The Electricity Transmission Competition Coalition released a report Nov. 29 arguing that getting rid of competitive forces in transmission development would cost consumers hundreds of billions of dollars on the grid buildout.

“Without competition, consumers are going to be faced with decades of high electricity inflation,” ETCC Chair Paul Cicio said in an interview. “We all know that transmission is very capital intensive, and even with competition, consumers’ electricity bills are going to go up. But with competition, we can avoid up to on average 40% of the cost of new transmission.”

That 40% figure would involve more transmission competition than has happened so far. While FERC ended the federal right of first refusal with Order 1000 more than a decade ago, since then just 3 to 8% of all transmission lines have been subject to competition, ETCC said.

Getting a third of all transmission development subject to competition would save $277 billion on the $2.1 trillion in transmission expansion that Princeton University forecast in its often cited “Net-Zero America” study. If all new transmission projects were open to competitive bidding at an average cost savings of 40%, it would save $840 billion on that buildout.

Transmission lines can get returns on equity of 10 to 12% for periods lasting 40 years, but competitive bidding can push that ROE down, ETCC said.

“Competitors can say, ‘Well, instead of accepting a 12% return on equity, our bid on this project is 10%,’” Cicio said. “That automatically is a lower cost to consumers, so competition drives down costs.”

In its Notice of Proposed Rulemaking on transmission planning, FERC went the other way, finding that total elimination of a federal ROFR for incumbent utilities on transmission lines running through their territories led to “flawed incentives” that might prevent the most efficient transmission from being developed. The NOPR would allow a ROFR to be reinstated as long as utilities work with another party on any lines (RM21-17). (See Battle Lines Drawn on FERC Tx Planning NOPR.)

“The real concern here is that competition, when you put it in the context of transmission, is a much more complicated issue than it would be, say, in the generation side,” WIRES Group Executive Director Larry Gasteiger said in an interview. “And what we’re seeing in reality is that things are taking longer, because the processes are much more involved.”

The two largest RTO markets offer different experiences in building out regional transmission lately, with Gasteiger noting that MISO, with its high share of state ROFR laws, is often touted as successful with its Multi-Value Project portfolio.

“So, in my mind, that kind of calls into question this argument that you need to have competition in order to get transmission done, and to get it the cheapest possible way,” Gasteiger said.

PJM has a much different process, leaving policy-based lines up to the states driving those needs. Its utilities’ spending on local transmission has often been criticized, including in a complaint by the Ohio Consumers’ Counsel (EL23-105). The OCC alleged that Ohio utilities had unjustly spent $6 billion on local supplemental projects since 2017, pushing up electricity rates.

Ohio’s utilities have responded that the OCC failed to show any evidence that they are overspending on such projects, and that it should be left to the state to oversee them. Both sides of the broader transmission-competition debate have weighed in on the complaint as well, with WIRES attaching a Charles River Associates report on the benefits of local transmission planning to its comments.

“Notwithstanding the challenges that there may be with getting regional, and even more so interregional, transmission [built], that doesn’t mean we don’t need a lot of local transmission developed too,” Gasteiger said. “So, the fact that we’re actually just getting something done at the local level doesn’t necessarily mean that is bad, or that it is wrong. What it means is that it’s needed, and it’s actually getting accomplished.”

ETCC did not weigh in on the complaint, but many of its members did. Cicio noted that it highlights another part of ensuring costs are low for customers as the grid expands.

“There’s the oversight to make sure that we need the project,” Cicio said. “The second part, if we need the project, it needs to be competitively bid, so that it reduces costs. It’s a two-step process.”

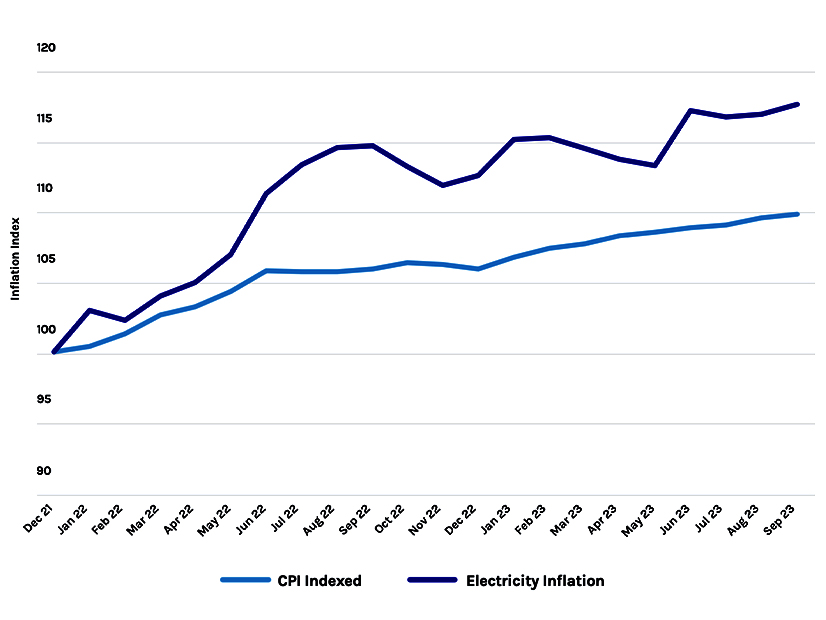

ETCC’s report, titled “FERC’s $277 Billion Electricity Price Hike,” focuses on consumer costs, reporting that the price of electricity has outstripped inflation in recent months, despite declines in the cost of other energy commodities including gasoline and fuel oil. One in five U.S. households have struggled to make a utility payment in the past year, and 26% of homes have experienced energy insecurity, it says, citing data on energy affordability from the U.S. Census Bureau.

“Even the Federal Trade Commission and the Department of Justice of this Biden administration weighed in, in writing, to FERC saying: ‘FERC, do not back away from competition,’” Cicio said. “And, so, we hope that they will do the right thing and strengthen Order 1000 and require all projects that are 100 kV or larger to be competitively bid.”

Gasteiger did not push back against the census data, but he did question whether transmission competition would really save hundreds of billions of dollars in future investments.

“Their savings projections are just that: They’re projections,” he said. “They’re hotly contested. And the track record shows that they’re often not reliable.”

Ultimately, these questions will be answered by FERC whenever it issues its final rule, he said.

WIRES does not want to see competition for transmission expanded, arguing that would delay transmission that is successfully getting built under the current regulatory model. Competitive transmission might work for the very-hard-to-build lines that stretch across multiple states to ship renewable power long-distance, or in similar transmission projects that help meet public policies, Gasteiger said.

“See if you can get it to work, and then build on that,” Gasteiger said. “But if not, don’t just automatically start expanding into areas where we’re actually getting transmission built and jeopardize the ability to get that transmission built as well.”