PJM last week presented a shortlist of three scenarios of transmission upgrades to address needs identified in the 2022 Regional Transmission Expansion Plan (RTEP) Window 3. (See “Update on RTEP Windows,” PJM PC/TEAC Briefs: Aug. 8, 2023.)

“There is a lot of interest in this particular planning window. … This is a major expansion of our transmission system,” PJM Senior Vice President of State Policy and Member Services Asim Haque said during an Oct. 3 meeting of the Transmission Expansion Advisory Committee (TEAC). “We’re facing some serious changes to the electric grid in this area based on increase in the electric demand and retirements of fossil fuel generators.”

All three scenarios would expand the 500-kV grid, and potentially construct the first 765-kV line in the Dominion region, to meet growing data center load and generation retirements such as the 1,295-MW Brandon Shores plant. PJM Executive Director of System Planning Dave Souder said more information about the potential of a reliability-must-run contract being reached with Talen Energy should be available around the end of the year. (See “Brandon Shores Deactivation to Require $786M in Grid Upgrades,” PJM PC/TEAC Briefs: June 6, 2023.)

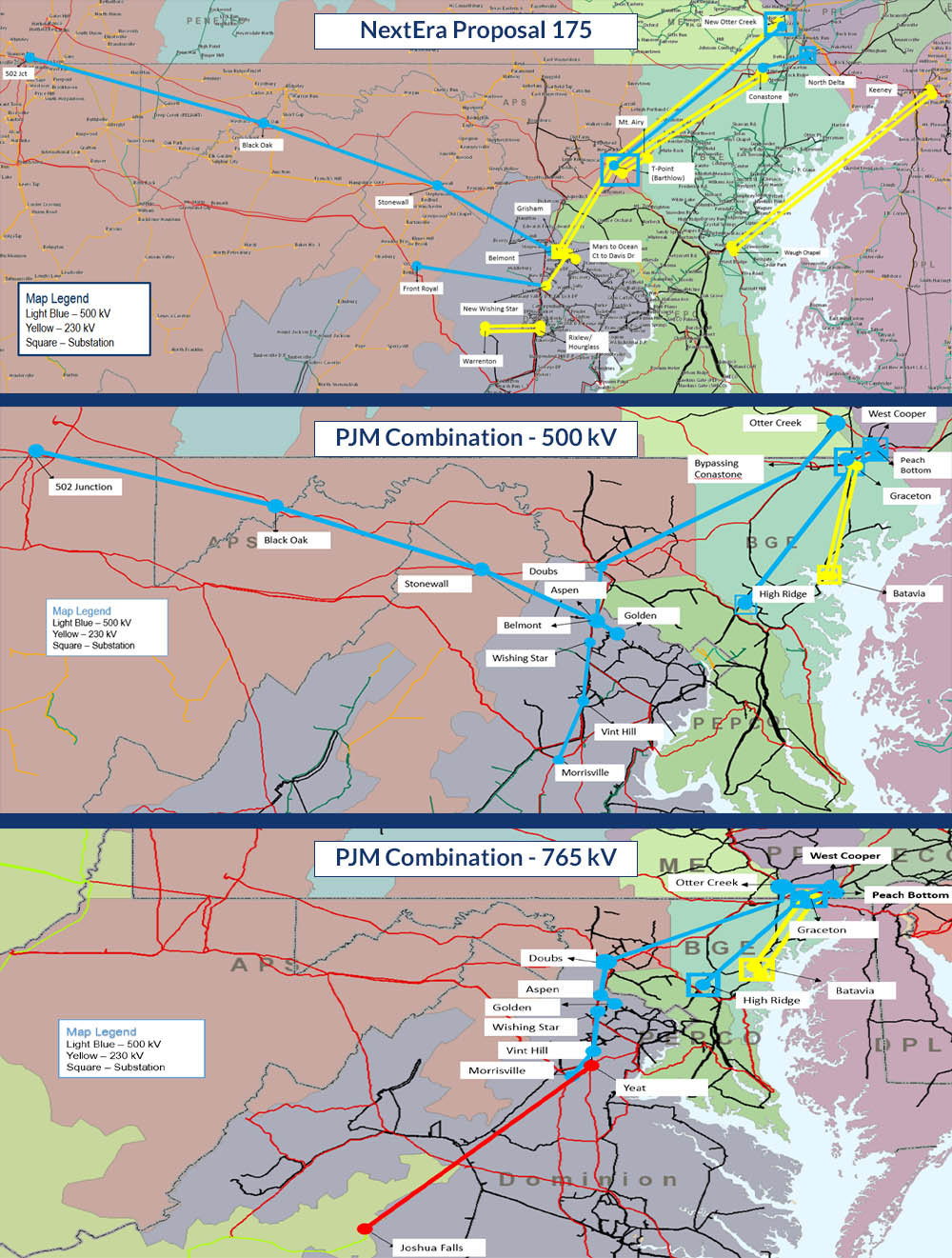

PJM received 72 proposals from 10 entities, portions of which were combined to form two scenarios. Only NextEra’s proposal #175 was selected as a shortlisted scenario without PJM modification. PJM’s Sami Abdulsalam said the RTO plans to bring one of the shortlisted scenarios to stakeholders for a first read Oct. 31 and to the board for approval in December.

