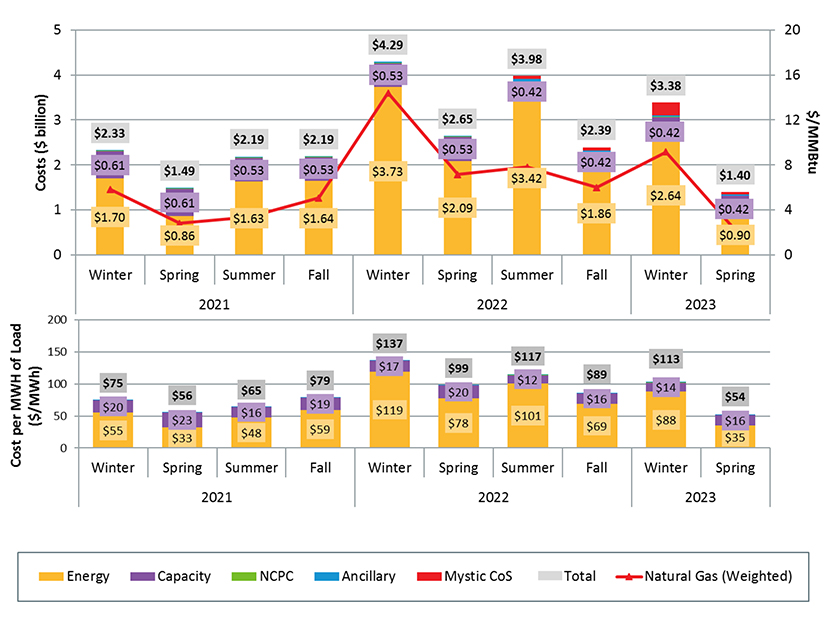

New England wholesale market costs were significantly lower in the spring of 2023 compared to spring 2022 and 2021, the ISO-NE Internal Market Monitor (IMM) told the Markets Committee on Wednesday.

The IMM noted that wholesale costs declined by 47%, or $1.25 billion, compared to spring of 2022, attributing the decrease to lower natural gas prices, which were down 69%. The IMM also said load was lower this spring because of a relatively cold May.

The monitor added that capacity market costs were down 21%, reflecting lower clearing prices from the Forward Capacity Auction (FCA) 13 relative to FCA 12.

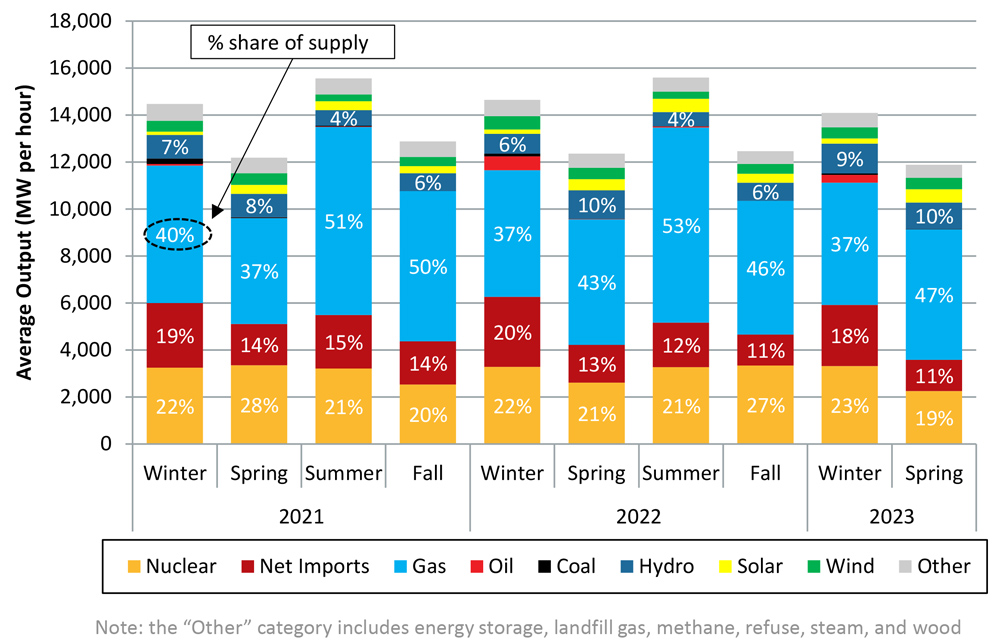

Looking at the resource mix, oil generation declined from 13% to 11% of the average output, while gas generation increased from 43% to 47%. Nuclear generation decreased by 354 MW compared to last spring, from 21% to 19% of average output, “due to refueling outages and unplanned outage continuation,” the IMM reported.

Barriers to Entry for Retired Resources

Also at the Markets Committee summer meeting, ISO-NE proposed removing the cost requirements for retired resources looking to re-enter the Forward Capacity Market (FCM). The most recent rules for resources looking to re-enter the FCM include an investment requirement of $417 per kW.

“These requirements apply to any re-entering resource after it has retired, regardless of its retirement elections and/or a reliability retention agreement,” said Ryan McCarthy of ISO-NE.

McCarthy said the requirement is intended to discourage generators from retiring and re-entering just to access unique pricing rules for new resources. Because these unique pricing rules have been removed, the investment requirement no longer is needed, McCarthy told the committee.

“As things stand currently, the investment requirement could create a barrier to cost-effective and timely re-entry of resources,” McCarthy said. “The ISO proposal removes the investment requirement for fully retired or permanently delisted resources seeking to requalify for the FCM.”

ISO-NE has proposed an October vote on removing the requirement, with an effective date of quarter four of 2024.

FCA 19 Uncertainty

The main focus of the Markets Committee summer meeting was discussing options for the format and timing of FCA 19. (For a more detailed breakdown of Tuesday’s discussion, see NEPOOL Debates Options for FCA 19.) Many NEPOOL members have supported delaying the auction a year to implement resource capacity accreditation (RCA) changes, and to consider moving to a prompt and seasonal capacity market.

“Getting the capacity market right is incredibly important,” Ben Griffiths of LS Power told RTO Insider. “We support a one-year delay in FCA 19 to give the ISO and stakeholders time to fully vet RCA and other possible changes in market design that will be in place for years to come.”

However, some clean energy companies have expressed worries about how a delay would impact new resources which did not receive commitments in FCA 18.

“In ISO-NE, the process for generators to have their capacity deliverability studied and secured currently resides within the FCA qualification process and not in the interconnection process as in some other regions,” said Alex Chaplin of New Leaf Energy. “Postponing FCA 19 would suspend this pathway to secure capacity deliverability, making new resource development in the region substantially riskier.”

Chaplin said this added uncertainty likely would increase the cost of capital for new resources in FCA 19, putting some projects in jeopardy.

“This would slow the pace of the clean energy transition and may introduce reliability concerns in light of ISO-NE’s rising forecast peak loads,” Chaplin said.

Cost of New Entry Changes

ISO-NE also detailed potential changes to its process of calculating Cost of New Entry (CONE) and Net CONE for FCA 19 and 20.

Using FCA 18 as a baseline, ISO-NE found that the updated formula would have increased CONE by 4.2% and Net CONE by 6.5%.

The RTO plans to vote on the proposal at the Markets Committee in September, with an effective date of March 2024.