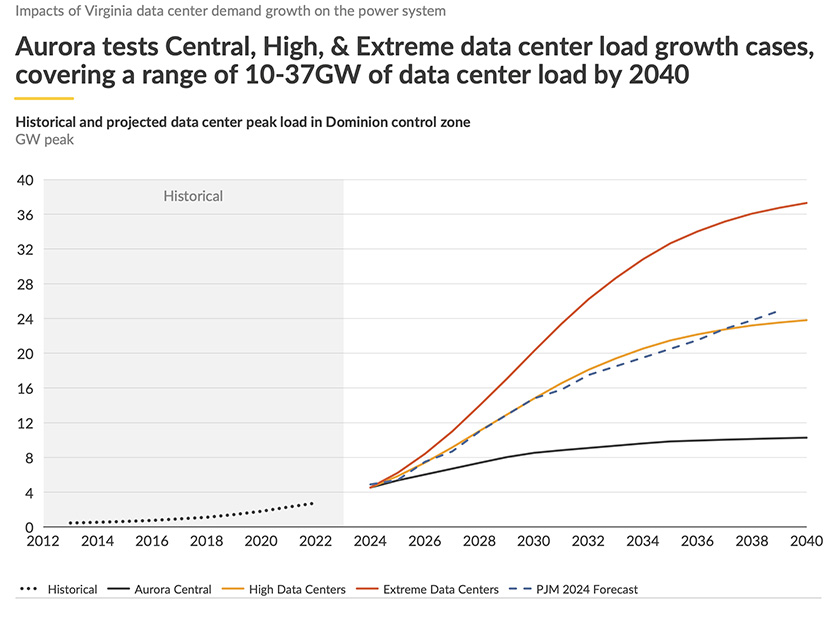

Growing demand from Northern Virginia’s Data Center Alley could outpace the power industry’s ability to keep up, according to a report released June 20 by Aurora Energy Research.

PJM’s latest 2024 forecast shows 11 GW of demand from new data centers in Northern Virginia alone by 2030, which would represent 40% of Virginia’s peak demand. In the report “Impacts of Virginia data center demand growth on the power system,” Aurora says data center demand could reach as much as 16 GW by the end of the decade.

New supply would be needed to meet such demand, which the report said could drive up to 15 GW of new natural gas capacity because intermittent renewables alone would not provide the reliability that PJM market rules require. Dispatchable resources such as natural gas or battery storage would be needed to reliably serve new data center load, according to Aurora.

The need for new supply could affect data center demand growth, with the report noting new plants take years to get through PJM’s interconnection process and connect to the grid. Relatively high power prices in Virginia and increasing geographic flexibility from data centers could drive them to be built elsewhere.

“Adding the 10 to 15 GW of firm generation capacity needed to supply these data centers and keep the lights on in Virginia will not be easy,” Aurora’s PJM Research Lead Zachary Edelen said in a statement. “It can take three to four years for the transmission organization just to greenlight a new generator, and market prices are currently too low for developers to build the kind of capacity required.”

Renewable capacity grows significantly in PJM under all of Aurora’s scenarios, which forecast a minimum of 40 GW of new nameplate capacity in the region. But renewables are credited well short of their nameplate capacity in PJM’s capacity market and that along with data centers’ need for steady power supplies lead to more need for natural gas plants and batteries.

“As a result, our analyses consistently show that data centers bolster the business case for natural gas generators, meaning state and federal governments will need to do more if they want to decarbonize,” Edelen said.

Northern Virginia’s Data Center Alley is home to 25% of national data center load. Its 4 GW of demand beat that of every country except the U.S. itself and China. Nearly 300 data center facilities are in Northern Virginia, with a cluster around Data Center Alley in Ashburn, according to the report.

Growth was so fast there that Dominion Energy had to pause new connections in 2022 to avoid spiking congestion. Now the utility is implementing grid updates to deal with the bottleneck. Dominion expects 20 GW of new load and plans to invest nearly $5 billion in transmission to deal with that, according to the report.

Data centers are considering behind-the-meter generation as they work to improve efficiency in their operations in the face of high electricity costs in Northern Virginia, according to the report, which also noted the centers increasingly can locate elsewhere as internet connections improve.

Aurora’s demand forecasts range from 10 to 37 GW by 2040; a 24-GW growth scenario is in line with PJM’s load forecast.

Dominion forecasts 11 GW of additional capacity obligations for its footprint by 2030 and plans to buy and import about 59% of that from around PJM. Its transmission spending plans will help enable that.

The RTO will need more capacity to meet the Virginia data center demand because of planned retirements. Aurora forecasts a 12-GW shortfall in “unforced capacity,” which would take 15 GW of new gas plants, or 20 GW of batteries if they hold four hours of charge.

The higher demand is expected to help push up power prices, with the forecast closest to PJM’s adding $3/MWh to the average, but the extreme case of 37 GW by 2040 would add $16/MWh.

Data centers building their own generation could put a cap on how high their new demand drives wholesale prices, the report noted. A combined cycle gas turbine would make sense for big data centers if the generator’s capacity factor is high enough, which would be the case at average data centers that have a load factor of 88%, according to the report.

“A strategy of building one’s own behind-the-meter generation carries risks, including necessitating a long generator lifetime to realize benefits, policy risk (from potential decarbonization rules), outage risk and potential local pushback from neighboring residents,” Aurora said in the report.