Reliability is a global problem that requires local solutions. For more than 15 years, PJM’s solution has been its forward-looking capacity market, the Reliability Pricing Model. Meanwhile, on the other side of the world, Japan recently enacted major reforms to its energy system. Those reforms have included a PJM-inspired capacity auction first held in 2020 for the 2024 delivery year and a related long-term decarbonized power resource auction inaugurated this year.

Japan’s energy reforms are of increasing importance globally, including to U.S. companies and investors. A weak yen has spurred investment in Japanese energy projects, and foreign- and U.S.-owned energy companies have started winning major capacity contracts in Japan’s new system. Recent developments in Japan have revealed, however, that its market differs in significant ways from those in the U.S. — including from the very PJM capacity market on which Japan modeled its own.

A Modified PJM Capacity Market in Japan

When Japan embarked on its energy reforms, it formed a study group to examine foreign capacity markets, including PJM’s, and to make a proposal for how best to ensure long- and midterm reliability in its energy markets. Ultimately, the study group concluded a capacity market similar to PJM’s model (and the model used in the U.K.) would work best.

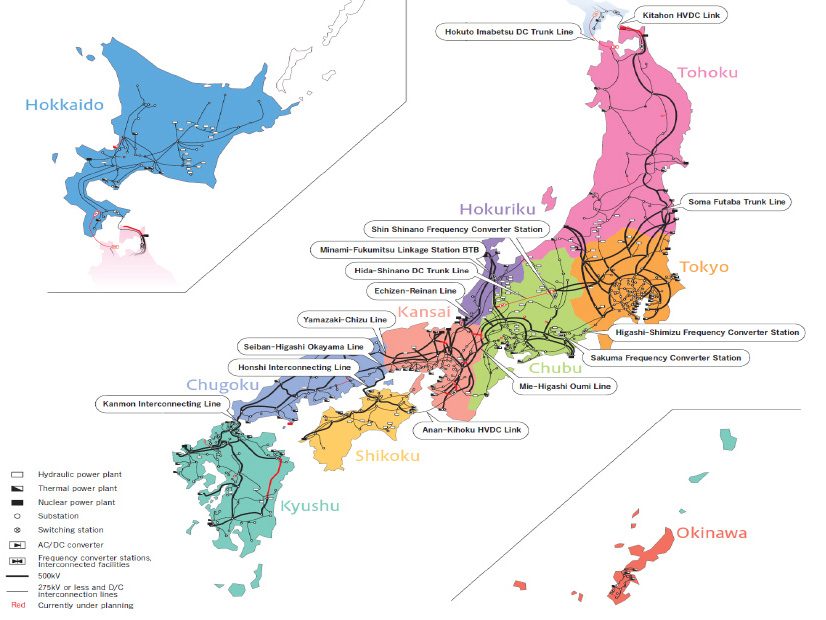

The capacity market system Japan ultimately adopted shares the same basic structure as PJM’s. It is presided over by a private transmission organization called the Organization for Cross-Regional Coordination of Transmission Operators (OCCTO). Like PJM, OCCTO runs a centralized capacity auction where generation resources offer to sell capacity for a price, and the auction’s clearing price is ultimately set at the point where supply and demand curves cross.

There are, however, several key differences between Japan’s market and PJM’s. For example, unlike PJM’s system, participation in OCCTO’s capacity market is never required for participation in Japan’s wholesale electricity markets. And unlike PJM, OCCTO does not administer the wholesale electricity market itself: Another organization, the Japan Electric Power Exchange, does.

Perhaps most critically, OCCTO’s and PJM’s systems are different because they are governed by different legal frameworks. OCCTO is authorized and governed by Japan’s 2015 amended Electricity Business Act, while PJM (like other U.S. RTOs) is governed by the Federal Power Act. Those laws impose materially different restrictions, based on different national policies. The FPA, for example, embraces what U.S. courts have long called the filed-rate doctrine, which forbids retroactive rate changes. That prioritizes pricing predictability, even when doing so may result in higher-than-necessary consumer prices. Japan, by contrast, has not adopted the filed-rate doctrine; it has prioritized lowering consumer prices instead.

A Focus on Reducing Prices

Japan’s focus on reducing prices has been especially clear in its management of its new capacity markets. Since the first capacity auction in 2020 yielded prices far higher than expected, Japan’s energy regulator — the Electricity and Gas Market Surveillance Commission (EGC) — has been on the lookout for ways to ensure that OCCTO’s capacity auction prices remain as low as possible. That has been especially clear in the EGC’s handling of the 2022 capacity auction for the 2026 delivery year.

First, after the 2022 auction closed but before results were announced, the EGC discovered that one capacity supplier’s offer was too high because of a mistake. In consultation with OCCTO, the commission took the unprecedented step — one that no statute or auction rule permitted — of requiring that the offer be corrected and the resulting capacity price for all participants be changed accordingly.

Second, this year, the EGC discovered another “misbidding” mistake — this time, after the 2022 auction results had been announced and the supplier had been awarded a contract. The commission and OCCTO promptly announced that they would amend the supplier’s contract to reduce the contracted capacity price. Recognizing that such a change was also unprecedented, the organizations emphasized that such an adjustment should be made only when the resulting capacity price would be lower, to protect consumers.

Will Japan Adopt Something Like the Filed-rate Doctrine?

Japan’s energy and capacity markets are, in many ways, still in their infancy. Japan might still develop or adopt something akin to the filed-rate doctrine, or it might reject the doctrine expressly. Either way, Japan cannot help but recognize that market forces demand some degree of pricing predictability. Even in the recent misbidding investigations, for example, Japanese regulators showed they are sensitive to the same concerns that motivate the filed-rate doctrine. They could have undone the entire 2022 capacity auction this year after they discovered that misbidding affected the clearing price, but they did not. Instead, they amended only the responsible supplier’s contract while recognizing that amending such established contracts should be a rare event — one limited to situations where it will protect consumers without destabilizing market expectations.

Even without a formal filed-rate doctrine, in other words, Japan’s capacity markets are not the Wild West. Japan cannot make reneging on capacity prices a habit, because participation in the capacity markets there is entirely voluntary. To incentivize participation and ensure reliability for consumers, if nothing else, Japan will need to safeguard the predictability of prices once they are set. Whether it will formally adopt the filed-rate doctrine, or something like it, in the years to come remains to be seen.

Eri Akiyama is an attorney with Nagashima Ohno & Tsunematsu with a practice that includes energy and other complex civil litigation. She served as an international associate at MoloLamken LLP in New York from September 2023 to June 2024.

Jennifer Fischell is a partner at MoloLamken with a practice focusing on energy and complex civil litigation, administrative law and appeals. She has clerked for judges at all levels of the federal judiciary, most recently for U.S. Supreme Court Justice Elena Kagan.