FERC last week unanimously approved the 2024 business plans and budgets for NERC, the regional entities and the Western Interconnection Regional Advisory Body (WIRAB), though Commissioner James Danly said in a concurrence that he would like to see “a significant improvement in the speed and agility” of the ERO’s response to energy reliability risks (RR23-3).

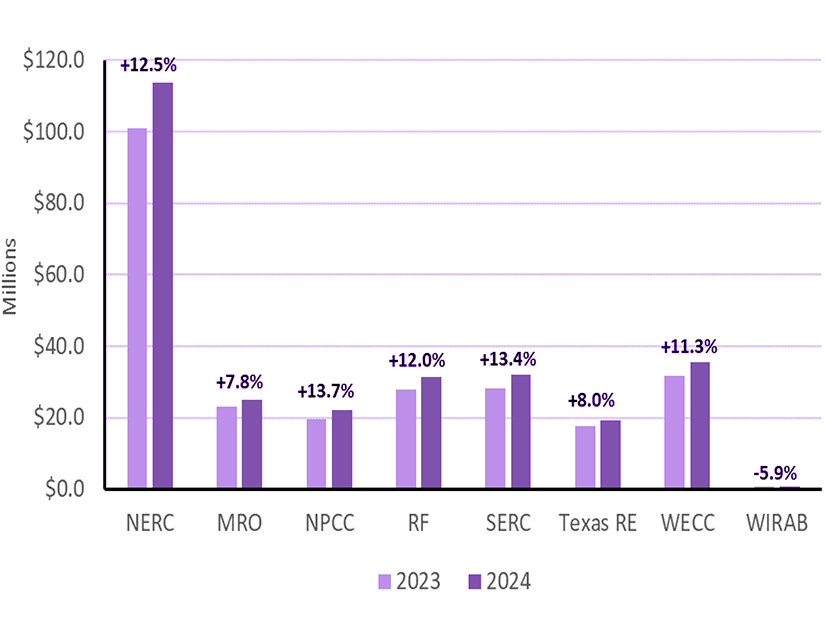

NERC’s final budget, approved by the organization’s Board of Trustees in August, stands at $113.6 million, an increase of $12.6 million (12.5%) over its 2023 budget. (See “2024 Budget Approved,” NERC Board of Trustees/MRC Meeting Briefs: Aug. 16-17, 2023.) The RE budgets are also set to grow:

-

- Midwest Reliability Organization — $24.9 million (up from $23.1 million);

- Northeast Power Coordinating Council — $22.1 million (from $19.4 million);

- ReliabilityFirst — $31.3 million (from $28 million);

- SERC Reliability — $32 million (from $28.2 million);

- Texas Reliability Entity — $19.2 million (from $17.7 million); and

- WECC — $35.4 million (from $31.8 million).

In contrast, WIRAB’s budget for next year is set to shrink from $883,520 to $831,492.

The total assessment for the ERO is set at $216 million, comprising $97 million for NERC ($87.1 million from U.S. entities, $9.5 million from Canadian entities and $346,814 from Mexican entities), $128.3 million for the REs and $580,417 for WIRAB.

In its filing, NERC also outlined anticipated funding sources outside of the assessment, such as $10.1 million of third-party funding for the Electricity Information Sharing Analysis Center’s (E-ISAC) Cybersecurity Risk Information Sharing Program; $1.8 million in fees for users of the System Operator Certification Program; and $1.1 million in interest and investment income.

NERC’s biggest spending increases next year are expected to be in personnel (+13.4%), meeting and travel (11.5%) and operating (15.7%). The organization plans to hire an additional 14.3 full-time equivalent (FTE) positions next year, bringing its total staffing level to 251.1 FTEs.

The increased meeting and travel costs reflect “a return to pre-pandemic levels of in-person meetings and travel … while continuing to utilize the efficiencies of virtual meetings where appropriate,” NERC said. The organization attributed its raise in operating expenses to increases in spending on contractors and consultants, along with increased software license and support costs.

A significant number of the added FTEs, 4.7, are to handle the Interregional Transfer Capability Study (ITCS), which Congress ordered NERC and the regional entities to perform in this year’s Fiscal Responsibility Act. (See Lawmakers, White House Promise More Work on Permitting After Debt Deal.) The ERO is required to submit the report to FERC by Dec. 2, 2024, imposing costs on NERC and the REs that were not envisioned in their initial budget drafts.

In order to avoid raising the assessment proposed in its draft budget, NERC proposed to fund the $2.6 million required for the ITCS costs by drawing $1.3 million from the Assessment Stabilization Reserve, for non-personnel costs, and the remainder from the Operating Contingency Reserve. Drawing on the ASR in this way requires an exception under section 1107 of NERC’s Rules of Procedure; FERC granted the request.

The commission also agreed to permit an exception under section 1107 to allow NPCC and SERC to deposit penalty funds received between July 1, 2022, and June 30, 2023, amounting to $535,018 and $6.6 million, respectively, into their ASRs; and to allow MRO to use $1.2 million from its ASR and $119,026 of penalties collected before June 30, 2022, to reduce its 2024 assessments.

Finally, FERC approved WECC’s request to use up to $250,000 from the funds donated by Peak Reliability upon its dissolution in 2019 to support an expanded trial of an energy market simulation platform and the acquisition of electromagnetic transient simulation software.

In his concurrence, Danly said he is “not convinced” that the commission is “really getting value for the money [NERC is] spending to address known or emerging reliability risks.” He noted the commission’s separate order on developing standards for inverter-based resources, a reliability risk that he said “we have known about, and been actively discussing, since at least 2016.” (See FERC Orders Reliability Rules for Inverter-Based Resources.)

Despite this long debate, he said, the proposed standards would not be required to take effect until 2030. “Up to nearly 14 years is a very long time, and the reliable operation of the [power grid] remains imperiled until these risks are adequately addressed. We are as responsible for this situation as NERC,” Danly wrote, noting that the proposed 2024 budget is 12.5% higher than that for 2023, which was 13.7% higher than 2022.

“Will this increased funding actually help expedite the development and implementation of needed NERC reliability standards? Based on NERC’s recent track record, I have my doubts,” he concluded.