FERC on Jan. 4 approved $2.3 million in penalties against Vitol and one of its traders for manipulating CAISO‘s market in 2013 to limit losses stemming from the energy and commodities company’s congestion revenue rights position (IN14-4).

Under the agreement negotiated by FERC’s Office of Enforcement (OE), Vitol will pay the U.S. Treasury Department $2,225,000. The trader, Federico Corteggiano, who helped CAISO develop its CRR software and had previously engaged in similar manipulation while at Deutsche Bank, was fined $75,000. Houston-based Vitol is part of a global commodities trading holding company based in Geneva, Switzerland.

The proceeding began in early 2014 when OE initiated an investigation into Vitol’s October 2013 trading activity in CAISO.

FERC staff alleged that during a five-day period, Vitol sold physical power at a loss of about $4,500 in CAISO’s day-ahead market to eliminate CRR losses of up to $1.2 million, according to a 2019 show cause order. (See FERC Proposes $6.8 Million Fine for CAISO Market Manipulation.)

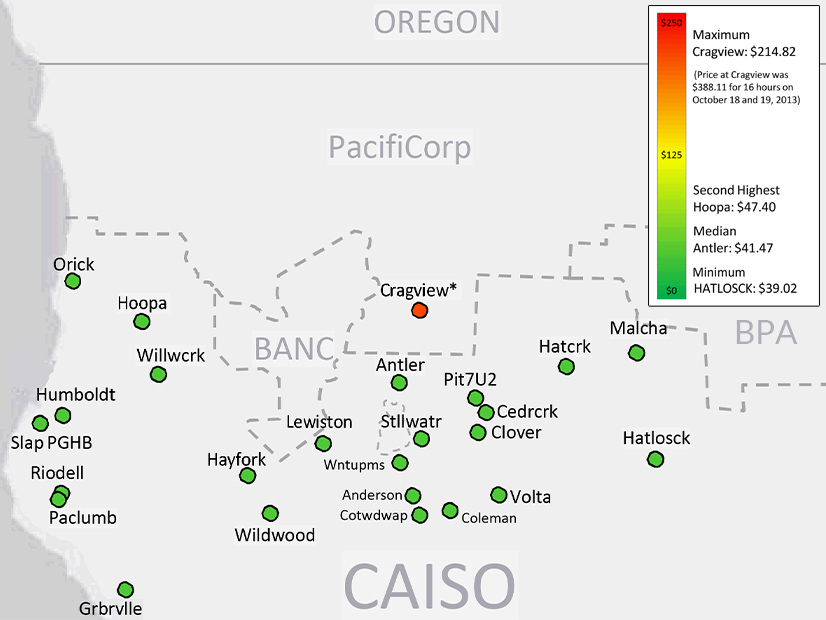

During the 2013 incident, Corteggiano purchased CRRs on the Cragview node, where CAISO transfers power from the PacifiCorp-West balancing authority area in far Northern California. He discovered he could cut Vitol’s losses on export congestion on the partially derated Cascade intertie by importing physical power.

“Corteggiano knew that he could likely eliminate the problematic export congestion for that week by importing physical power in the day-ahead market at Cragview,” the 2019 report reads. “Working with other Vitol employees, Corteggiano arranged to buy [5 MW of] physical power in the Pacific Northwest and successfully offered it for import at Cragview. Vitol’s imports over the Cascade intertie achieved their intended purpose, preventing export congestion from occurring during the period of Vitol’s imports…”

FERC determined that, by allowing itself to lose money on the imports, Vitol was “able to eliminate the export congestion and thereby avoid the far larger financial losses they otherwise would have incurred on the CRRs at Cragview.” FERC staff in 2019 recommended that Vitol pay $6 million and Corteggiano pay $800,000 in penalties, in addition to returning the $1.2 million in CRR savings. The proceeding then moved to a federal district court, where OE and the defendants engaged in negotiations and agreed to the terms of the Jan. 4 settlement.

Vitol and Corteggiano “neither admit nor deny the alleged violation,” and the current agreement settling the dispute orders the company to make payments within 10 days after the commission issued the order.

According to OE’s FY 2023 report, FERC approved 12 settlement agreements totaling around $48.8 million, saying that market manipulation and fraud create losses that are ultimately shouldered by consumers.