Transmission investments that could help “address reliability, congestion and cybersecurity concerns” in the nation’s electric grid are being held back by “regulatory tension” between the federal and state governments, according to a recently released report from Moody’s Investors Service.

The report, published on Monday, asserts that not only is massive transmission investment needed to keep pace with the growth of new wind and solar generation sources and aging infrastructure, but “opportunities abound” for developing transmission assets. However, in spite of support from decarbonization initiatives at various levels of government, the siting and permitting process represents a significant bottleneck for utilities with the experience and resources to carry out these projects.

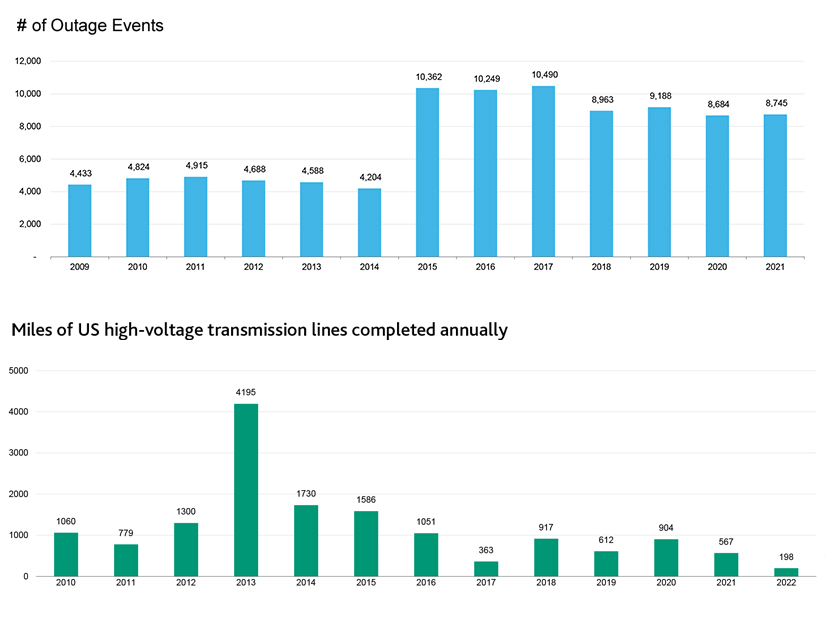

North America’s grid is long overdue for an upgrade, Moody’s argues in the report, citing data from NERC showing an annual average of about 9,500 “momentary or sustained transmission outage events” between 2015 and 2021, a figure “more than double the annual average of the preceding five years.” The report attributed most of these outages to severe weather events, which have become “more frequent and severe” in recent years.

Transmission improvements could be extremely useful to help the grid absorb the impact of such events, Moody’s said, citing a report from consulting firm Grid Strategies studying the winter storm of February 2021. More interregional transmission capacity could have saved nearly $1 billion in impact — and kept the lights on for 200,000 homes — for each gigawatt added, the report said.

Transmission improvements also could help with high congestion costs, which Moody’s said “have emerged as a major problem” in recent years; the firm cited data from the U.S. Energy Department’s draft National Transmission Needs Study indicating congestion costs in the Mid-Atlantic region surged from $529 million in 2020 to $953 million the following year. Additional investment is needed to bring the transmission system in line with mandatory cybersecurity requirements adopted in response to mounting threats from malicious online actors around the world.

FERC has sought to encourage transmission investments, the report said, noting “limited revenue risk [and] counterparty risk” on the part of transmission owners thanks to the commission’s cost recovery framework and transparent process for setting return on equity for transmission assets. The report considered revenue collected under FERC’s regulatory framework to be overall “more stable and predictable than” under state regulations and called the commission’s approach “favorable to transmission owners.”

While FERC has tried to cultivate a positive environment for TOs — particularly large utilities such as Duke Energy and Exelon, which Moody’s called “best positioned to take advantage of” these opportunities — challenges remain in the approval process. The report noted that authority over transmission siting and permitting largely remains in the hands of state and local governments, which “can be slow and impede the pace of transmission development.”

This regulatory dilemma is illustrated by the slowing pace of transmission capacity upgrades, Moody’s said, pointing to data from FERC that shows an average of around 600 miles of high-voltage transmission lines completed annually in the U.S. since 2017, far below the 2,000 average annual miles completed between 2012 and 2016. The slow pace of construction, in spite of steadily rising transmission investments since 2017, has resulted in long lead times for such projects, with Moody’s estimating up to 10 years is needed from preliminary planning to end of construction.

Moody’s said efforts are underway in the federal government to help with the permitting issue, citing Sen. Joe Manchin’s (D-W.Va.) Building American Energy Security Act as an example of the kind of work that could help get transmission projects moving. Among other reforms, the bill would set maximum timelines for permitting reviews and set a statute of limitations for court challenges to projects.

“Measures like these at the federal level, as well as improved coordinated planning at the state and regional level, could facilitate the nation’s transmission development and help meet long-term greenhouse gas emission goals,” Moody’s said.