Planning Committee

PJM Presents Quick Fix on Load Forecast Guidelines

VALLEY FORGE, Pa. — The frequency and magnitude of load forecast adjustment requests PJM is receiving from electric distribution companies (EDCs) has led the RTO to bring a problem statement, issue charge and proposed manual revisions on the timeline those adjustments are approved on.

The changes are being sought through the quick-fix process, which allows an issue charge and proposed solution to be brought concurrently and voted on in an expedited manner.

PJM’s proposal would move the Load Analysis Subcommittee’s review of forecast adjustment requests to September and October to provide more time for consideration, and EDCs would be requested to provide hourly data and a 15-year forecast of their adjusted load.

PJM’s Molly Mooney told the Planning Committee on Sept. 5 that numerous factors are taken into account to avoid double-counting load during forecasting, and any types of industries reflected in federal employment figures wouldn’t be counted as a discrete large load increase. Loads from data centers, however, are difficult to forecast because of their disproportionate demand and the fast turnaround between when an interconnection is requested and the in-service date.

Paul Sotkiewicz, president of E-Cubed Policy Associates, asked what PJM’s lead time is between when it finds out about an expected load and that consumer going live on the grid.

PJM’s Dave Souder said much of the load goes through the supplemental process at the Transmission Expansion Advisory Committee, providing a few years’ notice. The issue charge seeks to obtain that information from EDCs further out so more analysis can be built into the planning process.

James Wilson, a consultant for state consumer advocates, said data centers are largely being constructed by a few major parties that are concerned about transmission constraints hindering their projects, leading them to investigate siting in multiple EDCs when only one project will come to fruition. If this is not accounted for, he said projects could be double-counted and transmission built to serve loads that are not built.

Wilson urged PJM to hire an independent consultant to do a long-term forecast of data center load and questioned what PJM’s response would be if EDCs were unwilling to do a 15-year forecast of data center loads. He said that in the event that an EDC submits a total load adjustment request for load-serving entities within their territory, those entities should be required to verify the adjustment.

Mooney said increasing the horizon on the data PJM is seeking also allows for more time to collaborate with EDCs and work through any issues distributors may have with the process.

First Read of 2023 Reserve Requirement Study

Load forecast uncertainty and increased winter risk are driving a significant increase in the reserve procurement levels recommended by the 2023 Reserve Requirement Study (RRS), which went before the PC for a first read. (See PJM Presents Preliminary 2023 Reserve Requirement Study to Stakeholders.)

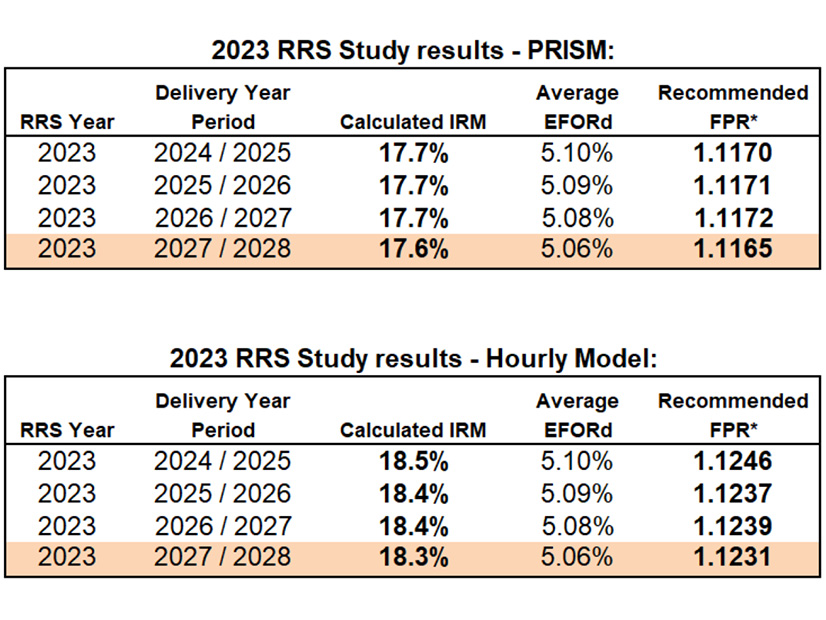

The installed reserve margin (IRM), which sets the targeted capacity level above expected loads, would rise from 14.7% for the 2026/27 delivery year in the 2022 study to 17.6% for the 2027/28 DY using PRISM modeling software. The forecast pool requirement, which considers forced outage rates, also would increase from 9.18% to 11.65% for the corresponding DYs.

