MINNEAPOLIS — MISO officials last week said they probably could have held off their decision to call a summertime emergency in late August.

MISO declared its lone summertime emergency and instated maximum generation procedures Aug. 24. (See MISO Calls 1st Summertime Emergency amid Systemwide Heat Wave.) However, the 123-GW peak under the widespread heat dome wasn’t the 127-GW peak MISO anticipated that morning. It also didn’t amount to the grim possibility MISO warned about ahead of summer, where it could exhaust all of its emergency reserves.

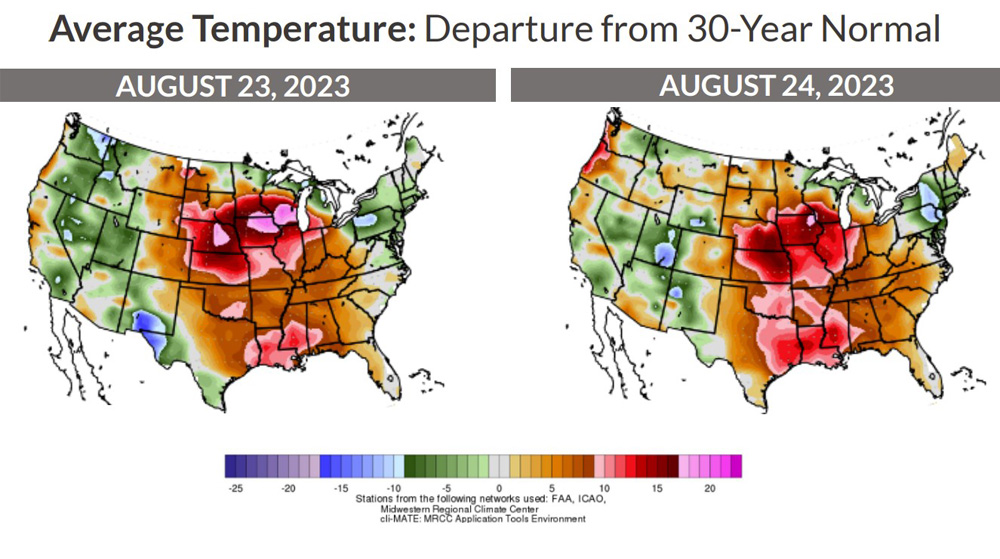

MISO’s summer peak demand of 125 GW interestingly arrived Aug. 23, a day before MISO called the maximum generation event. Intense heat struck multiple major cities in MISO simultaneously Aug. 23-24.

During a Sept. 12 Markets Committee of the Board of Directors meeting, Executive Director of System Operations Jessica Lucas said on Aug. 24, MISO worked to de-commit previously signed-on resource as load outlooks improved during the day. Lucas said in hindsight, MISO could have waited longer to make resource commitments to make sure they were necessary.

MISO CEO John Bear said it’s important to judge control room operators on what they saw in the moment and not by perfect hindsight. Multiple MISO executives said load forecasting and unit commitment during extremes is difficult, especially when fuel supply issues, low wind and other environmental limits related to heat hinder resource performance.

“We walked into that day knowing we had a high load forecast,” Executive Director of Market Operations J.T. Smith said.

Smith said a more sophisticated forecast might better anticipate coming “cloud cover in Detroit” so operators aren’t forced to commit as many resources on the mornings of pervasive heat waves.

Lucas said it was the hottest summer — and resulted in the highest demand — in MISO South since its integration in 2013. Southern demand hit a new high of 35 GW on Aug. 23.

“This summer was marked by five major heat waves,” Lucas said.

Despite that, Lucas said MISO used its emergency procedures only once. She said average temperatures in MISO Midwest shook out about normal, while MISO South was above normal.

Independent Market Monitor David Patton said MISO’s forecast model overestimated load between 2-8 GW on the hottest days in July and August. He said the model may not be picking up voluntary actions of MISO market participants to reduce load and behind-the-meter solar generation that likely spikes as demand soars on hot days.

Patton warned MISO about creating “artificial surpluses” during hot days that mute real-time prices. He reminded MISO leadership that MISO has short-term reserves and often experiences a “wave of imports” from neighboring regions when its prices rise. He urged them to let MISO’s market dynamics do more of the lifting in a heat dome.

However, Patton lauded MISO operators for having the foresight to cancel resource commitments Aug. 24 when it became clear they would be unnecessary. He said the move saved MISO customers about $1.6 million, though some MISO suppliers were unhappy because they purchased gas in anticipation after being selected to generate.

“It’s much better that you do that instead of ride it out and have more resources than you need,” Patton said.

Patton urged MISO to hold out longer on resource commitment decisions and declaring emergencies. He said MISO shouldn’t allow its market “to work against us” in tight operating conditions. Committing so many resources that prices stay low at about $45/MWh might lead some resources to export their output, Patton said.

MISO Director Barbara Krumsiek asked if MISO would have enough transmission capability if “decisions were made differently” and MISO were more confident in imports. Patton assured her MISO is flush with import capability.

Patton also acknowledged that for control room operators, overseeing the situation in real time is much tougher than delivering after-the-fact analysis.

“I can sit here and say, ‘have faith in the markets,’ but when you’re an engineer sitting in the control room, that’s a hard thing to accept,” Patton said.

“Thank you! Thank you for saying that; I don’t think I’ve ever heard you say that,” MISO Director Phyllis Currie said, eliciting laughs from the audience.

MISO again prepared for near-record electricity demand and tight conditions this month as a lingering September heat wave settled on its Midwest region. It enacted a hot weather alert for its North and Central regions Sept. 3-5 when temperatures again exceeded 95 F in some parts of MISO Midwest. The grid operator handled those days without emergency procedures.

Executive Director of Market and Grid Strategy Zak Joundi said until recent years, MISO and members have been “fortunate” to preside over smooth operations and manage them with simpler market tools. However, he said a multitude of renewable resources and increasingly unstable weather is poised to further drive volatility and riskier operations.

“The world that we are operating is a lot more complex, so to maintain the reliability we’ve become accustomed to, we will need to adjust our markets and processes,” Joundi told board members.

Joundi said the weather years MISO has experienced recently are more indicative of what’s to come and should be assigned more weight in loss of load prediction modeling than other historic years.

Smith said MISO has a goal to set dynamic reserves, so the markets determine a greater share of the operations, rather than control room operators.

Smith said MISO is headed into a future where operators can’t feasibly consider all the “various inputs” to mitigate risk. He also said MISO is conducting “toes in the water” testing of machine learning in its markets to forecast risk.