MISO discussed the second part of its long-range transmission planning project at a workshop with stakeholders, detailing how the project would help meet transmission needs.

MISO discussed the second part of its long-range transmission planning (LRTP) project at a stakeholder workshop March 15, detailing how the project would help meet Midwestern transmission needs.

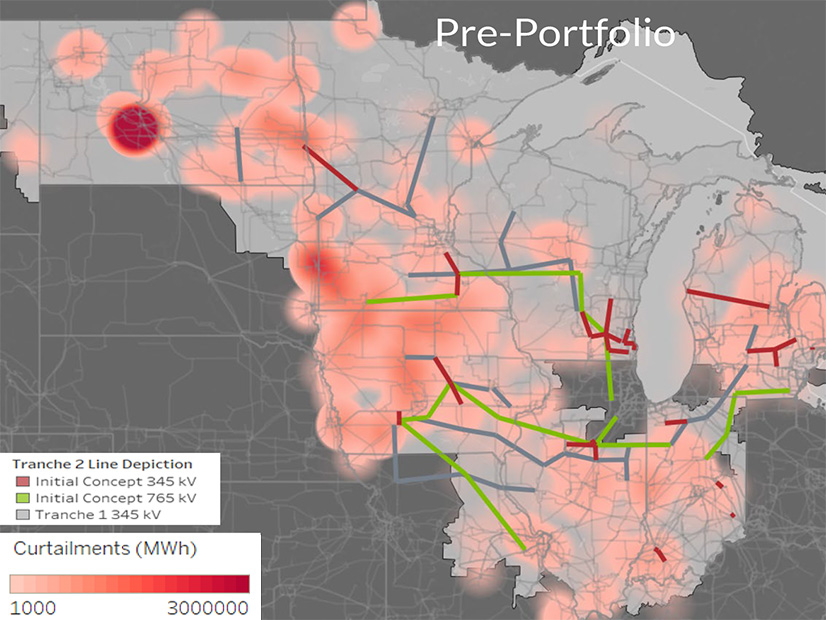

Tranche 2, the proposed transmission portfolio, includes a series of 765-kV lines intended to “enable a reliable and efficient transmission system while minimizing land use” as the region copes with increasing electricity demand and a changing resource mix. The project is projected to cost between $17 billion and $23 billion. (See MISO Says 2nd LRTP Portfolio Should Run About $20B, Rate Mostly 765 kV.)

“This anticipated portfolio builds on both the investment made in Tranche 1 and our existing system,” said Laura Rauch, executive director of transmission planning at MISO. Rauch added the proposal is intended to be a “least-regrets and robust step” to start solving anticipated transmission constraint issues and enable increased regional power flows.

MISO’s initial analyses indicate the transmission investments would significantly reduce thermal transmission constraints and the severity of overloads across the Midwest. The portfolio would also reduce resource curtailments throughout the region and decrease price differences between regions, MISO said.

The grid operator outlined its plans to quantify the portfolio’s potential savings from reduced losses, avoided capacity costs and decreased transmission outages, and asked for stakeholder feedback on the proposed methodology.

Tranche 2 is not intended to address all the potential regional transmission constraints, and “there is a need for additional transmission after this Tranche 2 portfolio,” Rauch said. She declined to specify the timing or targeted areas of this additional transmission.

Rauch stressed that the first phase of Tranche 2 proposal must be “independently valuable regardless of what next steps we might have.”

MISO expects the portfolio to “continue to be refined,” Rauch said. The RTO will continue to consider alternative solutions that could affect the outlined routes.

Chris Plante of WEC Energy Group asked MISO about how its proposal relates to the Grain Belt Express project, a proposed 5-GW merchant transmission project that would deliver power from Kansas to the Midwest. (See Grain Belt Express Gets Partial Approval for Negotiated Rate Authority from FERC.)

“We will make sure that we are not proposing a line that will not be valuable because of something that will be in service,” responded Rauch.

“There are legitimate questions about Grain Belt Express,” Rauch said, but added that MISO will address whether the merchant transmission project is likely to address issues similar to those met by Tranche 2 and adjust accordingly.

Some stakeholders expressed concern the portfolio is not based on the planning scenario that assumes the highest level of load growth and renewable energy penetration. MISO responded that running an additional analysis based on the more aggressive scenario would add six to nine months to the overall process, while the proposed portfolio would likely remain a good first step.

“We can’t continue to kick this can down the road; we need to start moving forward,” said Bob McKee of American Transmission.

McKee added his support for the consideration of 765-kV lines, saying stakeholders “should not be surprised that 765 is showing up on this map … it’s been two years that we’ve been talking about the possibility of 765.”

While MISO determined 765-kV lines make the most sense for Tranche 2, the RTO said it will continue to consider HVDC solutions in future proposals.

Asked whether grid-enhancing technologies (GETs) are part of the solution to the transmission constraints, Rauch said GETs are unlikely to supplant the needs of the proposed Tranche 2 lines but could complement the upgrades and help the grid operator get the most out of the infrastructure.

MISO will hold another LRTP workshop April 26.