Stakeholders Endorse Proposal on Co-located Load

VALLEY FORGE, Pa. — The PJM Market Implementation Committee voted to endorse one of several packages to flesh out the rules around loads seeking to receive their power from behind the meter of a generator. (See “Vote on Rules for Generation with Co-located Load Deferred,” PJM MIC Briefs: July 12, 2023.)

A 51.2% majority of stakeholders supported Exelon’s proposal for co-located loads not considered to be receiving service from the wholesale grid, passing over three competing proposals. None of the four proposals for co-located loads receiving grid service received majority support.

The Exelon proposal would permit a generator to retain its capacity interconnection rights (CIRs) for the share of its output supplied to the co-located load, so long as that load curtails within 10 minutes of PJM calling on the generator to supply that capacity to the grid.

For co-located configurations to be considered to not be receiving grid service, they would need to be designed to ensure that they’re exclusively supplied by the corresponding generator and disconnected whenever they’re not being served by the generator.

The proposal would consider the generator to be a load-serving entity for the co-located load and levy all relevant load-serving entity (LSE) credits and charges.

The approach of allowing co-located load to not be considered receiving grid service — but assigning some of the charges a wholesale customer would be assessed to the generator — has raised stakeholder questions, with some arguing it could muddy the waters of state and federal jurisdiction.

PJM’s Tim Horger said the current rules for generators receiving grid service remain unclear without a package approved addressing those configurations, and he plans to examine the Exelon package for ways to discuss additional changes.

“I think we probably still want to do that, but we also want to take into account the Exelon package that was approved,” he said. “To be clear, we do have rules in place now and we are following them.”

Lynn Horning, of American Municipal Power (AMP), said any approach PJM plans to take on co-located load with grid service should be clear when stakeholders make their final endorsement vote on the Exelon package.

MIC Rejects Reactive Power Compensation Proposals

Stakeholders rejected four proposals to revise the compensation structure for generators providing reactive power service and voted to sunset the Reactive Power Compensation Task Force (RPCTF). Generator owners are required to submit a FERC filing for each facility providing the service to receive compensation, which creates administrative burden and lacks a standardized approach. (See “First Read on Reactive Power Compensation Proposals,” PJM MIC Briefs: July 12, 2023.)

The clean energy coalition (CEC) proposal, formed by a group of renewable developers, received the most support at 62.2% when compared to the other three packages. But it didn’t hold onto that support when compared to the status quo and failed to pass at 44.3% support.

The CEC package would create a cost-of-service structure with a flat rate based on the methodology FERC uses to evaluate reactive filings and would require testing to validate that generators receiving compensation are able to provide the service.

The PJM proposal would have determined each generator’s reactive capability, measured in MVAR, and compensated them monthly. Synchronous and storage resources would have been compensated based on their availability in the prior month.

The Independent Market Monitor made two proposals, the first of which would have eliminated compensation outside of existing markets on the basis that all generators are required to provide reactive service as part of their interconnection service agreement (ISA).

The Monitor’s second would have used a flat rate structure based on demonstrated capability, similar to PJM’s proposal, but would have phased out compensation.

The proposals would have affected only new generators or facilities entering new compensation agreements, with the task force’s scope precluding changing existing reactive rates. The MIC voted down a proposal to expand the task force’s scope to include existing service rates last month. (See “Stakeholders Reject Proposal to Expand Reactive Power Task Force Scope,” PJM MIC Briefs: June 7, 2023.)

Danielle Croop, facilitator for PJM’s Reactor Power Compensation Task Force, said in the absence of a main motion to move to the Markets and Reliability Committee, stakeholders could decide to continue deliberations at the task force, move discussion to the MIC or sunset the task force and close the issue.

David “Scarp” Scarpignato, of Calpine, said it’s significant that none of the proposals gained support over the reigning rules and given that the task force began its work two years ago it’s unlikely more discussion would yield new proposals.

“It doesn’t look to me like it’s a good idea to go back to the task force. I don’t think it’s a matter of whittling down the existing proposals to better proposals, I think people like the status quo,” he said.

Scarp motioned to sunset the task force, which was approved by acclamation without objection.

First Reads on Proposals Addressing Multi-schedule Modeling in MCE

Package sponsors gave first reads of three proposals aimed at addressing the expected performance impact of implementing multi-schedule modeling in the rebuild of the market clearing engine (MCE). (See “Merged IMM-PJM Issue Charge on Multi-schedule Modeling Endorsed,” PJM MIC Briefs: March 8, 2023.)

The discussion stems from a finding that introducing the enhanced combined cycle (ECC) model and energy storage resource (ESR) and hybrid model into the Next Generation Markets (nGEM) overhaul of the engine would cause the amount of time it takes for PJM to determine what resources will clear in the day ahead market to become impractical.

For combined cycle generators, the number of different configurations they can operate in, with varying numbers of turbines paired with heat recovery steam generators (HRSGs) and multiple offers for each configuration, multi-schedule modeling could lead to an exponential increase in MCE computation times.

PJM’s Package A would address the issue by creating a formula that would select one offer resulting in the lowest total dispatch cost to be modeled in the MCE.

