After two requests for more information and nine months, FERC has greenlit MISO’s plan to exchange its current, vertical curve for sloped demand curves in its seasonal capacity auctions (ER23-2977).

FERC said use of a downward-sloping curve in MISO should “reduce volatility in auction clearing prices, increase the stability of the capacity revenue stream over time and render capacity investments less risky, thereby encouraging greater investment and at a lower financing cost.” The commission pointed out that it has approved similar sloped curves in the PJM, NYISO and ISO-NE capacity markets.

“We find that using the proposed sloped demand curve will result in capacity price signals that reflect the marginal reliability impact of incremental capacity additions, provide better incentives for efficient resource entry and exit and, as a result, improve resource adequacy and economic efficiency across the MISO footprint,” the commission said in an order issued at its monthly open meeting June 27.

MISO CEO John Bear announced the approval during the Board of Directors’ meeting the same day in Eagan, Minn., to applause from stakeholders.

FERC addressed arguments from Midwestern transmission-dependent utilities and the Mississippi Public Service Commission that it foreclosed on the possibility for a sloped demand curve when it consistently found in previous orders that the RTO’s vertical curve was just and reasonable.

FERC said that its past orders finding the vertical curve sufficient did not mean that it would not entertain a proposal from MISO to change the design of the curve.

Prior to its approval, the commission twice said it needed more information before it could judge the plan. (See MISO’s Sloped Demand Curve Plan Draws 2nd Deficiency Letter.) Both times, the commission focused on MISO’s proposal to remove its annual price cap for auction clearing prices as part of the move to sloped demand curves. It said it required more explanation for the RTO’s proposal to eliminate the yearly cap.

The commission ultimately found that it is appropriate under the sloped demand curve for clearing prices to reach as high as four times the cost to build new generation. It said MISO is free to scrap its current annual price cap of 1.75 times the cost of new entry (CONE) for local resource zones (LRZs).

MISO has said that once it implements the sloped curves, the total annual price for an LRZ could reach as high as four times CONE, depending on whether capacity shortages occur in all four seasons of the auction. The RTO didn’t explicitly list an annual price cap in its new tariff language, telling FERC it isn’t necessary because its plan limits clearing prices to seasonal CONE values. It also said there’s only a small chance a zone would experience shortage conditions in all four seasons, and if that occurred, the more than $1,300/MW-day prices that ensue would properly reflect an “extreme” situation.

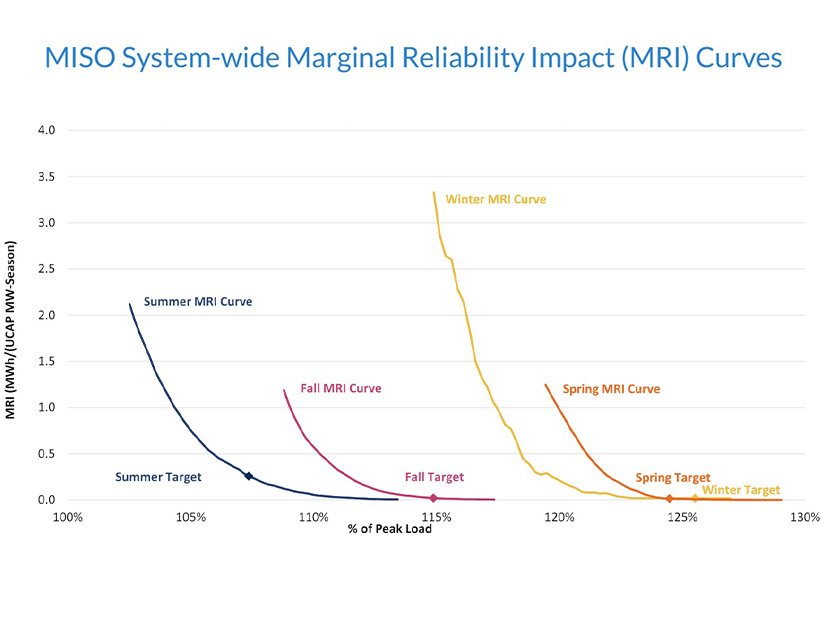

This year’s CONE value averages $330/MW-day. MISO has said its sloped demand curves won’t allow prices to automatically jump to CONE values for small capacity shortages below reserve requirements, unlike the current, unyielding vertical demand curve.

FERC agreed that sloped curves will result in a more nuanced pricing of shortages, rendering an annual price cap no longer necessary.

“Given that the sloped demand curve more accurately reflects the value of the increase or decrease in reliability of one additional (or one fewer) megawatt of capacity, under a small megawatt shortfall scenario, the auction clearing price will increase more gradually than it would with a vertical demand curve, and the capacity price will not rise to CONE unless MISO is experiencing a severe capacity shortage,” the commission reasoned.

It agreed with MISO that sloped curves will moderate pricing extremes and produce more “graduated and meaningful” price signals.

Commissioner Allison Clements wrote a concurrence to express a longstanding concern with the design of MISO’s seasonal capacity auction. She said that while downward-sloping demand curves in the auctions are a sound idea, she remains apprehensive over MISO appearing to allow sellers to compress their full annual costs into the seasonal offers they make.

Clements said that in the 2023 order accepting MISO’s seasonal auction design, the RTO’s testimony appeared to contradict its tariff language that seasonal offers may include only costs associated with providing capacity for that season. (See FERC Affirms MISO’s Seasonal Auctions, Accreditation.)

“My concern at the time was that if sellers can include their full annual costs into each and every seasonal offer, and they clear multiple seasons, they could receive in excess — potentially up to two, three or four times — their actual costs of providing capacity,” Clements wrote. “This risk is a direct result of MISO’s choice to conduct the four seasonal auctions for each delivery year simultaneously.”

Clements ended by asking MISO to consider conducting its auctions sequentially.

In a statement to RTO Insider, MISO said while offers generally are cleared on a seasonal basis in the auction, there may be “a situation where a unit clears one season but still needs to recover its full cost.” MISO noted that its Independent Market Monitor reviews all offers to make sure they’re appropriate.

“The sloped demand curve and seasonal construct are designed to work together to provide the right market signals to address the growing complexity of the system,” MISO said.