MISO and the Organization of MISO States’ 10th annual resource adequacy survey warned that a more than 9-GW shortfall could loom by the decade’s end, though it painted an adequate supply picture for the coming year.

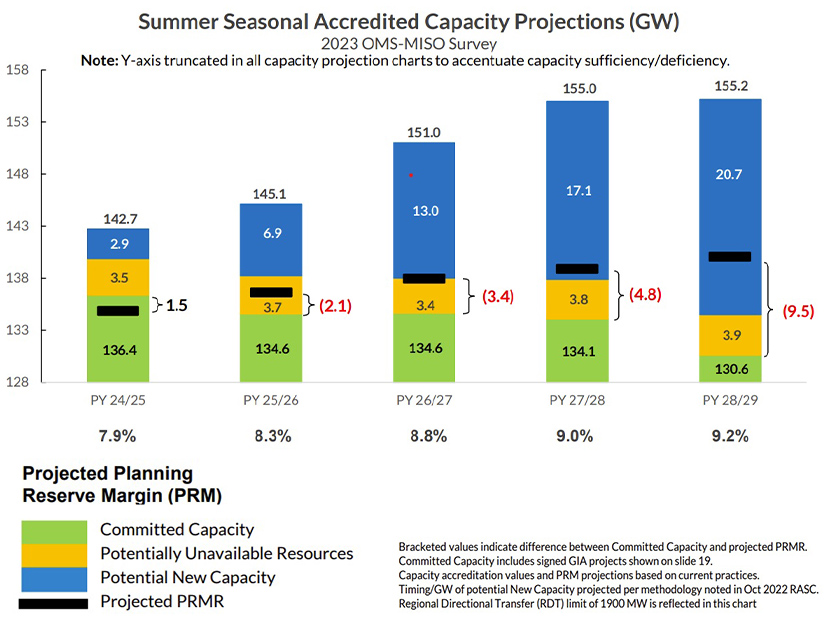

MISO and OMS found the footprint will have 1.5 GW of residual capacity beyond the summer planning reserve margin requirement in the 2024/25 planning year.

However, survey results in the four subsequent years are light on reassuring news.

The organizations said that without swift action, a 2.1-GW total shortage is possible the summer of the 2025/26 planning year, a 3.4-GW deficit by the 2026/27 planning year, a 4.8-GW gap in the 2027/28 planning year and a 9.5-GW shortfall by the 2028/29 planning year.

According to the survey, MISO Midwest’s potential capacity deficits start in the summer of the 2025/26 planning year, while MISO South shows a potential deficit brewing by winter 2027/28. MISO and OMS said so far, the seasons outside of summer show sufficient — yet declining — capacity.

MISO said about 90% of its generating fleet responded to this year’s survey.

This year, the survey was divided by season to reflect MISO’s new seasonal format and projected capacity values across four seasons for the next four years. Results were delayed by more than a month because of MISO’s monthlong auction delay on a FERC show-cause order.

MISO and OMS are betting that demand grows at a clip of 0.8 GW or 0.68% per year on average and the planning reserve margin requirements climb from 7.9% in the 2024/25 timeframe to 9.2% in 2028/29. MISO used its loss-of-load modeling to predict margin requirements.

The two also said the survey showed potential capacity additions of as much as 6.9 GW in the 2025/26 planning year, 13 GW in 2026/27, 17.1 GW in 2027/28 and 20.7 GW in 2028/29, which could offset the potential shortages. Historically, MISO grants grid access to about 2.5 GW per year on its system. As of last month, MISO’s generator interconnection contained 1,412 active projects totaling almost 241 GW.

“These results continue to illustrate the reliability risk we face and reinforce the need for dispatchable, long-duration resources to be maintained and brought online to manage the transition to weather-dependent, low-carbon resources,” MISO CEO John Bear said in a press release.

This survey’s potential deficits are marginally better than those from last year’s OMS-MISO survey, which projected the footprint could experience as much as a 2.6-GW capacity deficit below the 2023 planning reserve margin requirement. The 2022 survey showed possible capacity deficits thereafter of 4.4 GW in the 2024/25 planning year, 6.5 GW in 2025/26, 7.4 GW in 2026/27 and nearly 11 GW by 2027/28. (See OMS-MISO RA Survey Says Supply Deficits Could Top 10 GW by 2027.)

While last year’s results were affected by MISO’s 1.2-GW capacity deficit across all Midwestern local resource zones, this year’s survey results were influenced by the fact that all zones were resource-adequate starting June 1 and through May 30, 2024, according to the spring capacity auction. (See 1st MISO Seasonal Auctions Yield Adequate Supply, Low Prices.)

“With so many moving pieces involved with the changing electricity mix, regional assessments such as this one are becoming increasingly important to fully understand how the region will maintain reliable and affordable electricity delivery to customers,” Organization of MISO States President and Michigan Public Service Commission Chair Dan Scripps said in the release. “The increased transparency that comes with the seasonal granularity of this survey will undoubtably prove useful to state commissions, utilities and other market participants as they look to firm up their future resource plans to provide reliable and affordable electricity.”

MISO said this year’s survey reflected actions market participants took since becoming aware of the capacity deficit in the 2022/23 planning year, which included delaying unit retirements and making additional capacity available to the footprint. However, the grid operator warned that “these actions may not be repeatable in the future. It said the survey once again “highlights the need for additional resources and other solutions — such as market changes — to avoid potential capacity deficits in the future.”

During a Friday stakeholder teleconference to discuss results, Scripps stressed that the survey isn’t a carved-in-stone future, but an “aggregation of all the information that is available to us today.” He said it was “undeniable” that market participants’ reactions to last year’s shortfall moved capacity projections from in the red to black for the coming year.

“That said, this is a one-year response,” Scripps said, adding that the temporary remedies are not a substitute for long-term solutions for increasingly scarce capacity.

On the same call, Senior Resource Adequacy Engineer Nick Przybilla said MISO’s supply picture could improve if MISO makes headway on ushering projects through its interconnection queue faster, if supply chain snarls improve and if future planning reserve margins turn up lower than expected.

MISO also cautioned that “resource accreditation will continue to evolve based on performance during high-risk periods.” MISO is resolved to adopt a new marginal capacity accreditation style that values availability during forecasted hazardous periods and stands to lower many resources’ capacity values. (See MISO Intent on Marginal Accreditation and Requirements Based on Risky Hours.)