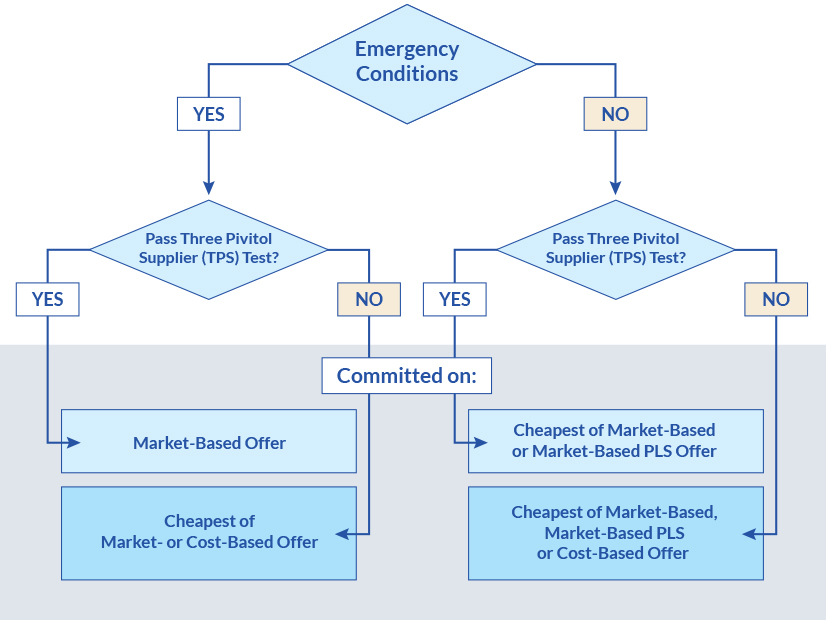

PJM’s Keyur Patel said the schedule selection built into the MCE is the most optimal approach, but he does not see any way of getting the benefits of including the new models into the engine without some compromises. A joint PJM and GT Power proposal would use the Package A approach, but consider only cost-based offers for resources that fail the three-pivotal-supplier (TPS) test. Price-based offers would be used for resources that pass the test, aside from price-based parameter-limited schedule (PLS) offers being used for capacity resources under emergency conditions.

The Monitor’s proposals could combine the lowest offer points and most flexible parameters from resources price and cost based offers under certain scenarios, impose offer capping and parameter limits to all resources that fail the TPS test and apply parameter limits to capacity resources during emergencies.

Deputy Monitor Catherine Tyler said there are market power concerns in the MCE which allow resources to inflate LMPs by using high markups and to extract uplift using inflexible parameters, both of which would be made worse by PJM’s proposal. She said that parameters other than minimum run time aren’t considered under PJM’s approach.

Endorsement of the proposals is scheduled for the Sept. 6 MIC meeting. Customized Energy Solutions’ Carl Johnson said deciding between the packages likely will remain difficult for stakeholders who aren’t as familiar with offer structures.

“For those of us who aren’t really in the weeds on this, this is a really difficult choice to make,” he said.

Voltus Brings Economic Demand Response Parameter Issue Charge

Voltus presented an issue charge and problem statement making the case that demand response resources lack the parameters other generators can include in their offers, limiting the consumers able to participate as an economic resource.

David Aitoro, of Voltus, said DR now can be dispatched for a single five-minute interval, then be curtailed only to be called on again in the third interval. For many DR participants, that may not match their curtailment capabilities and is not in line with parameters other generation resources can include in their offers, he said.

He also argued that many consumers who could curtail air conditioning systems could do so for one to three hours without a major impact to building temperatures, but there’s no capability to structure an offer to reflect that.

“It’s really DR that’s getting left out in the cold here,” Aitoro said.

Several stakeholders discussed the scope of the issue charge and how economic DR in the energy market relates to DR entering the capacity market. Aitoro said Voltus’ intent is to focus on the energy market, which could include resources that also offer into the capacity market.

PJM’s Peter Langbein said there’s around 8 GW of DR in the capacity market with corresponding energy market offers, most of which are in excess of $1,000/MWh. Economic DR also can offer separate energy-only offers, with about 2 GW doing so.

Scarpignato said generators are required to enter their most flexible parameters in their offers and those Voltus is seeking to include appear to reflect desires rather than true capability.

Exelon’s Alex Stern noted that discussion held at the Distributed Resources Subcommittee (DISRS) on the issue charge and problem statement was raised during the July MIC meeting, with stakeholders questioning if the topic fit into the group’s scope or if it should be discussed elsewhere. (See “Stakeholders Question Scope of Distributed Resources Subcommittee,” PJM MIC Briefs: July 12, 2023.)

MIC Facilitator Foluso Afelumo said the scope and proper group to host the discussion are the primary issues to be ironed out before a vote.

Stakeholders Discuss Proposals to Include Local Factors in Net CONE

Paul Sotkiewicz, president of E-Cubed Policy Associates, presented a second proposal to create rules for incorporating local considerations that could impact generators’ net cost of new entry (CONE), such as local or state regulations or legislation. (See “Discussion on Local Considerations for Net CONE,” PJM MIC Briefs: March 8, 2023.)

The package would create a fifth CONE area for the Commonwealth Edison region, which Sotkiewicz has argued will see significant impacts to generator lifespans under the Illinois Climate and Equitable Jobs Act (CEJA). PJM also automatically would create new CONE areas for any regions where new local factors cause a reduction in asset lifespan or set emissions limits that “imply a reference resource with different technology” than the current resource net CONE is based on.

Sotkiewicz said the proposal would capture the potential for hydrogen fuel blending or carbon sequestration requirements to increase operating and maintenance costs or introduce issues with the asset life.

If the reference resource were to remain a combined cycle generator at a point when those resources are being required to blend hydrogen, he said there would be a need to incorporate that in the energy and ancillary services (E&AS) offset and update its asset lifespan more regularly.

The PJM package would also create a fifth CONE area for the ComEd region but does not create any provisions for the future addition of new areas.