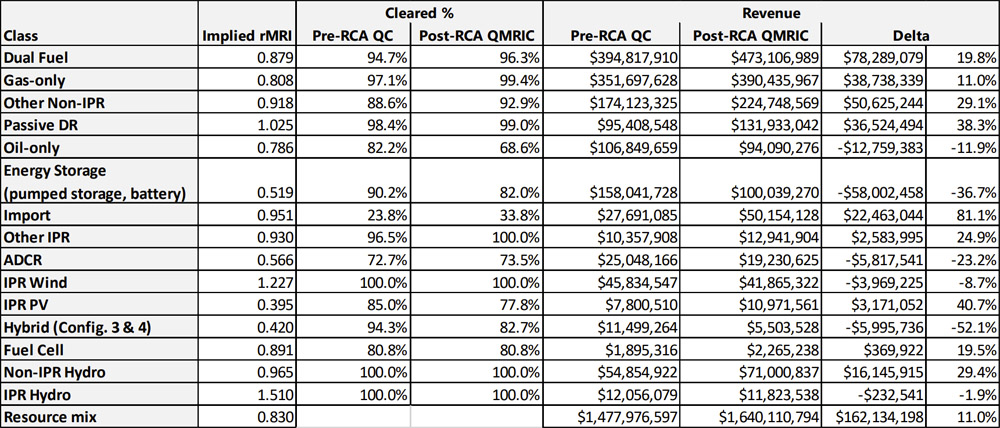

ISO-NE’s proposed resource capacity accreditation (RCA) updates would result in an estimated 11% increase in capacity market revenues, the RTO told the NEPOOL Markets Committee on May 7.

Despite the overall increase, ISO-NE projects revenues to vary significantly based on resource class. The modeling showed that compensation for gas, dual fuel, energy efficiency, solar and imports would increase, while revenues for oil, energy storage, active demand response, wind and hybrid resources would decrease.

The RTO also estimated that the RCA updates would reduce the loss-of-load expectation by about 38%.

Initially introduced in 2021, the RCA project is intended to better align ISO-NE’s capacity market with the reliability contributions that different resources provide to the grid. Accreditation values would be based on a given resource’s expected output during the hours of greatest reliability risk.

The RTO emphasized that the revenue results are dependent on the modeling assumptions and are likely to change as the resource mix and seasonal risk profile shifts. The RTO’s modeling indicates that near-term reliability risks are concentrated in the summer, and it projects that winter reliability risks will rise dramatically as heating electrification intensifies and winter peak loads will surpass summer peaks in the mid-2030s.

The seasonal risk balance likely significantly affects the revenues projected for gas-only resources. While one of the main drivers of the RCA project was to better account for gas constraints during winter months, ISO-NE projects that the changes will increase gas-only resources’ revenues by 11% (coincidentally). This increase is attributed in part to the concentration of risks in the summer, when gas resources face minimal constraints, ISO-NE said. As winter reliability contributions become more important, gas constraints will have a greater impact on capacity accreditation, likely reducing revenues.

The design of the capacity auction could also significantly change before the RCA updates are implemented.

ISO-NE is proposing to shift its capacity auction from a forward annual design, with the auction for each yearlong capacity commitment period (CCP) held over three years in advance, to a prompt seasonal design, with auctions held much closer to the CCP, which would be broken up into seasonal segments.

If FERC accepts ISO-NE’s proposal to delay Forward Capacity Auction 19 an additional two years, the RTO “will focus on evaluating scope and phasing of work for a combined accreditation design with a seasonal/prompt capacity market to implement for CCP 19 and would target discussing initial scope considerations with the MC in July,” said the RTO’s principal analyst, Dane Schiro.

Despite the uncertainties, the RTO’s presentation provides the most detailed look to date at how the changes will ultimately impact resource compensation.

ISO-NE projects dual-fuel resources to have the largest increase in total revenue, about $78.3 million (19.8%), followed by a class of non-intermittent resources including coal, nuclear and wood-burning generators at $50.6 million (29.1%); gas-only resources at $38.7 million; energy efficiency at $36.5 million (38.3%); imports at $22.5 million (81.1%, the largest percentage increase); and non-intermittent hydro at $16.1 million (29.4%).

Meanwhile, ISO-NE estimated that energy storage (including both batteries and pumped hydro) would have the most significant decrease in revenue, about $58 million (36.7%), followed by oil-only resources at $12.8 million (11.9%), hybrid resources at $6 million (52.1%, the largest percentage decrease), active demand response at $5.8 million (23.2%) and wind at $4 million (8.7%).

Alex Chaplin of New Leaf Energy told RTO Insider the company is concerned that the projected revenues indicate the updated accreditation methodology may undervalue storage resources.

“Some New England states have energy storage goals and have implemented (or are working to implement) incentive programs for storage to help address the ‘missing money’ problem batteries face,” Chaplin wrote in an email. “We fear that a significant reduction in capacity revenues will worsen the missing money problem and negatively impact storage deployments in the region.”

Aleks Mitreski of Brookfield Renewable expressed perplexity about why storage resources experienced such a significant reduction in capacity revenues relative to fossil resources, adding that the differences may stem from how ISO-NE models the physical parameters of various resource classes.

“Pumped storage resources that operate every day receive a sizable capacity payment reduction of 36%, while oil units that run a few days of the year only get a 12% payment reduction,” Mitreski told RTO Insider.