Numerous changes were made to the study’s processes this year, including two parallel analyses using the PRISM software historically used in the RRS, as well as using software developed to perform hourly loss-of-load modeling used in effective load-carrying capability (ELCC) and the inclusion of data from the 2014 polar vortex and the December 2022 winter storm. PJM has historically not included the 2014 storm in the RRS dataset, but experience from the storm led staff to revise that practice.

The hourly modeling largely led to higher figures, yielding an IRM of 18.3% for the 2027/28 DY and 12.31% FPR, with much of the difference between the PRISM values arising from the load model. Prior to stakeholders voting on endorsement, PJM plans to recommend use of either the PRISM or hourly results, which stakeholders will have the opportunity to chose between.

PJM’s Patricio Rocha Garrido said 70% of the loss-of-load expectation (LOLE) is concentrated in the summer and 30% in the winter under the PRISM modeling, while the hourly modeling has an 80/20 balance between the summer and winter. Past modeling is now believed to have understated extreme loads, especially in the summer, he said.

“The previous load forecast model was producing values that were understated … whereas the new model that is more granular looks at every hour of the year and the weather in that hour” and the corresponding intermittent output, Rocha Garrido said.

Minimal coincidence between the PJM peak load period and the “World” peak — which is defined as MISO, NYISO, TVA and VACAR — led to the capacity benefit of ties (CBOT) value more than doubling to 2.2% from the 1% value in the 2022 study. To reduce volatility, PJM elected to average the CBOT values from 2017 to 2022 and use that figure, which landed at 1.5% instead.

Transmission Expansion Advisory Committee

PJM Updates Stakeholders on RTEP Windows

Project proposals for the first window of PJM’s 2023 Regional Transmission Expansion Plan (RTEP) are being accepted through Sept. 22, with the goal of resolving 266 flowgates, 130 of which are competitive. The window opened on July 24, and PJM is targeting receiving approval from the Board of Managers in February, PJM’s Sami Abdulsalam said during last week’s meeting.

PJM is also conducting scenario evaluations on the 72 proposals submitted in the third window of its 2022 RTEP, which opened in May to solicit solutions to load growth centered on the northern Virginia region, which is experiencing high data center load growth. Staff plans to walk stakeholders through the window evaluation results during the Oct. 3 TEAC meeting, which will be followed by a first read Oct. 31.

Several ratepayers expressed concerns about land use and cost allocation to regions they argued would not be benefited by the projects, and they urged PJM to consider historical opposition similar projects have received.

Supplemental Projects

FirstEnergy presented a project to replace a 230/34.5-kV transformer nearing its end of life and associated relays at its Windsor substation in the JCPL zone at a $6.3 million price tag. The replacement is underway and is expected to be completed in November.

FirstEnergy presented a $2.2 million project to replace circuit switcher and limiting substation conductor at its Damascus substation and a wave trap, disconnect switches and limiting substation conductor at its Mount Airy facility, which are connected by the 230-kV Damascus-Mount Airy line in its APS zone. The equipment at the two sites has a history of misoperation and cannot be repaired due to lacking spare parts and limited expertise in the technology.

The Public Service Enterprise Group presented two projects to add substations in the South Edison and Perth Amboy area to address rising loads and aging equipment at its existing local infrastructure. The 230/13-kV South Edison substation would be built at a $56.1 million cost adjacent to the existing Meadow Road facility, which has a contingency overload of 124%. A new 69-kV line would be built from South Edison to a new 69/13-kV substation, which would be built adjacent to the Keasby facility. The $220.9 million project would support the Keasby substation, which is nearing 100 years old and in need of repairs, and the Pierson Avenue substation, which has a contingency overload of 123.3%.