[EDITOR’S NOTE: A previous version of this article used the wrong figure for the bottom of the range of expected resource adequacy in summer 2025 in the first sentence (“a potential 1-GW capacity deficit”); this error was also in the excerpt for the article. The survey found that MISO could be short by as much as 2.7 GW.]

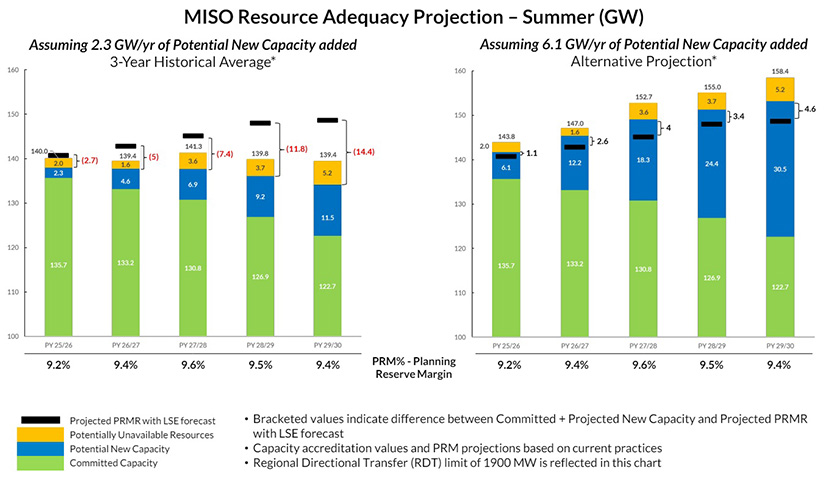

A relatively low turnout of constructed capacity in recent years could continue and deepen a potential 2.7-GW capacity deficit in summer 2025 to more than 14 GW by summer 2029, MISO and the Organization of MISO States revealed in their five-year resource adequacy projection.

According to the pair’s 11th annual joint survey, the footprint could either enjoy a 1-GW capacity surplus or contend with a nearly 3-GW deficit by next summer. Much depends on how quickly developers can overcome obstacles to get new resources into commercial operation.

This year’s survey assumed MISO will realize only about 2.3 GW/year in accredited capacity from new builds and did not designate projects with signed generator interconnection agreements as a foregone conclusion in committed capacity totals. The survey also didn’t account for the size of MISO’s record-breaking 300-GW interconnection queue and used a 9.2 to 9.6% planning reserve margin requirement over the next five years.

At the 2.3-GW/year rate — which is the historical average of what developers were able to connect in the past three years — a 5-GW capacity shortfall in planning year 2026/27 widens to 7.4 GW by 2027/28 and nearly 12 GW by 2028/29. Last year’s survey anticipated a 9.5-GW shortfall by the 2028/29 planning year. (See OMS-MISO RA Survey Signals Potential for 9-GW Shortfall by 2028.)

This year’s lower rate of assumed capacity additions spurred debate between MISO staff and stakeholders about what developers realistically can accomplish. That stalled the announcement of the survey results by a week.

During a June 20 teleconference to discuss the results, David Schoon, MISO resource adequacy engineer, said the RTO reflected a “new paradigm” from its interconnection queue in the survey. He said MISO’s current 50-GW backlog of unfinished generation that’s been approved to connect to the system but still is waiting in the wings influenced the survey’s new method of evaluating capacity additions.

Schoon said MISO felt it needed to reflect the stubborn trends from the “COVID slowdown, such as continuing supply chain bottlenecks, commercial uncertainty and permitting and labor delays,” despite what interconnection customers claim will be brought online.

“We’ve got to get out of that guessing game,” Schoon said of the queue’s annual yields. He said it’s not realistic to assume developers can bring an “explosion” of resources online in a single year.

However, Schoon said MISO and OMS also contemplated that circumstances mend over time, and the footprint experiences an influx of skilled labor, a less fraught supply chain, expedited permitting and commercial viability of new technologies. In that alternative projection, MISO might connect more than double its three-year historical rate, at a little more than 6 GW annually.

At 6.1 GW/year, MISO could enjoy a 4.6-GW surplus by summer 2029.

However, MISO added a caveat that large, spot-load additions could balloon over the next five years and threaten a more than 30-GW shortfall under the 2.3-GW/year scenario and a nearly 10-GW shortfall even under the 6.1-GW/year rate.

“The situation is changing very rapidly around us,” said Senior Director of Resource Adequacy Durgesh Manjure, referring to generation retirements and a resurgence in load growth through new data centers.

“Immediate actions are needed to expedite the addition of new capacity, coordinate resources for new load additions and potentially moderate the pace of resource retirements,” Schoon said.

Josh Byrnes, OMS president and member of the Iowa Utilities Board, said RTO members’ actions over the next year will matter a great deal. “We need to quickly move to make sure that new load doesn’t outpace generation additions,” he said.

Byrnes said the RTO should focus on ushering new capacity through its interconnection queue expeditiously and “use the expansive MISO footprint to the fullest” through regional transfers.

In a press release accompanying survey results, Byrnes stressed that as the region faces “tightening capacity reserve margins compounded with rapid and large load additions, it is imperative for everyone from developers (new load and generation), economic development authorities, utilities, regulators, MISO and other stakeholders to work in close coordination.”

WEC Energy Group’s Chris Plante asked if MISO has considered that load-serving entities with planned data centers in their territories will take pains to ensure they can cover the large load additions with new capacity or purchases.

MISO’s Scott Wright said OMS and the RTO deliberated on the steps utilities and local governments will take to spur economic development.

“But we’ve also noted that laying it out this way highlights the fact that … a lot of these are un-resourced loads,” Wright said.

Michigan Public Power Agency’s Tom Weeks asked if MISO or its consultants mulled quantum computing emerging in time for the new decade, which could make data center energy consumption “plummet by orders of magnitude.”

Schoon said such breakthroughs weren’t included as possibilities in survey results.