WESTBOROUGH, Mass. — ISO-NE outlined key components of tariff changes it plans to make to comply with Order 2023 at the Dec. 21 Transmission Committee (TC) meeting, including cluster timelines and storage study assumptions.

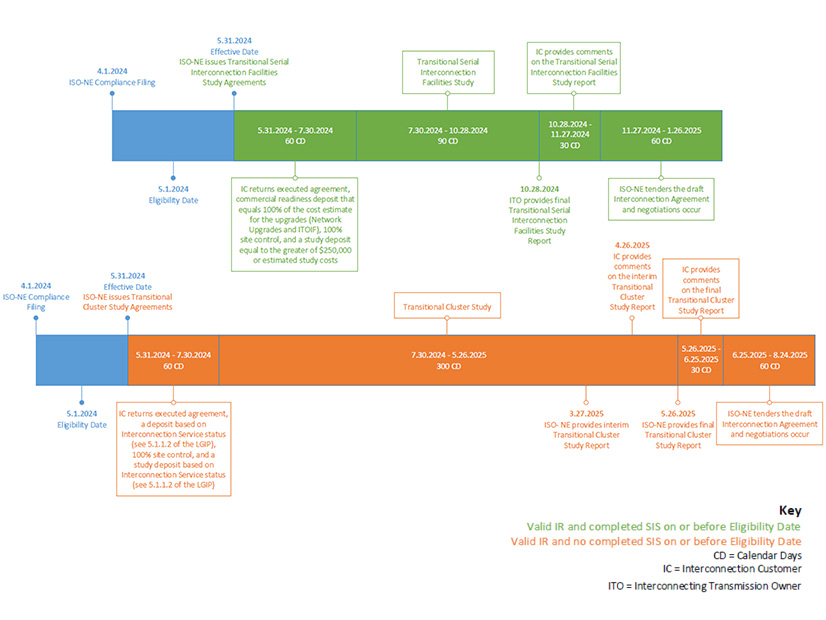

Al McBride, director of transmission services and resource qualification, outlined the RTO’s proposed timeline for the cluster process, which would span 582 days before the initiation of a subsequent cluster. This is longer than the process proposed by FERC due to a 270-day cluster study period, 120 days longer than FERC’s proposal. To help reduce the total timeline, ISO-NE has cut the cluster restudy period to 90 days compared to its initial proposal of 150 days. (See ISO-NE Details Proposed Order 2023 Compliance.)

McBride said the RTO will allow letters of credit for the commercial readiness deposits, in response to a stakeholder request at the November TC meeting. ISO-NE is proposing a $5 million commercial readiness deposit for large generators seeking to enter the transitional cluster study, and a smaller fee for small generators.

Customers with a valid interconnection request as of May 1, 2024, will be able to proceed with a transition study or withdraw from the interconnection queue without penalties.

ISO-NE is also proposing to incorporate its existing cluster enabling transmission upgrade (CETU) process into the new interconnection procedures. ISO-NE can initiate CETUs for state resource procurements that seek interconnection in similar locations, as well as for withdrawn interconnection requests in the same part of the New England Control Area.

For ongoing affected system operator studies, which look at the effects of distributed generation projects on grid reliability, ISO-NE is proposing to allow transmission owners to continue studies if they are on track to be completed within 90 days of the start of the transitional cluster study.

McBride also outlined ISO-NE’s proposal for studying storage resources, which differs from the approach taken by Order 2023. The order would let interconnection customers choose the maximum system load at which batteries will be studied, while requiring control technologies to prevent batteries from charging when load exceeds these limits.

ISO-NE is proposing an approach that would avoid the need for control technologies, instead relying on energy market bidding to determine which batteries can charge. During the study process, the RTO is proposing to study batteries at an 18,000-MW “shoulder” net system load.

NEPOOL will turn its focus to stakeholder amendments to the RTO’s Order 2023 compliance proposal at its Jan. 4 meeting.

Longer-Term Transmission Planning

Brent Oberlin of ISO-NE introduced tariff changes associated with the second phase of ISO-NE’s Longer-Term Transmission Planning project. The project is aimed at enabling forward-looking transmission projects that can prepare the region for the load growth and changing resource profile associated with the clean energy transition. (See ISO-NE Updates Longer-Term Tx Planning Proposal.)

The new process will allow ISO-NE to issue a request for proposals (RFP) at the direction of the New England States Committee on Electricity (NESCOE) to address reliability needs identified in longer-term transmission studies.

To be selected in the RFP, bids will first be evaluated on whether they solve the identified reliability needs. ISO-NE will then consider a quantification of a project’s benefits relative to its total costs. The quantified benefits of a project must outweigh its costs over a 20-year period for the project to be eligible for selection, Oberlin said.

Once these thresholds are met, the cost-benefit ratio will be one of the aspects considered by ISO-NE when selecting the preferred solution, along with factors like operability and expansion capability.

Oberlin noted that NESCOE can cancel the project at any time throughout the process. This could introduce uncertainty for transmission developers, as the process would be contingent on the states agreeing on a cost allocation method.

David Burnham of Eversource said that some longer-term reliability concerns should be exempted from the RFP process and assigned to incumbent transmission owners. He said that an “overreliance on competitive RFPs” could incentivize greenfield projects over upgrades of existing infrastructure, reduce flexibility in the solutions selected and “increase risk of duplicative transmission investment,” such as overlap between the longer-term process and asset condition projects.

The proposed exemptions would be focused on “needs that can be addressed cost-effectively by upgrades to existing facilities or by maximizing use of existing properties/[rights of way].”

In Eversource’s proposal, ISO-NE could identify exemptions for “qualifying low-impact projects.” This definition would extend to upgrades or replacements of aging equipment, new infrastructure sited largely on existing rights of way and the deployment of grid-enhancing technologies.

ISO-NE initially floated the possibility that some reliability projects could be assigned to incumbent transmission owners but said at the November TC meeting that it would abandon this aspect of the proposal. The RTO said it received mixed feedback from stakeholders on assigning needs to incumbents and was concerned the development of these RFP exemptions would delay the overall longer-term transmission planning effort.