesman responded that the RTO “reformed its interconnection queue process with stakeholder approval in record time” and will implement the new rules on July 10.

While the RTO has a large queue, it also noted 44,000 MW of resources, which are mostly renewables, have already cleared the study process, but have yet to be built. Those projects are running into delays elsewhere such as the supply chain, financing, siting or other regulatory issues. “The queue is really not the current issue,” PJM said.