The New York Public Service Commission on Monday asked FERC to rehear its order approving NYISO’s proposal to use a 17-year amortization period in the ISO’s capacity auction demand curves (ER21-502).

The PSC said its rehearing request is supported by points it made last month in a petition urging the D.C. Circuit Court of Appeals to review FERC’s decision to allow the ISO to reduce the 20-year amortization period — the assumed time that a hypothetical gas-fired peaking plant will remain operational — to 17 years. (See DC Circuit Asked Again to Rule on NYISO’s 17-Year Amortization.)

NYISO proposed the changes in response to legislation that set strict net-zero standards for fossil fuel plants, reducing their operational lives, but the PSC said the move will hurt consumers and “cause an increase in over $100 million in unhedged capacity costs for the state.”

The PSC noted that FERC’s letter order accepting the amortization proposal departed from precedent because the commission accepted the NYISO plan without explanation after having rejected it twice previously.

The FERC-approved demand curves became effective in July, prompting the PSC to seek a quick ruling because the use of the new amortization period in auctions “will wrongfully increase by hundreds of millions of dollars per year the wholesale electricity rates paid by New York ratepayers between July 2023 and March 2025.”

The PSC also contended that NYISO’s proposal is speculative, basing current demand curves on technologies that are either not yet in development or may never exist, highlighting how previous rulings wrote that state legislation “does not require that all existing fossil fuel generators retire by no later than 2040 to satisfy the 2040 zero-emission requirement.”

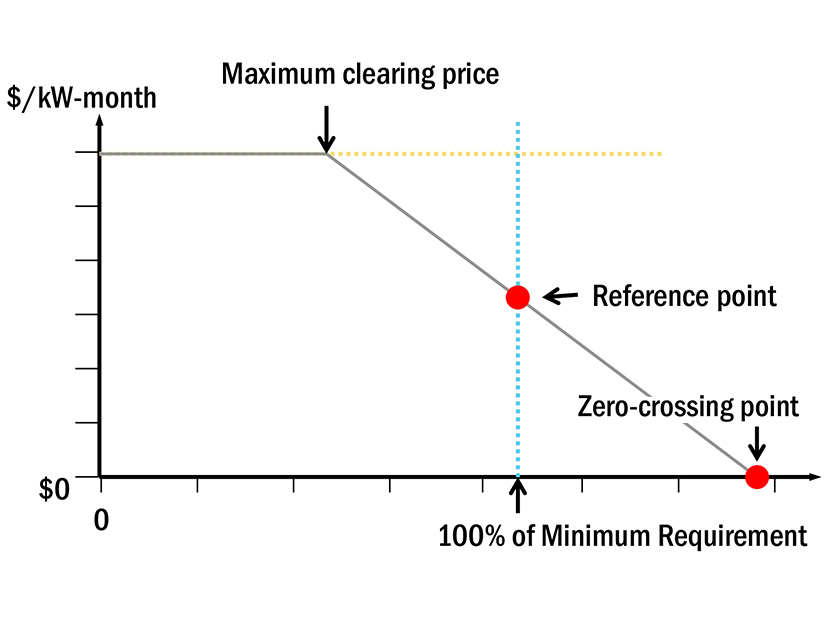

NYISO implemented the 17-year amortization period as part of its demand curve reset to adjust market demand assumptions for upcoming capability years.