The 765-kV line proposed in one of the two aggregate PJM scenarios would begin at the Joshua Falls substation and run north to the data center alley in Loudoun County, Va.

One of the PJM plans would construct a 765-kV line between the Joshua Falls and Yeat substations, bringing power into Loudoun County from the south. Additional transmission capability would also be constructed to the northeast, tapping into the 500-kV grid at Peach Bottom.

PJM’s other scenario focuses on expanding the 500-kV grid by building new lines from northern Virginia out to Peach Bottom to the northeast and the 502 Junction substation to the northwest.

Both scenarios include additional 500- and 230-kV lines that would be built in the BGE zone to meet some of the expected need created by the Brandon Shores retirement.

The NextEra scenario would follow a similar 500-kV pathway between the 502 Junction and the data center alley, as well as several 500- and 230-kV lines to the northeast routing through a proposed Barthlow substation and continuing to the Conastone and New Otter Creek facilities.

Two 230-kV lines would be constructed between the Keeney substation on the Delmarva Peninsula, across the Chesapeake Bay and connecting to the Waugh Chapel substation in the BGE area.

Abdulsalam said each of the scenarios comes with positives and negatives. The NextEra scenario would avoid modifications to the Doubs substation, which has become the terminus for an increasing number of lines, while the Barthlow substation would have nearly a dozen lines tying into it. The scenario would also require significant acquisition of new rights of way and the component running a line under the Chesapeake could pose voltage concerns in BGE, as well as environmental and permitting concerns.

The 500-kV scenario offers the advantage of avoiding disruption to the Conastone substation and having strong cost containment for the component constructing a line between Doubs and Otter Creek. The 765-kV plan would relax flows in the north with the addition of the higher voltage transmission proposed in the south and would add to the backbone capability in Dominion. Siting, permitting and procuring equipment for a 765-kV line comes with higher risk, but Abdulsalam said the 500-kV components of the scenario could provide short-term relief while the 765-kV is built.

Abdulsalam said the proposals contain commonalities that demonstrate a general understanding that additional transmission capability will be needed to move energy from the east to the west, augmented by transmission either from the south or northwest.

PJM’s Nebiat Tesfa said planning staff used a combination of NextEra, Exelon, FirstEnergy and Dominion proposals as a starting point to construct its aggregate proposals, in some cases working with proposing entities to break out individual components to combine with portions of other proposals. Analysis of combining several LS Power, Transource and NextEra proposals found a larger number of violations in the 2028 case.

Of the 72 proposals, 50 involve greenfield development of new lines, while the remainder are upgrades or construction within existing rights of way.

PJM’s characterization of the impacts and risks that greenfield proposals carry was disputed by several residents who live in the communities some of the projects would pass through. They argued that expanding rights of way to construct lines paralleling existing infrastructure would have a larger impact than is represented in PJM’s analysis and that the extent of the amount of greenfield was underplayed.

The window contains models for both 2027 and 2028, with the primary differences being that the latter includes more deactivations, including Brandon Shores, and adjustments to how resource dispatch is reflected in the analysis. Both the Brandon Shores retirement and the changes to block dispatching came after PJM had released the 2027 case, but before the following year had been finalized. (See “Load Forecast for Northern Virginia Data Centers Continues to Climb,” PJM PC/TEAC Briefs: Jan. 10, 2023.)

Exelon’s Alex Stern encouraged PJM to reach out to both the relevant incumbent transmission owners and state commissions regarding any non-incumbent proposals that include underbuilding on existing lines, particularly if it could cause states to lose jurisdiction. Incumbent TOs are also likely to have more detailed insight into anticipated needs in their region and may have a use for the underbuilding capability they were planning to use in the future.

After an initial assessment of the potential of each of the 72 proposals, PJM created an initial shortlist for more detailed analysis of their cost estimate, cost containment, scheduling, constructability, brownfield and outage coordination risks. The risk assessment also considered permitting, potential environmental issues and public opposition to past projects.